S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Nov, 2021

By Annie Sabater and Dylan Thomas

Sky-high markets and avid competition for deals are costing private equity firms more to take public companies private in 2021 than at any time during the past five years, S&P Global Market Intelligence data shows.

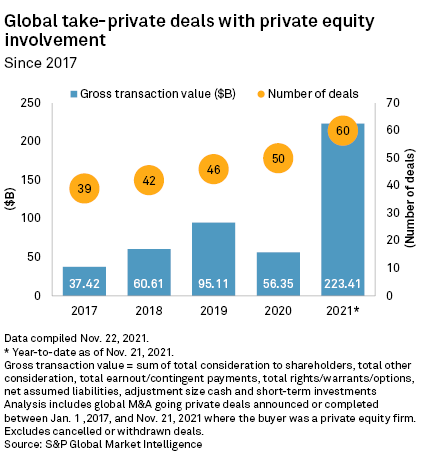

Between the start of the year and Nov. 22, PE firms announced or completed 60 take-private deals totaling more than $223.4 billion in value, for an average transaction size of about $3.85 billion. The industry's average take-private deal was about $1.20 billion in 2020 and approximately $2.11 billion in 2019, according to Market Intelligence data.

Cheap debt and heaps of dry powder have stoked competition for acquisitions — not just among private equity firms, but also between industry players and well-resourced outsiders, including strategic buyers and special purpose acquisitions companies, said Glenn Mincey, global and U.S. head of private equity for KPMG.

"It's everybody chasing the same deals," Mincey said.

The role of competition in driving up the price of take-private deals was highlighted by the bidding for U.K. retailer Wm Morrison Supermarkets PLC, which was decided in an Oct. 2 auction that pitted New York-based Clayton Dubilier & Rice LLC against Fortress Investment Group (UK) Ltd., headquartered in London. The auction was used to resolve a four-month bidding war between the two PE firms that drove the value of the final offer roughly 76% higher than the initial bid for the supermarket chain. When debt and liabilities are factored into CD&R's winning bid, it comes to a total transaction value of $14.07 billion.

Pricey tech sector

Reflecting the take-private deal euphoria is this month's monster buyout proposal from KKR & Co. Inc. for Rome-based telecommunications provider Telecom Italia SpA, estimated at $52.20 billion.

With strong corporate earnings pushing U.S. and European public markets to record highs this year, acquisition prices are rising, particularly in the technology sector, the arena for several of the year's largest take-private deals.

Between 2010 and 2019, the median annual valuation for publicly listed tech sector companies globally ranged from a price-to-revenue multiple of 1.2 to 2.9, according to 451 Research data, before hitting 3.7 in 2020 and jumping to 5.7 for the 2021 year-to-date period.

The sector's largest take-private deal so far this year, announced Nov. 8, is the $20.25 billion planned buyout of cybersecurity company McAfee Corp. by an investor group led by Advent International Corp. and Permira Advisers LLC.

Technology and software-focused Thoma Bravo LP had a busy year racking up several large take-private deals. On Aug. 31, the Chicago-based private equity firm closed a $12.37 billion deal to acquire and take private Sunnyvale, Calif.-based Proofpoint Inc., a cybersecurity and compliance company.

The firm executed two more large take-private deals that closed in July: the $7.07 billion acquisition of Medallia Inc. and the $6.72 billion acquisition of El Segundo, Calif.-based Stamps.com Inc.

The double edge of high valuation

Taking companies private at relatively high valuations sets the bar higher for private equity, requiring firms to be even more diligent in executing their value-creation strategies, Mincey said. But higher valuations also come with an upside.

"This is going to be really counterintuitive, but the higher valuations actually make it easier for private equity to do its job," Mincey said. "If you think about their business model, they borrow against the company, so the higher valuation allows them to borrow more and thereby allows them to execute more quickly on what they need to do to polish the company."

Leveraging technology to improve a service or make a company's operations more efficient is a tried-and-true strategy to improve value, regardless of what's going on in the wider market, he said. And firms are increasingly seizing opportunities to create value by improving the environmental, social and governance profiles of portfolio companies.

"Before, private equity would look at a company, and if you had a bad ESG story, that's a red flag and maybe you don't want to invest in that company. Now, it's seen as, 'Hey, we can come in [and] change the ESG story, really crystallize it, and then that adds value to a company'," Mincey said.

A hike in interest rates, anticipated to hit by mid-2022 or 2023, could put a damper on take-private activity.

"That's one factor going in the opposite direction, but I certainly think the trend is going to continue over the next year," he said.