S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

31 Aug, 2021

By Beata Fojcik

Polish banks could face a further hit related to their Swiss franc mortgage exposure if a ruling by the country's Supreme Court goes against them.

The court is due to rule Sept. 2 on whether banks can charge customers for using their capital over the period when now-annulled mortgages were active. The Polish financial regulator has calculated that if banks cannot charge for this, they would face costs of 101.5 billion zlotys, compared to an estimated cost of 34.5 billion zlotys under an alternative proposal for out-of-court settlements. The central bank has identified the associated legal risk as a major threat to financial stability.

Large numbers of Polish borrowers took out mortgages denominated in Swiss francs in the 2000s to take advantage of low interest rates in Switzerland. When the Swiss franc rose sharply in value in early 2015, mortgage holders were left with higher repayments, and many are now involved in legal disputes with their banks.

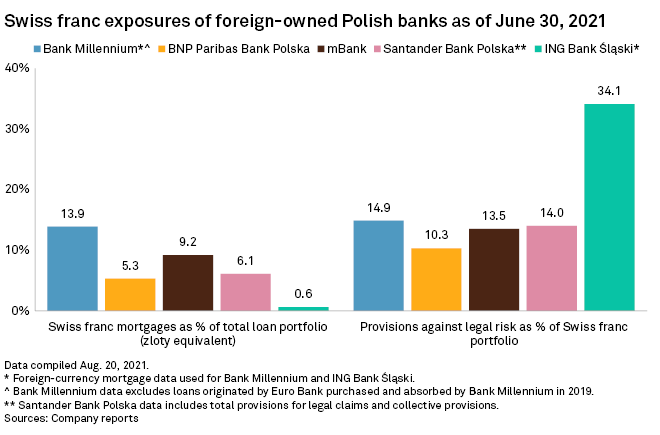

Several foreign-owned lenders — such as mBank SA, Bank Millennium SA, Santander Bank Polska SA and BNP Paribas Bank Polska SA — have significant Swiss franc mortgage exposure. Such loans make up 13.9% of Bank Millennium's total portfolio and 9.2% of mBank's. Millennium has provisions that cover 14.9% of its portfolio, while mBank's cover 13.5%.

Potential extra costs

The Supreme Court ruling, if not favorable for banks, may trigger large levels of extra provisions to cover legal risk, according to Bettina Orlopp, CFO of Germany's Commerzbank AG, which owns Warsaw-based mBank. Speaking on an Aug. 4 earnings call, Orlopp said Commerzbank currently has an adequate level of provisioning.

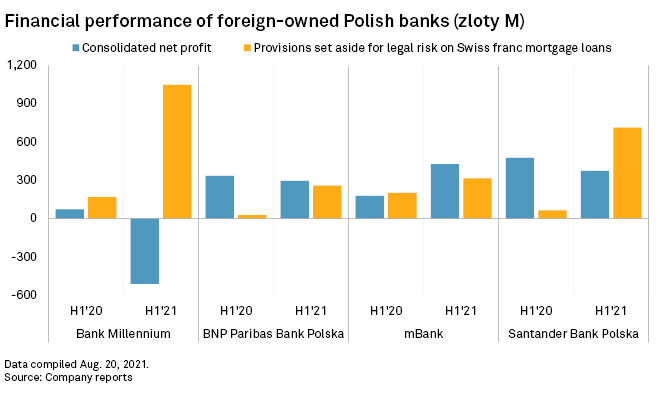

mBank set aside close to 315 million zlotys in extra provisions in the first half. Bank Millennium, Santander Bank Polska and BNP Paribas Bank Polska set aside an extra 1 billion zlotys, 713 million zlotys and 259 million zlotys, respectively. Bank Millennium is owned by Banco Comercial Português SA, while Santander Bank Polska and BNP Paribas Bank Polska are owned by Spain's Banco Santander SA and France-based BNP Paribas SA.

The ruling could have a significant impact on the banks, and related provisions will continue to affect their earnings strongly in the near future, Dom Maklerski BOŚ analyst Michał Sobolewski told S&P Global Market Intelligence.

A European Court of Justice ruling in 2019 allowed borrowers to ask Polish courts to convert their mortgages into Polish zlotys. The foreign-owned banks and Poland's largest bank, PKO Bank Polski SA, faced thousands of individual court cases as of June-end. However, rulings in the lower courts differ over whether banks can charge for use of capital for the active duration of the mortgages.

The Sept. 2 ruling is expected to clarify that and will be key in helping banks and their clients to decide whether to seek out-of-court settlements, as proposed by Poland's Financial Supervision Authority. The ruling has been delayed before, however, and may be again amid a dispute between Poland and the EU over the procedure around appointing judges, local newspaper Rzeczpospolita reported.

Provisions for legal risk

Bank Millennium has said that if all its Swiss franc mortgage agreements currently under court proceedings were to be declared invalid without compensation for capital, the pretax cost for the lender could reach 3 billion zlotys. The bank has provisions for legal risk amounting to 1.9 billion zlotys, a foreign currency buffer of 1.8 billion zlotys and a similar surplus in other parts of the capital stack, a spokesperson for the bank told S&P Global Market Intelligence.

This is "a significant buffer to absorb possible losses in a realistic scenario," the spokesperson said.

During their second-quarter earnings conference calls with analysts, Banco Santander and Raiffeisen Bank International AG both noted the uncertainty around the Supreme Court ruling. But Santander said the issue is not expected to have a material impact on the group, and RBI said it would not pose a risk for RBI's dividend plans under the current provisioning model.

Bank Pekao SA and ING Groep NV unit ING Bank Slaski SA, which both saw a big inflow of Swiss franc mortgage lawsuits but have relatively small exposures to this segment, did not set aside any new provisions this year. Neither did PKO Bank, which set aside a 6.7 billion zloty fund in 2020.

Austria-based RBI, which completed the sale of its Polish unit in 2018 but still has some Swiss franc mortgage exposure, set aside €77 million of provisions in the second quarter for potential related claims, bringing the total to €195 million. It expects about 300 new court cases per month in 2021, with the total number of pending cases amounting to 5,455 as of June 30.

ING Bank Śląski and PKO Bank have said they would participate in the Financial Supervision Authority's proposed out-of-court settlement program, but other Polish banks continue to wait for the Supreme Court's ruling to come out. RBI said it has no plans to participate in the program.

As of Aug. 30, US$1 was equivalent to 3.87 Polish zlotys.