S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Jul, 2022

By Sydney Price

With inflation continuing to climb, wireless companies are getting creative with pricing plans to hold onto customers who are becoming more discriminatory spenders.

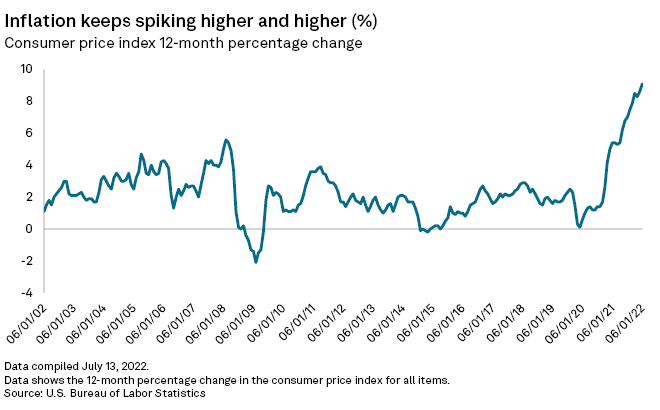

When first-quarter wireless earnings presentations kick off this week, analysts will ask just how many more telcos will have to adjust to keep up with the skyrocketing rate of inflation. The Consumer Price Index rose 9.1% from June 2021 to June 2022, the largest year-over-year increase since November 1981. Meanwhile, the price customers paid for wireless decreased by 0.9%. Unlike long-established industries such as energy and agriculture, the wireless sector is relatively young and has never experienced this level of inflation before, putting carriers in uncharted territory as they seek to raise prices to keep up with rising costs.

Because many consumers consider their cell phones to be as essential as food and electricity, most consumers are unlikely to eschew wireless subscriptions altogether, analysts said. But consumers may be persuaded to switch providers.

"These services are viewed as necessities," said Lynnette Luna, an analyst at Kagan, a media research group within S&P Global Market Intelligence. "Right now, it's not clear to me that customers are reducing their spending dramatically when it comes to wireless services."

New plans, new prices

Verizon Communications Inc. recently introduced a new pricing plan with inflation and high churn in mind. The company unveiled Welcome Unlimited, an entry-level plan that gives customers unlimited talk, text and data for $30 per line for four lines with an automatic payment plan. Customers are offered $240 Verizon gift cards for bringing their own devices when they switch. The new plan effectively cut Verizon's price to $30 per month from $35 per month for entry-level unlimited lines.

The announcement came after Verizon started informing customers with shared data plans in late June that their monthly bills would go up by as much as $12. The company attributed the change to "rising operational costs."

"This new price cut on the heels of that increase might indicate that it may have triggered some incremental churn," LightShed Partners analysts Walter Piecyk and Joe Galone wrote in a research note.

The analysts estimated that plan restrictions on Verizon's new $30 monthly wireless plan mean fewer than 1 million existing subscribers will switch to the offer, translating to a $60 million impact on annual service revenue.

The price increases that Verizon announced in late June followed similar hikes from AT&T Inc. in May. AT&T increased the cost of a single-line-of-service by $6 a month, while shared data customers saw a $12 step up. The company said it will have to get creative with ways to raise wireless revenues without losing customers.

Rising costs

"We've built in a fairly healthy level of inflationary expectations into our budget. With that said, it's running harder than we thought," AT&T Senior Executive Vice President and CFO Pascal Desroches said during a June investor presentation.

Even with the higher prices, MoffettNathanson analyst Craig Moffett said AT&T and Verizon could actually see EBITDA fall because rising costs are outstripping their increased revenue.

"By Verizon's own estimate, about a quarter of their total costs are inflation-sensitive. Assuming that those ~$21B of annual costs are rising by something like 5%, their total cost base will rise by ~$1B a year, offsetting all of the ARPU increase," Moffett said.

AT&T is in a similar position, with the analyst pointing to a recent agreement with a portion of the Communications Workers of America union that included a 15% escalator over the term of the contract.

But AT&T faces additional challenges from its heavy debt load. "In the wake of unwinding their ill-fated diversification into media, their balance sheet remains over-stretched, putting continued pressure on their ability to sustain their dividend should revenue or EBITDA growth turn negative," MoffettNathanson analysts wrote.

Ever the maverick

Meanwhile, T-Mobile US Inc. is not raising prices.

"We are giving our customers more without asking more from them — simply because we know it's the right thing to do," T-Mobile Business Group President Callie Ford wrote in a blog post for T-Mobile's website.

Although T-Mobile may not directly raise prices on plans, the company may resort to aggressive upselling and repackaging of services in order to bring in more monthly revenue per customer, said Alex Besen, founder and CEO of mobile data consulting firm The Besen Group LLC.

"T-Mobile subsidizes the inflation from other value-added services, so the customer has to watch those additional expenses that they might not have today," Besen said. "Voicemail was once one of those services, though it is now standard."

Moffett expects T-Mobile to perform better against inflation than its competitors.

"Despite not having taken meaningful price increases, T-Mobile's ARPU trajectory has improved, a consequence of a more favorable take rate for premium priced plans," Moffett said, noting that T-Mobile expects 1% annual ARPU growth.

T-Mobile's average revenue per user for postpaid phones grew to $48.41 in the first quarter, up from $47.30 a year earlier.