Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Nov, 2021

By Allison Good

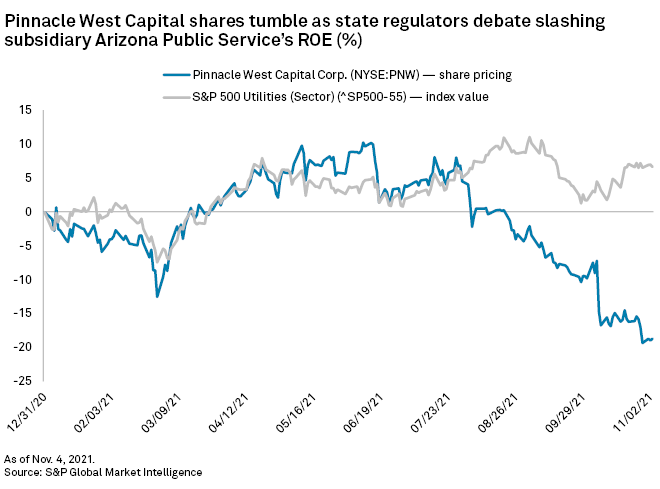

Pinnacle West Capital Corp. plans to immediately prioritize stanching the holding company's wounded equity after the Arizona Corporation Commission dramatically reduced utility Arizona Public Service Co.'s earning and cost recovery potential, executives said.

The commission on Nov. 2 voted to cut the utility's rate of return on equity to 8.7% and disallowed a $215.5 million recovery of pollution control costs at the Four Corners coal-fired power plant in a controversial case that has seen Pinnacle West stock plunge over 14% since mid-October.

While Arizona Public Service, or APS, plans initiate another rate case proceeding in 2022 and sue the commission if it denies a request for rehearing about the costs of installing selective catalytic reduction equipment at Four Corners, CFO Ted Geisler said the company can pull several financial levers in the meantime.

The most important near-term measure for protecting investors from the regulatory fallout, the CFO explained, is deferring equity issuance until the conclusion of the next rate case. Instead, debt raised by Pinnacle West will be transferred to Arizona Public Service in the form of an equity investment, a practice known as double leverage.

"We believe that the commission will understand that we have to lever the company in order to keep funding the growth in the state, and that's the position they put us in as a result of the outcome of this recent case," Geisler said during Pinnacle West's Nov. 5 third-quarter earnings conference call.

Investor reaction to the company's plan was tepid, with Pinnacle Capital shares up just over 2% during afternoon trading.

Analysts at Guggenheim Securities LLC wrote Nov. 2 that "the recent credit downgrades ... and any further credit downgrades which may follow will make it difficult for PNW to avoid an issuance of common equity as being the most significant source of capital for that infusion into APS."

The rate case decision, Pinnacle West's Geisler noted, had a negative 90-cent impact on earnings for the third quarter and added a $13 million downward adjustment to the $90 million net income impact estimated from an administrative law judge's recommended opinion and order in August that called for a 9.16% ROE.

Before the commission's final vote, Chairman, President and CEO Jeffrey Guldner made a counter-proposal stipulating that APS would be "willing to forgo all earnings" on its Four Corners equipment costs if the commission authorized a debt return on that investment, decreased the utility's ROE to no lower than the administrative law judge's recommended 9.16% and adopted "no other harmful amendments." In return, APS would put another $10 million toward its coal communities transition plan.

Guldner called the rate case "unique in nearly every aspect" because it was compelled by the commission, did not allow for a settlement and concerned coal, which APS aims to completely exit by 2031.

"The process that transpired was not constructive," Guldner said during the call. "We're not apologetic for standing up for what's right."

Regarding the Four Corners selective catalytic reduction equipment, Guldner emphasized that denying a $215.5 million investment recovery sets a potentially harmful precedent as decarbonization-related technologies change.

"If every time we do that, there's a look backwards to say, 'Well, maybe there's a different technology that would have been better or cheaper,' it makes it really hard to think about how you're going to navigate this clean energy transition," Guldner said.

An amendment submitted by Commissioner Jim O'Connor on Oct. 25, however, blamed APS for staying the course on the pollution control costs.

"We believe that as a large and sophisticated electric utility, APS knew (or reasonably should have known) that the economic assumptions ... had changed," O'Connor wrote.

Pinnacle West also provided a 2022 earnings guidance range of $3.80 to $4 per share, which Geisler acknowledged was a "significant reduction" compared to 2021.

Still, the company anticipates "steady" rate base growth amid a housing boom in Maricopa County.

"The ROE granted ignores the fact that we're one of the fastest-growing states in the country, and we need to attract capital in order to fund the growth and economic development that we're experiencing in Arizona," Guldner said.