S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Sep, 2022

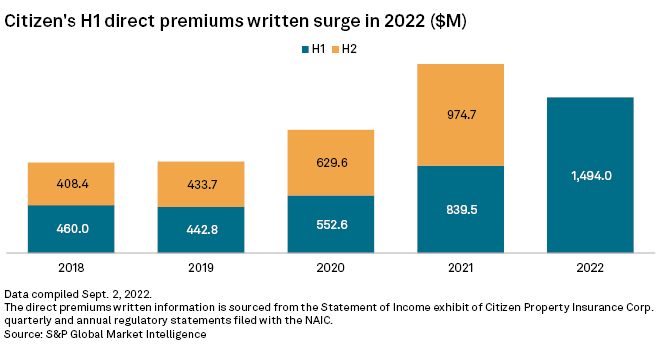

A rash of liquidations, stricter underwriting rules and property and casualty insurers retreating from the Florida market have flooded Citizens Property Insurance Corp. with new premiums dollars, putting the state's property insurer of last resort on track to substantially surpass its totals from last year.

Premiums skyrocket

Through the first six months of 2022, Citizens' direct premiums written soared to $1.49 billion, compared to the $1.81 billion total for all of 2021. Roughly 63% of the insurer's year-to-date premiums stemmed from the second quarter, when it recorded nearly $941 million in direct premiums written.

|

* Read more about second-quarter results for U.S. property and casualty industry. |

The surge in premiums, in large part, can be attributed to new policyholders. Citizens' in-force policy count grew to 931,357 as of June 30 from roughly 760,000 at the end of the previous year. The insurer surpassed 1 million policyholders at the end of August.

With the influx of additional policyholders, Citizens has also seen more claims and lawsuits, according to comments made at a June board of governors meeting.

The insurer of last resort was served 5,907 lawsuits in the first half of 2022, for an average of 985 new lawsuits per month. The monthly average is 10% higher when compared to the same time in 2021. As of June 30, pending lawsuits totaled 19,139 versus 15,256 a year earlier.

The bulk of the cases continue to originate in the Tri-County region of southeastern Florida, but a greater portion are beginning to come from areas along the Gulf Coast. New cases associated with assignment of benefit claims have ballooned by 78%, representing 47% of all new lawsuits.

The cost of litigation and defending lawsuits by insurers within the Florida residential property market are far and away the highest in the nation.

Private insurers' struggles continue

Four individual insurance subsidiaries within the domestic Florida residential property market reported losses of more than $75 million during the second quarter.

The financially troubled FedNat Insurance Co.'s $91 million in losses during the quarter was the highest among those insurers, followed by $89 million of losses for United Property & Casualty Insurance Co.

United Property & Casualty's parent company announced in August it would place the insurer into runoff.

The Progressive Corp.'s American Strategic Insurance Corp. and Tokio Marine Holdings Inc.'s Privilege Underwriters Reciprocal Exchange also generated losses of more than $75 million during the quarter.

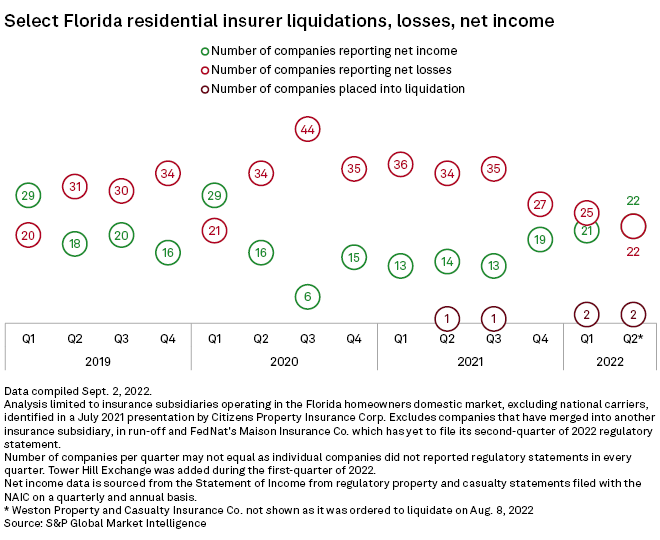

Market shrinks as liquidations rise

A total of five P&C underwriters within the Florida residential property market have become insolvent so far this year. Four of them were ordered into liquidation in the first half of the year, while Weston Property & Casualty Insurance Co. was declared insolvent in early August.

The remaining underwriters in this analysis split evenly between losses and gains in the second quarter. FedNat Holding Co.'s Maison Insurance Co. has yet to file its quarterly regulatory statement, but announced it was cancelling all its 3,300 polices in May.

Collectively, Florida residential property insurers lost $354.2 million for the second quarter.