Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Dec, 2023

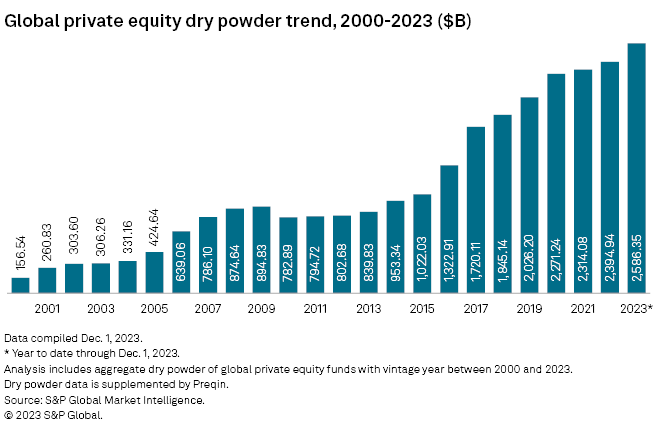

Global private equity dry powder has soared to an unprecedented $2.59 trillion in 2023 as a slow year in dealmaking closes with limited opportunities for firms to deploy capital raised in previous years.

The dry powder total as of Dec. 1 represented close to an 8% increase over the December 2022 total of $2.39 trillion, according to S&P Global Market Intelligence and Preqin data.

Smaller deals such as corporate carveouts and add-on transactions were easier to execute in 2023, particularly those without significant third-party debt, Genna Marten, a partner in Linklaters' private equity team, told S&P Global Market Intelligence.

Weak deal activity is reflected in Market Intelligence data for the year to Nov. 30, when global private equity deal value showed a 35.6% decline compared to the same period in 2022.

Top 25 dry powder holders

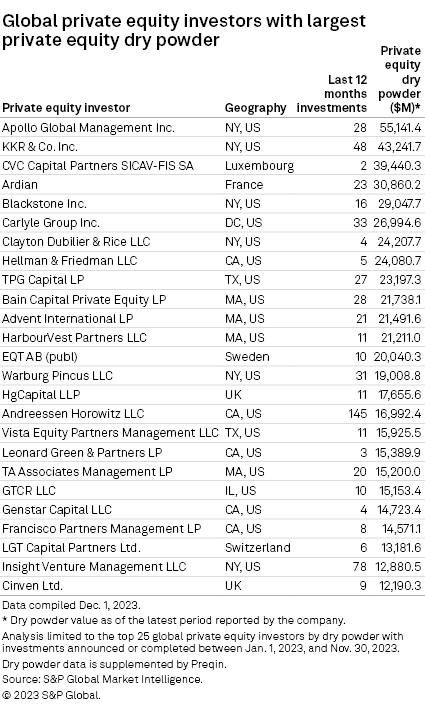

Just 25 private equity firms held 21.8% of the dry powder total year to date. Nineteen of those firms were headquartered in the US.

Apollo Global Management Inc. led all other firms, with $55.14 billion in uncommitted capital available to its private equity strategies, Market Intelligence and Preqin data shows.

Buyers and sellers

Record dry powder accumulation is rooted in the robust M&A market of the last several years, which set high valuation expectations for sellers that remained elevated even as macroeconomic conditions increasingly slowed deal activity from 2022 onward.

Buyers want lower asset prices, and the resulting valuation gap creates hesitancy to execute deals, Chris Zochowski, a private equity partner at Shearman & Sterling, told Market Intelligence.

"All of a sudden, macroeconomic issues happen in the market with interest rates and general economic variables and deals start to take longer, so more and more capital just starts to back up in the system," Zochowski said.

– Download a spreadsheet with data featured in the story.

– Read about global venture capital funding rounds in November.

– Explore more private equity coverage.

Lukewarm outlook

Deployment of the massive capital raised could begin in 2024 if inflation subsides and interest rates begin to stabilize.

Zochowski forecasts an uptick in deal activity in the next 12 months, "likely not at the fever pitch that was being experienced in 2022, but certainly, at a much greater rate than what we have seen in 2023."

"Pressure dynamics are simply going to drive people to start trying to not necessarily find deal opportunities, but to find ways to work with sellers to come up with different [valuation] models."

Thomas Scott, managing associate on Linklaters' private equity team, was "cautiously optimistic" for private equity capital deployment in 2024.

More specifically, the technology, energy and healthcare sectors are expected to remain attractive for private equity.

Digital infrastructure and datacenter deals will also get private equity buy-in because infrastructure is "viewed as being robust, stable and cash generative," Scott said.

"We should expect to see increasingly high volumes of deal activity within this space as strong macro trends, including cloud computing and AI, continue to fuel growth in this sector," Scott said.