S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

29 Dec, 2021

By David Feliba

Brazil, notorious for its bureaucracy and complexities, has created one of the most efficient payments systems in Latin America, with blow-out numbers proving its success.

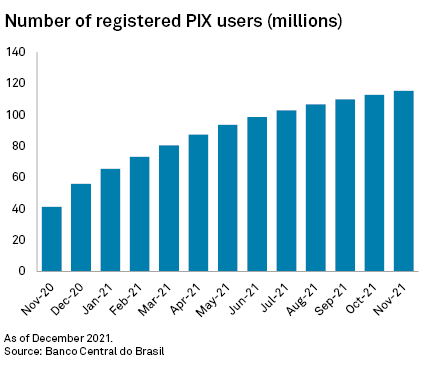

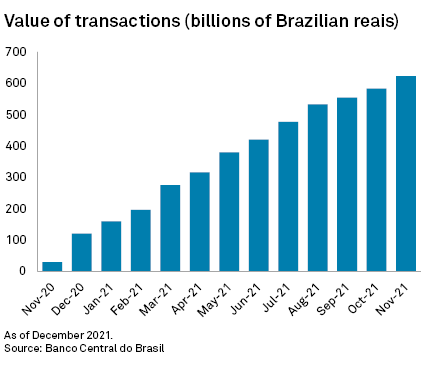

Pix, rolled out by the Banco Central do Brasil in Nov. 2020, was built for efficiency and financial inclusion. It now has 107.5 million registered accounts, more than half of the country's population. One year after implementation, more than half a trillion Brazilian reais were transacted through the low-cost payments system last month. According to central bank data, Pix payments volume is already equivalent to 80% of debit and credit card transactions.

"Pix has set a new standard in Brazil," Julian Colombo, CEO of banking technology firm N5, said in an interview. "It has already achieved critical mass."

Pix continues adding new features, making older payment forms obsolete. Traditional banks may be losing revenue as a result, but the system has replaced cash, bringing more people into the digital realm.

"Except for very particular transactions, market penetration tends to 99% on all individual transfers," he added. However, the rollout has not been without hiccups, including kidnapping.

This month, the central bank announced two new Pix features that will allow cash withdrawals from stores. Coming in 2022 are Pix Offline — no internet required — and Pix NFC Payments, allowing payment by approximation. That is good news for the millions of Brazilians who work informally, like those selling food on the beach or even street musicians.

On a recent Sunday in Rio de Janeiro, a three-member samba band played for a crowded restaurant. At the end, they passed around the tambourine to collect money. One diner apologized, saying he did not have any cash on him. The drummer said, "No problem, I take Pix," and proceeded to share his code — which can be an email, phone number or other easy-to-remember code — with the diner, who promptly transferred the money his way.

According to the central bank, some 30,000 Pix transactions are carried out every minute.

"It exceeded all expectations," Roberto Campos Neto, president of Brazil's central bank, said on Pix's first anniversary. "It has proven to be a powerful tool for financial inclusion ... and when we look at the number of transactions, we see that growth continues to be almost exponential."

Tool for financial inclusion

Low-cost payment transfer systems in Latin America are not new. Banco de México launched CoDi in 2019, while Banco Central de la República Argentina recently implemented Transfer 3.0.

But both CoDi and Transfer 3.0 have trailed by a long shot the adoption levels that Pix swiftly achieved in Brazil, where banks have been instrumental in marketing and promoting the tool.

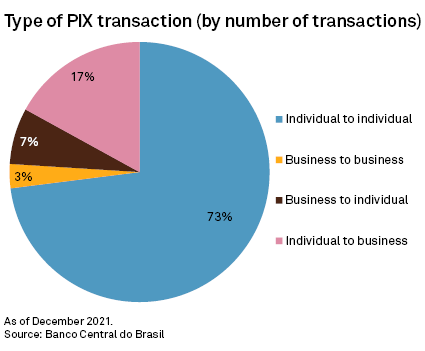

Three out of four payment and transfer operations were carried out from mobile devices in the second quarter, an increase of 184% from the previous period, according to César Oliveira, a central bank senior advisor.

The number of Pix users has grown systematically each month. By the end of November, some 98 million people had transacted on Pix. Usage has been particularly high between peers.

"Whether you look at it from the number of people or volume of transactions, or you name it, Pix has been a huge success," Renato Lulia Jacob, head of investor relations and market intelligence at Banco Itaú, said in an interview.

However, there have been setbacks. Pix usage has raised concerns about cybersecurity and ransomware attacks. Violent robberies and kidnappings led to limiting transactions overnight to 1,000 reais. While kidnapping to empty bank accounts is not unusual, criminals are increasingly preferring Pix, using other people's accounts as fronts.

The bank impact

Rating agencies have flagged Pix would take a toll on big Brazilian banks, and particularly on income from fees, with checking accounts as one of the most affected areas.

Brazil's three largest privately controlled banks — Banco Santander (Brasil) SA, Banco Bradesco SA and Itaú Unibanco Holding SA — reported 23.7 billion Brazilian reais in fee income in the third quarter 2021, about a third of all their revenue. Checking account fees, in particular, represented about 20% of that pool.

At Santander Brasil, fee income on current accounts dropped by as much as 4.6% in the third quarter, to 975 million reais. At Bradesco, they grew, but at a slow pace of 2.7%, to 2.0 billion reais.

But banks, looking on the bright side, see an increasing population of clients to target.

"It is impossible to imagine a fiercer competition in Brazil," Leandro Miranda Araujo, head of investor relations with Bradesco, said in the bank's latest earnings call. "On the other hand, we shall have a bigger pie to share as the economy grows."

The increase in the number of checking account customers in the third quarter, with the addition of 1.7 million new customers over the past year, "offset all the revenue losses from Pix," Araujo said.

"Big banks in Brazil are largely diversified," Guilherme Machado, a bank director at S&P Global Ratings, said in an interview. "They have so many fee revenue lines that this isn't something that they are worried about but that they rather see as an opportunity to cross-sell."

As of Dec. 28, US$ 1 was equivalent to 5.63 Brazilian reais.