Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Apr, 2022

By Allison Good

Barriers to entry have eased significantly for private equity and credit looking to fund North American energy transition ventures, but premiums for sustainable financing must fall to enable deep industrial decarbonization, industry experts said.

"Private clean-tech companies up until the last two years were really funded by wealthy individuals, sovereign wealth funds and corporates," Skip Grow, Morgan Stanley managing director for power and utilities, said during an April 20 panel at Bloomberg New Energy Finance's New York City summit. "There was virtually no ecosystem to support the funding of these companies."

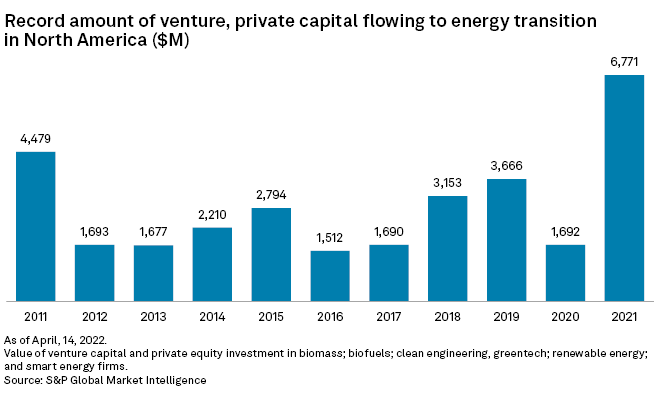

While President Joe Biden's election did not necessarily cause the paradigm shift, Grow said, it did coincide with the public market "floodgates" opening, which helped draw capital into the private market. U.S. and Canadian venture capital and private equity firms invested nearly $6.8 billion in 2021 in energy efficiency, storage and management along with new technologies to reduce carbon emissions, data from S&P Global Market Intelligence indicates.

Between growth equity funds and the equity market lowering its maturity threshold, "dipping down into sort of venture-stage investing," Grow said the capital that has been deployed will enable clean-tech companies "to move from the lab and build out actual plants."

That dynamic will help a new $15 billion fund by private equity giant Brookfield Asset Management Inc. to scale renewable energy projects and support the industrial sector, which needs an enormous amount of capital to reduce emissions.

"If you think about what it's going to take to move from blast furnaces to electric arc furnaces in the steel sector, that's not something that can be solved with a $50 million equity check," said Natalie Adomait, a managing partner in Brookfield's renewable power and transition group. "That is a $2 billion project, and steel players aren't just doing one of those, they're doing 10 to 20."

The Biden administration took executive action Feb. 15 to promote domestic manufacturing of low-carbon materials, including low-emission steel and aluminum, to create more U.S. manufacturing jobs and slash carbon pollution coming from the country's industrial base.

Adomait described Brookfield's fund as playing the role of an infrastructure partner, injecting cash into companies that already have the technology and intellectual property, providing "an alternative to further stock dilution as they want to invest in rolling out their projects but continue to maintain control of their companies."

Credit evolution

Blackstone Inc. is optimistic with regard to the need for private debt to fund the energy transition.

Jean Rogers, global head of environmental, social and governance issues at Blackstone, said credit represents "a better mechanism when you are trying to be intentional than equity because while you can perhaps take a board seat, it's not as targeted to the outcomes and the financial incentive isn't there."

Nearly $80 billion of green, social and sustainability bonds were issued in the U.S. in 2021, according to the Climate Bonds Initiative. Green bonds are earmarked for a specific use of proceeds, while sustainability-linked bonds have frameworks tied to a set of key performance indicators but come with no restrictions on how proceeds can be used.

Private debt may also be preferable to equity now that companies are more focused on sustainability, according to Robert Camacho, who heads Blackstone's structured products group.

"Most of the companies we invest in just ... need the help, they need the resources," Camacho said during the panel. "That's a big change from the last couple of years where you really needed to control the company to drive change."

But industrial decarbonization will require a hybrid approach combining transparency with financial penalties.

"What we'll begin to need to see is ... an integrated framework approach that covers both use of proceeds as well as sustainability-linked debt," ING Groep NV Director of Sustainable Finance Daniel Shurey said. "Credit that has the story that is credible, that is transparent, that is aligned to principles, we found through the bookbuilding process for bonds, for example, that we can attract a greater base of investors."

The higher prices that many North American investors still pay for green bonds on the primary market must also come down to facilitate eliminating industrial emissions since "magical subsidization by investors at scale of that for the sake of advancing decarbonization" is not a feasible option, said Paul Bodnar, global head of sustainable investing for BlackRock Inc. "We're not just talking about technologies, we're talking about remaking ... entire industrial systems."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.