S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Apr, 2021

Loan moratoria and other policy measures have protected Portuguese banks' asset quality so far during the COVID-19 pandemic, but this may change in 2021 as many programs are unwound, DBRS Morningstar said in a report April 8.

Despite a doubling of loan loss provisions, the stock of nonperforming loans at a group of Portugal's largest banks shrunk by more than a fifth in 2020, the credit rating agency estimated. Its sample included Caixa Geral de Depósitos SA, Banco Comercial Português SA, Novo Banco SA, Banco Santander Totta SA, Banco BPI SA and Caixa Económica Montepio Geral.

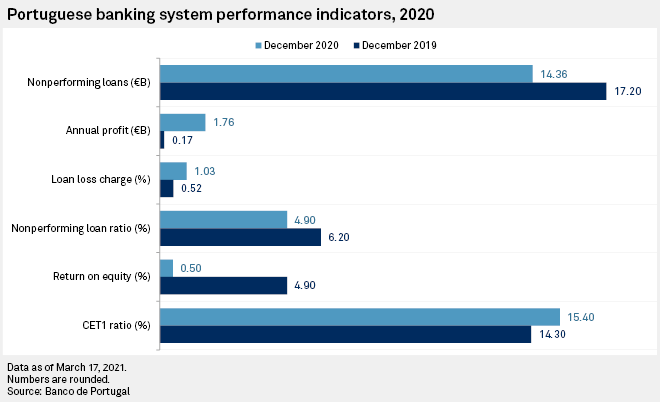

Banco de Portugal data shows a similar trend for the whole banking system, with 2020 loan loss charges — measuring total credit impairments as a percentage of average gross customer loans — nearly doubling to 1.03% from 0.52% in 2019, and the NPL stock dropping to €14.36 billion in 2020 from €17.20 billion a year ago.

NPL sales, write-offs and cures helped reduce the bad loan stock in 2020 and COVID-19-related policy measures have staved off the impact of the economic downturn on banks' credit portfolios, DBRS Morningstar said.

"Our view is that asset quality may deteriorate from late 2021 with the eventual loosening of moratoria and other support schemes," Nicola de Caro, senior vice president at the global financial institutions team of DBRS Morningstar told S&P Global Market Intelligence.

With over 20% of total loans under moratoria, Portugal's banks are among the most dependent on such pandemic support schemes in Europe. The majority of these loans comprise exposures to small and medium-sized enterprises which are set to expire in the third quarter of 2021, DBRS Morningstar said.

At 2020-end, Portugal's banking system had the third-largest stock of loans and advances under moratoria, of €41.5 billion, according to data by the European Banking Authority. Italy and Spain ranked first and second with a stock of €115.6 billion and €57.9 billion, respectively.

Bad loan risk

According to current estimates out of Portugal, up to 10% of loans currently under moratoria could "go bad" in the future, Olivia Perney Guillot, managing director at the financial institutions team of Fitch Ratings, said in an interview. Fitch expects asset quality to deteriorate in 2021 but some banks in southern Europe will be able to offset some of the negative impact through NPL sales and write-offs as they did in 2020, Rafael Quina, on the financial institutions team at Fitch Ratings, said.

The NPL ratio for loans in already-expired moratoria schemes in Portugal stood at 2.8% at the end of 2020, almost as high as the 2.9% in Italy but lower than the 4.2% in Spain, EBA data shows.

There will be wide differences in risk depending on the borrower type, Quina said. Residential mortgages, for example, would be typically less risky than exposure to unable-to-pay SMEs that are in the tourism sector, he told S&P Global Market Intelligence.

Based on its exposure, Portugal is the fourth most-dependent country on the tourism sector in the eurozone, DBRS Morningstar estimated in a Sept. 14, 2020 report. The country ranked second by the share of tourism sector contribution to GDP — 16.5%, and third by the share tourism employment to total employment — 18.6%, according to the report.

"In DBRS Morningstar's view, the longer the epidemiological situation continues, the greater the risk that the travel and tourism industries in these countries will suffer more lasting damage, resulting in permanent job losses and closures of some businesses. Even after the travel restrictions are largely lifted across geographies, the fear of travel might linger for longer," the rating agency said at the time.