Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Dec, 2021

If YouTube, LLC's YouTube TV drops Walt Disney Co.'s networks as threatened, the streaming service has promised a $15 price drop, with a bulk of that savings likely coming from losing just ESPN (US).

Disney and YouTube's virtual multichannel service are continuing to negotiate terms for a new affiliate contract before their current pact expires at 11:59 p.m. ET on Dec. 17.

In a blog post, YouTube TV said it remains in active conversations with Disney, but has not yet been able to reach an equitable agreement. If a deal cannot be realized by the deadline, the virtual provider's estimated 4 million customers could lose access to Disney's expansive portfolio of cable networks, as well as the ABC (US)-owned TV stations. If this happens, YouTube TV will drop its monthly retail price by $15, or almost 23%, to $49.99 per month.

|

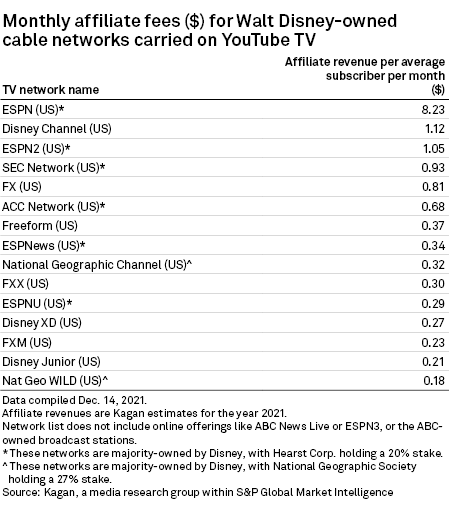

Disney owns the most expensive basic cable network in the U.S., with ESPN (US) having a monthly affiliate fee per average subscriber of $8.23, according to 2021 estimates from Kagan, a media research group within S&P Global Market Intelligence.

Its second most expensive network is the Disney Channel (US), with a monthly affiliate fee per average subscriber of $1.12. ESPN2 (US) follows close behind at $1.05.

Looking at the affiliate fees for just Disney's linear cable networks carried on YouTube TV, the monthly affiliate fee total per average subscriber comes to $15.33.

Notably absent from that total are the retransmission-consent fees, which pay TV operators pay to broadcasters to carry local station signals. Kagan projected ABC-owned stations' average monthly retransmission-consent-per-subscriber fee at $2.48, in the third quarter. That was up 11.6% from $2.22 in the corresponding period in 2020.

With the pay-TV ecosystem continuing to decline amid consumers' push to lower monthly viewing bills and growing affinity for streaming services, Disney could see further erosion of an already-declining subscriber universe should it not come to terms with YouTube TV. At the close of its fiscal 2021, ended Sept. 30, Disney counted 77 million subscribers for FX (US), and 76 million apiece for ESPN, ESPN2 (US), Disney Channel, Freeform (US) and National Geographic Channel (US).

That compares with 86 million for FX a year earlier, or a loss of almost 9 million. Disney Channel, Nat Geo and Freeform each tallied 85 million a year earlier, while ESPN and ESPN2 reached 84 million subscribers.

In a statement, Disney expressed confidence a disconnect will be averted.

"Disney Media and Entertainment Distribution has a highly successful track record of negotiating such agreements with providers of all types and sizes across the country and is committed to working with Google to reach a fair, market-based agreement," the company said in a statement. "We are optimistic that we can reach a deal and continue to provide their YouTube TV customers with our live sporting events and news coverage plus kids, family and general entertainment programming."

For its part, YouTube TV's message noted that if a subscriber wants to continue watching some Disney fare, the company's direct-to-consumer bundle is available for $13.99 per month. The bundle includes Disney+, Hulu LLC's subscription video-on-demand service and sports streamer ESPN+.

YouTube TV served up a similar warning to its subscriber base in September when it was facing a carriage dispute with NBCUniversal Media LLC. YouTube said it would drop $10 from its monthly retail price if it could not reach a deal with Comcast Corp.'s programming arm, while also alerting subscribers that they could sign up for Peacock, NBCU's streaming service, for $4.99 per month.

The two sides eventually reached an agreement in October to keep all of the NBCUniversal networks on YouTube TV. The new deal did not expand to encompass the streaming service Peacock.

It is unclear if current negotiations with YouTube TV extend to Disney's direct-to-consumer offerings. Disney did not respond to a request for comment on the matter.