Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Jan, 2023

By Dylan Thomas and Annie Sabater

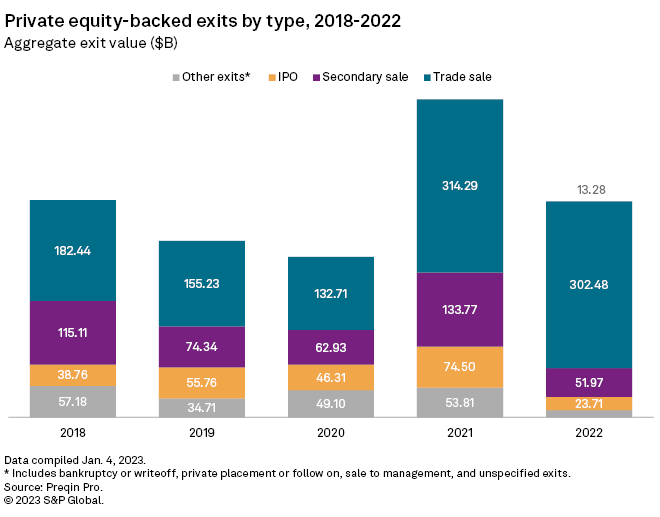

Months of macroeconomic turmoil and rising recession risk put global private equity exit value on track to fall by nearly one-third in 2022 compared to 2021's record year.

The aggregate value of private equity exits globally came in at $391.44 billion for the year, down 32.1% from the 2021 total, according to private markets data source Preqin Pro.

Private equity dealmaking and fundraising also faded over the course of 2022, a year marked by Russia's invasion of Ukraine, the lingering effects of the pandemic and central bank interest rates hikes intended to curb surging inflation.

Private equity-backed IPOs slowed to a trickle in 2022, totaling 52 globally and raising an aggregate $23.71 billion as steep declines in public markets essentially eliminated that exit path for many firms.

By comparison, there were nearly four times as many private equity-backed IPOs in 2021 — a total of 196 globally, according to Preqin — and they raised an aggregate $74.50 billion, or nearly 3x the 2022 total.

Looking at the fourth quarter of 2022, preliminary Preqin data shows just five private equity exits via IPO recorded globally, the fewest in any quarter since at least the start of 2018.

Shifting exit routes

Secondary sales, another leading exit route for private equity, totaled just $51.97 billion in 2022, according to Preqin. That was the lowest annual figure for private equity-backed secondary sales since at least 2018.

* Private equity dry powder is approaching $2 trillion.

* Private equity fund launches fell sharply in 2022.

* Read more private equity coverage.

Trade sales, however, increased. They were the dominant exit route for private equity firms in 2022, coming in at $302.48 billion for the year, according to Preqin.

Trade sales amounted to 77.3% of the exit value realized in 2022, a larger portion of overall private equity exits than in any of the previous four years, when they accounted for between 45.6% and 54.2% of all private equity exits.

Largest exits

The largest private equity exit of the year was the $20.77 billion take-private deal for cybersecurity business McAfee Corp., according to S&P Global Market Intelligence data. In a transaction that included private equity firms on both sides, TPG Capital LP and other McAfee shareholders sold their stakes to an investor group led by Advent International Corp. and Permira Advisers LLC.

The next-largest exit of 2022, a $17 billion deal for healthcare technology company Athenahealth Inc., also included private equity participation on both the buyers' and sellers' sides. Evergreen Coast Capital Corp. and Veritas Capital Fund Management LLC sold a majority stake in the cloud-based medical records business to an investor group comprised of sovereign wealth funds Abu Dhabi Investment Authority and GIC Pte. Ltd. alongside private equity firms Bain Capital Pvt. Equity LP and Hellman & Friedman LLC.

Rounding out the three largest private equity exits of 2022 was the $13.40 billion sale of healthcare technology company Change Healthcare Inc. to strategic buyer Optum Inc. leading to an exit for private equity investor Blackstone Inc.