Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Feb, 2022

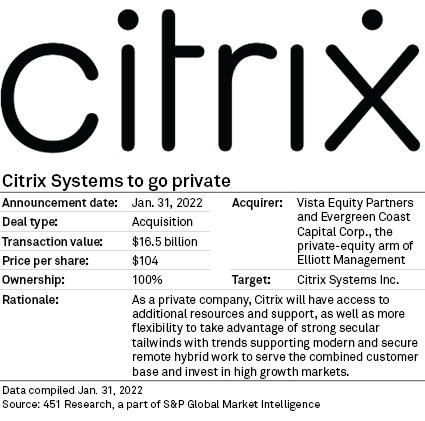

The $16.50 billion deal to acquire enterprise software company Citrix Systems Inc. represents the largest acquisition on record for buyers Vista Equity Partners and Evergreen Coast Capital Corp., as well as a liquidity event for Citrix investors after a volatile year on the market.

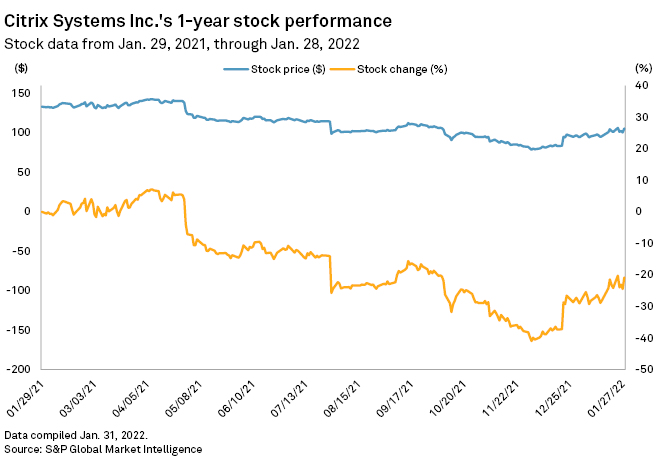

The two private equity firms agreed Jan. 31 to pay $104 per share of Citrix, representing a 1.5% discount from the company's Jan. 28 closing price. However, Citrix shares have outperformed broad market and sector-specific indexes since late December 2021 when media reports indicated an imminent sale. Citrix shares added 21.5% from Dec. 20 through Jan. 30, compared to a 6.3% drop in the S&P U.S. BMI Information Technology Index.

Still, the per-share price is still well below the company's 12-month high of $144.47 per share.

The deal is a culmination of a five-month strategic review process, said Bob Calderoni, president and interim CEO of Citrix.

The private equity firms intend to roll the Citrix business into infrastructure and business intelligence holding TIBCO Software Inc., according to the merger press release. The combination will provide solutions for enterprise digital transformation and hybrid work environments, two accelerating dynamics that have driven information technology valuations upward through the COVID-19 pandemic. Combined, the two companies will serve about 400,000 customers and 100 million users.

"As a private company, Citrix will have access to additional resources and support, as well as more flexibility to take advantage of strong secular tailwinds with trends supporting modern and secure remote hybrid work," said Monti Saroya, senior managing director at Vista.

Citrix has managed to grow its business in recent years to $3.24 billion in 2020 revenue from $2.83 billion in 2017. However, revenue dipped slightly in 2021 to $3.22 billion.

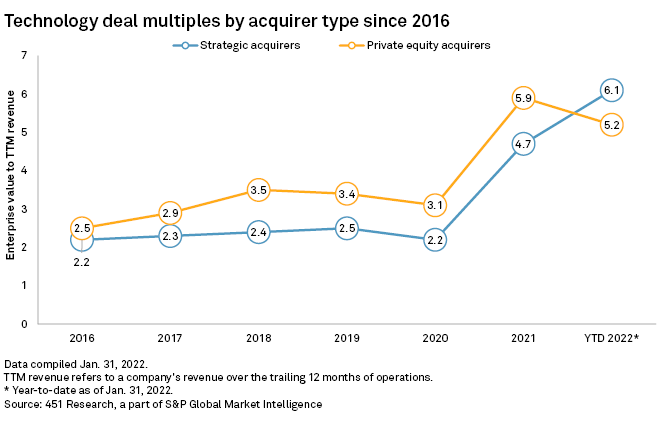

The $16.50 billion price tag amounts to 5.2x trailing-12-month revenue, according to 451 Research. The valuation multiple is high historically — technology targets went for just 2.3x as recently as 2016. But a boom in technology M&A through 2021, which coincided with a run in public market capital, pushed average annual industry M&A valuations up to 5.2x.

Private equity firms have contributed significantly to the expanding valuations and deal activity. Over five years, private equity firms increased their industry M&A activity to 1,493 acquisitions in 2021 from just 806 in 2016, according to 451 Research. And those firms paid more and more for their technology targets. Average private equity acquisition multiples climbed from 2.5x in 2016 to 3.5x in 2018 and spiked to 5.9x in 2021. Comparatively, corporate strategic acquirers paid 4.7x for their targets in 2021.

Evergreen's parent company Elliott Investment Management LPin 2021 purchased a 10% stake in Citrix valued at approximately $1.3 billion.

The transaction will be the largest in the history of both Vista and Evergreen, according to 451 Research. Vista held more than $86 billion in assets under management as of September 2021, with about three-quarters of its holdings in the information technology sector, according to the most recent data from S&P Global Market Intelligence. Elliot holds about $51.5 billion in assets, according to the press release, and it employs its Evergreen affiliate to focus on technology investments.

451 Research is part of S&P Global Market Intelligence.