Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Nov, 2021

By Regina Liezl Gambe and Ranina Sanglap

Virtual banks in the Philippines will likely have a strong start as they capitalize on growing demand for cross-border digital remittances and a large unbanked population.

The nation's six newly licensed digital-only banks are set to grab a slice of the $35 billion remittance market from brick-and-mortar lenders and nonbank platforms, analysts said. Identification technology and agile operations allow virtual banks to fill the gaps in current services such as instant fund transfers and other financial products targeting around 70% of the population that do not have a bank account.

"What may be a huge opportunity for the Philippines' [virtual banks] is the large overseas Filipino workforce across ASEAN, Hong Kong and the Middle East," said Teng Sherng Lim, chief commercial officer of ADVANCE.AI, a Singapore-based artificial intelligence and data company.

"Certainly, digital banking will create new opportunities for the Philippines' banking sector and make it more competitive internationally, which of course could include new avenues to expand into regional markets."

The Philippines’ remittance market is the fourth largest in the world, after India, China and Mexico, according to the World Bank. Personal remittances from overseas Filipinos are an important source of foreign exchange to the Philippine economy, equivalent to 9.2% of its GDP in 2020.

The underserved segment creates a unique opportunity for Philippine online-only banks to grow their customer base and revenue more quickly than its peers in neighboring markets, especially during their first years of operations, analysts said. Virtual banks such as

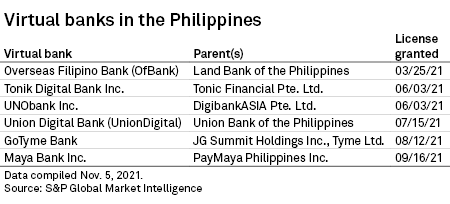

The Bangko Sentral ng Pilipinas, or BSP, has granted licenses to six virtual banks as of late September. The central bank on Aug. 31 closed the window for accepting digital bank applications for three years to allow the companies to build out their businesses.

"We wanted to assess the impact of these digital banks in terms of promoting efficiency in the financial sector, as well as achieving our goals to promote inclusive growth," Lyn Javier, the BSP's managing director for policy and specialized supervision, said in an interview with S&P Global Market Intelligence.

Chronic challenges

The Philippines, like many other developing countries, are hoping virtual banks will help bring their unbanked population under the formal banking system.

Under the central bank's digital banking framework released in November 2020, operators are required to offer financial services that are processed end-to-end through a digital platform or electronic channels and must not have physical branches.

"Using innovation and technology, digital banks can find ways of overcoming many of the issues that have prevented people from having even a basic bank account," said Shweta Jain, head of retail banking cloud and digital strategy at Finastra, a global financial technology firm. "Digital banking has the potential to bring millions of unbanked and underbanked people into the financial system."

Many Filipinos remain unbanked as they do not have enough supporting documents required to open a bank account because they are either elderly, unemployed or working in the informal sector, analysts said. It has also been difficult for banks to set up physical branches in the archipelago of nearly 7,000 islands.

The Philippines lags most of its Southeast Asian neighbors in digital banking penetration, with only 76% of respondents in a VMWare study in July embracing contactless payment, compared with the region’s average of 85%.

Growing demand

In addition to cross-border remittance, local digital payments have also been rising in the Philippines, creating a fertile ground for virtual banks to grow.

The volume of payments made digitally rose to an estimate of 17% of all payments in the first half of 2020, from 10% in 2018, according to a report by the Better Than Cash Alliance in partnership with the BSP. The growth was mainly due to payments made to merchants and person-to-person payments during the pandemic.

"Demand is clearly there given over 70% of the population are Gen Z and millennials under 30 who are unlikely to ever step foot inside a physical bank," ADVANCE.AI's Lim said.

Internet connectivity is another significant lever that can move the needle for the central bank’s goal of shifting at least 50% of total retail payment transactions to digital and bringing 70% of Filipinos into the financial system, according to the BSP. The Philippines has an internet penetration rate of 67%, according to a February study by Hootsuite, a social media management platform.

Over time, growing transaction accounts "will enable Filipinos to build financial profiles that further unlock access to more complex financial services," BSP Governor Benjamin Diokno said at a Sept. 28 webinar on the rise of challenger banks, hosted by the Management Association of the Philippines.

"A digital bank that is able to grow its loan book at a faster pace, while at the same time mitigating the risk of lending using a purely digital platform, will achieve profitability much faster," said Long Pineda, president of Tonik Digital Bank.