Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Jun, 2022

By Dylan Thomas

Private equity investments drove record levels of consolidation in the highly fragmented wealth management industry last year, and deal volume remained elevated through the first half of 2022, despite rising interest rates and market volatility.

An industry that was once wary of private equity ownership has come to embrace it, said David DeVoe, founder and CEO of DeVoe & Co., a consulting firm and investment bank that advises wealth management companies on M&A. The firm estimates private equity had a role in 60% of the record 242 U.S.-linked wealth manager transactions it tracked last year, either as a direct investor or, more commonly, via a portfolio company.

"Private equity is seeing these strategic underpinnings of the industry — consolidation occurring, the potential power of strong players, dominant players coming to the space — and it's a nice, tight business case for them to invest," DeVoe said.

For wealth managers, private equity ownership promises an injection of resources and expertise, allowing them to roll out new products and services to their customers, he added. That could give them the edge in a highly competitive industry that has independent wealth managers vying not only among each other for clients but also against the bulge-bracket firms at the top of the investment bank food chain.

"The acquiring [private equity] firms are run by sophisticated management teams that have been designed to increase profitability and drive faster growth for acquisitions," said Michael Wunderli, managing director for Echelon Partners, a boutique investment bank that specializes in wealth management M&A.

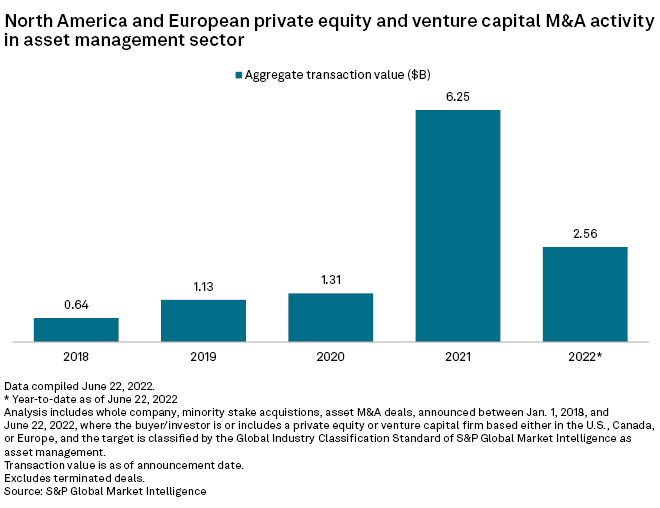

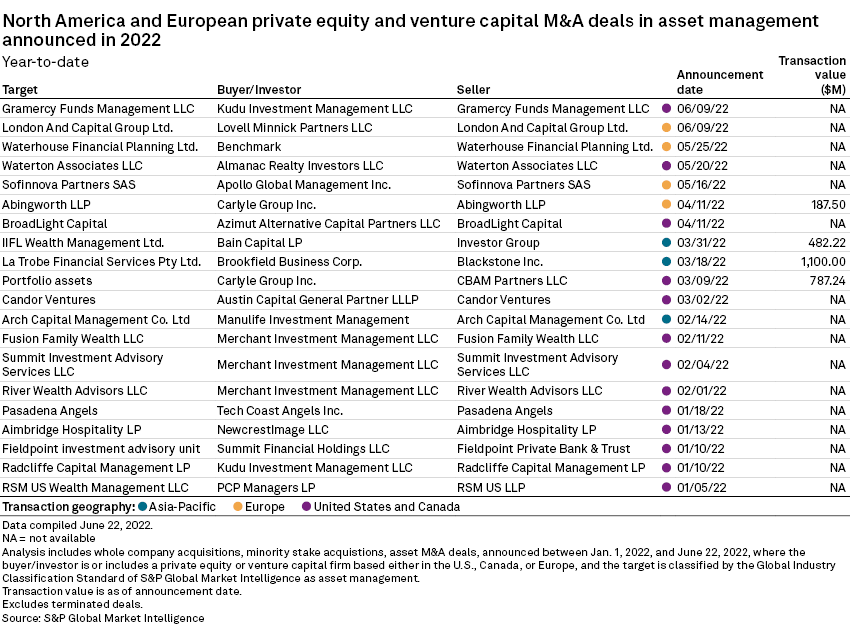

Private equity and venture capital firms based in North America and Europe announced $2.56 billion worth of investments in the asset management sector, which includes wealth managers, this year through June 22, according to S&P Global Market Intelligence data. That is more than the full-year totals in 2018, 2019 and 2020.

Of the deals with announced transaction values, the largest of the year so far was the $1.1 billion sale of Melbourne, Australia-based La Trobe Financial Services Pty. Ltd. by Blackstone Inc. Expected to close by the end of June, the deal involved a majority stake in La Trobe being acquired by a Brookfield Asset Management Inc.-led investor group.

Changing perception of PE

Guy McGlashan, CEO of U.K.-based wealth manager London & Capital Group Ltd., said private equity's reputation in the wealth management space has undergone a swift turnaround.

Even just a decade ago, there was widespread concern that the three- to five-year investment timeframe for private equity was mismatched with the longer-term goals of wealth managers and their clients, or that a private equity owner would simply cut costs and hike fees to make a quick buck, McGlashan said. That perception has changed rapidly, with many wealth management clients now viewing private equity ownership as the path of stability through a time of fast-paced consolidation.

"The firm retains its independence. It retains all the things the clients signed up for in the first place," he said, noting that stay-the-course outcome may be less likely when a small firm is swallowed up by a strategic buyer.

Lovell Minnick Partners LLC announced its planned acquisition of a majority stake in London & Capital in early June, a deal McGlashan said would speed the rollout of new products and services to the firm's client base. He said Lovell Minnick's financial services expertise was a large part of the deal's appeal. Just over 70% of the firms' investments are in the financials sector, according to Market Intelligence data.

"They've built up a lot of in-house experience around what works, what doesn't work, what's attractive for clients, what's not attractive to clients. And we're hoping to tap into some of that intellectual property that will help us be a better business," McGlashan said.

Retail investor base

Private equity last year upped its pace of hiring wealth management professionals, as executives at some of the industry's largest firms spoke of unlocking a retail investor market potentially worth tens of trillions of dollars. But the experts cautioned against drawing a direct line between private equity's newly prominent role in wealth management M&A and the possibility that it could in the future market its funds directly to retail investors.

"Right now, that's not a factor we've seen," DeVoe said.

M&A outlook

DeVoe said wealth management's consolidation trend was "still in the early innings." One prominent factor is that the majority of independent firms do not have a solid succession plan, he said, making a sale to a strategic buyer or private equity — especially at a time of historically high valuations — an appealing out.

"It's an industry with over 10,000 firms, depending how you cut it, and 5,000 of them are over $100 million" in assets under management, he said. "So, despite these record numbers of mergers and acquisitions over the last couple years, we've only recently hit a point which I think is the steady state of M&A."

By the estimate of DeVoe & Co., M&A deal volume in the wealth management industry jumped 50% year over year in 2021, at least the third consecutive year of double-digit growth. It is still on track to trend higher in 2022, DeVoe said, and both his firm and Echelon rank the first quarter of 2022 as the most active first quarter for M&A activity the industry has ever seen.

"It will be above that blockbuster year. But, good news, it won't be at these huge jumps anymore. Extreme growth in M&A is something that's not super-scalable. It actually creates a risk of having some unhealthy M&A," DeVoe said.

Wunderli agreed but noted that rising interest rates and market volatility pose risks for that forecast, with the largest deals becoming more expensive to finance and shaky valuations potentially giving sellers second thoughts. That has not happened yet, he added.

"As of now, we're seeing no haircuts," he said.