S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

29 Nov, 2021

By Jon Rees and Cheska Lozano

|

Private equity firm The Carlyle Group ended talks over a possible offer for Metro Bank, but analysts believe more suitors could come forward. |

Private equity firms have set their sights on midtier U.K. banks, but a divergence over valuations has stymied deal-making — for now.

A flurry of activity in recent weeks has seen U.S. buyout firm The Carlyle Group Inc. approach Metro Bank PLC, and The Co-operative Bank PLC, backed by J.C. Flowers & Co. LLC and Bain Capital Pvt. Equity LP, approach Spain's Banco de Sabadell SA about acquiring its U.K. subsidiary TSB Bank PLC.

Private equity has been attracted by mid-sized banks' low valuations, said Shore Capital investment analyst Gary Greenwood, noting that Metro was trading at 0.2 times book value when Carlyle made its approach.

But after years of weak profitability and painful restructurings amid prolonged low interest rates, banks are now finally in a position to benefit from rate increases, making boards reluctant to accept offers that they believe do not fully reflect future potential performance, analysts said.

"Private equity firms will be looking at these banks and thinking they can pick up an asset on the cheap just as interest rates start to go up," Greenwood said.

Reluctant bedfellows

Co-op Bank's reported £1 billion move for TSB was rebuffed by Sabadell. The Spanish bank said it saw no need for a "fire sale" of TSB but nevertheless left the door open for a later approach when it said it was not a transaction it wished to explore "at the moment." For its part, Co-op Bank said it had drawn up a shortlist of potential targets, of which TSB was the most attractive.

Carlyle, meanwhile, ended its discussions with Metro, whose shares fell before rebounding to pre-approach levels. Other potential buyers could emerge in the wake of the Carlyle talks, analysts at Goodbody said.

Elsewhere, supermarket chain J Sainsbury PLC in October ended a sales process for Sainsbury's Bank PLC after deciding that a disposal would not offer better value for shareholders than retaining the bank.

Long-standing investors in midtier banks who have "taken a lot of pain" in recent years want a significant premium from potential acquirers now, Goodbody noted. However, change is required if challenger banks are to provide genuine competition to the established lenders.

"None of the challengers are making a fantastic return on equity. They've struggled to make inroads because they need scale to compete with the big banks," said Greenwood.

David vs. Goliath

Despite The Bank of England authorizing more than 30 new banks in the past decade, traditional high-street lenders have retained their dominance of the market. TSB, for instance, has a 5% share of the U.K. current account market and Co-op Bank a 2% share. This compares with Barclays PLC, NatWest and Lloyds Banking Group PLC, which between them have a near-40% share.

Trade body UK Finance said the largest lenders' share of the mortgage market had increased in the past two years because the ring-fencing of high street banks brought in following the financial crisis to separate them from their investment banking arms meant larger banks had access to very high levels of funds.

Major banks like HSBC Holdings PLC, which previously spread assets across its operations worldwide, now used their ring-fenced funds to build share in the U.K. mortgage market at increasingly competitive rates. Indeed, gross mortgage lending among midtier banks fell more than 15% in 2020 compared with a drop of less than 3% from the biggest lenders, said UK Finance.

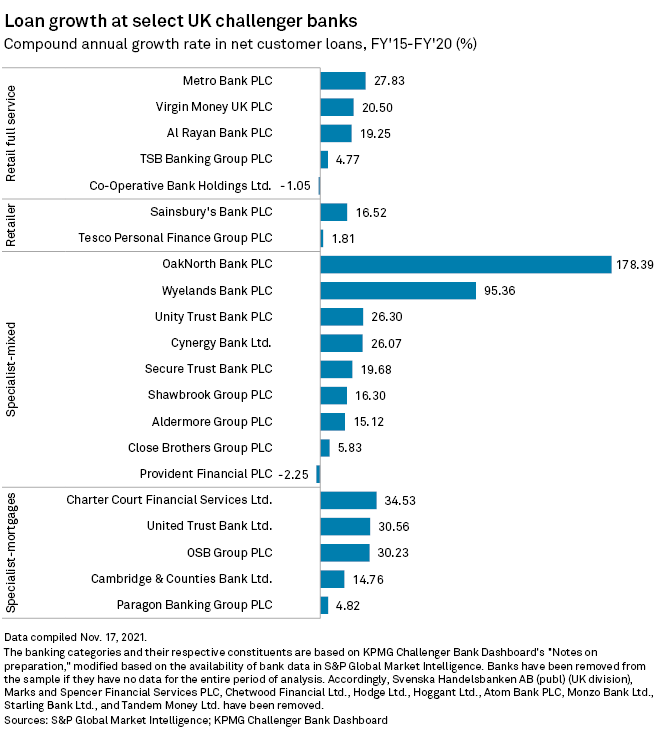

Traditional lenders still outgun the challenger banks in terms of net customer loans by almost 10-to-1. This is despite rapid loan growth by some smaller banks, like business and property loan specialist OakNorth Bank PLC.

Government-backed lending schemes during the pandemic have also had the effect of concentrating business lending in the hands of large incumbent banks, said the Social Market Foundation think tank in a report on banking competition sponsored by Metro Bank. Challenger and specialist banks' share of total gross lending to small and medium-sized enterprises fell to 31% in 2020 from 48% in the previous year, it said.

Deep value play

Private equity has been involved in the U.K. banking sector for some time. Aldermore Bank PLC was established with backing from AnaCap Financial Partners Ltd. before being listed and subsequently acquired, while Pollen Street Capital Ltd. floated Shawbrook Bank Ltd. in 2015, only to take it private again alongside fellow buyout firm BC Partners Advisors LP two years later.

Flush with dry powder after years of supportive fundraising conditions, private equity firms can provide a capital injection for challenger banks to gain the size required to take on incumbents.

"The key is getting the platform in the right place and then you can build scale through M&A," said James Hamilton, analyst at Numis. He said the crucial measurement for private equity firms in banking is to judge the price per customer through acquisition against the price required to acquire those customers organically.

In the case of TSB and Metro, some self-inflicted wounds present a further value arbitrage opportunity for private equity. The catastrophic installation of a new IT system at TSB saw customers locked out of accounts and sparked the departure of CEO Paul Pester in 2018, while Metro's misreporting of assets resulted in co-founder and Chairman Vernon Hill stepping down the following year.

"Great businesses that are doing fantastically well tend to be expensive and there's less that somebody else can bring to the party," said Hamilton.

Regulators have traditionally been wary of private equity involvement in banking, analysts said, not least because it was excess leverage in the financial system that led to it all but crashing during the financial crisis. But regulations introduced since then mean there are now fewer hurdles for buyout firms to clear.

"Banks now sit with big capital buffers and their core operations serving U.K. customers are ring-fenced," said Steve Clayton, manager of HL Select Funds at Hargreaves Lansdown. "That means that even if a leveraged owner gets into trouble, the core day-to-day banking activities that support the U.K. economy should be protected."