S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Feb, 2022

By Michael Gibney

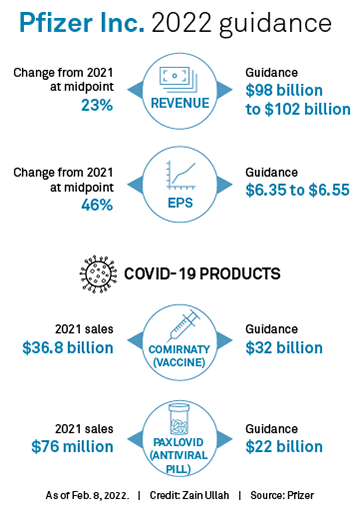

Pfizer Inc.'s 2022 sales forecast of $22 billion for its COVID-19 pill Paxlovid would make it the highest annual sales of any branded pharmaceutical drug in history.

Add in an expected $32 billion in sales in 2022 for COVID-19 vaccine Comirnaty, which would remain at the top of best-selling vaccines ever, and Pfizer is expecting a historical year.

|

The best-selling drug of all time in annual sales is AbbVie Inc.'s Humira, totaling $20.7 billion in 2021. The arthritis and psoriasis drug is the top-selling drug of all time due to the longevity of sales since first approved in 2002, drug data aggregator Evaluate Vantage editor Lisa Urquhart told S&P Global Market Intelligence.

Sales of Pfizer's own pneumococcal vaccine Prevnar 13 top the list for immunizations outside of COVID-19 at $6.2 billion in 2015, Urquhart confirmed.

Comirnaty sales reached $12.5 billion globally in the fourth quarter of 2021 and $36.8 billion in the full year.

Pfizer's sales guidance for the COVID-19 products includes only signed contracts with governments and not any ongoing discussions for further supply, executives said on Pfizer's fourth-quarter and full-year earnings call on Feb. 8.

Sales of Paxlovid, in particular, could be higher than anticipated due to demand and the potential for lucrative government contracts that have not yet been signed, Pfizer CFO Frank D'Amelio said on the call. J.P. Morgan analyst Christopher Schott said in a Feb. 8 note that the upside to the guidance is likely.

"This leaves Paxlovid as the major swing factor for 2022 with the company almost certainly positioned to exceed 2022 guidance but with implied margins that appear modestly below our prior expectations," Schott said.

Newly authorized in the U.S. in December, Paxlovid brought in $76 million in 2021 as therapies from rival pharmas brought in $5.7 billion combined in the fourth quarter.

For Comirnaty, sales are more likely to stay consistent with the 2022 forecast, D'Amelio said.

"While we can't predict what may be needed due to omicron or other variants, I would caution you that there is less potential upside to this guidance through the year compared to the situation we faced in 2021 when the vaccine was newly available and few people had received any doses of the vaccine," D'Amelio said.

An expert advisory committee will meet Feb. 15 to discuss the potential emergency use authorization of two doses of Comirnaty in children ages 6 months to 4 years. With pediatric COVID-19 cases and hospitalizations at an all-time high, Chief Scientific Officer Mikael Dolsten said the U.S. Food and Drug Administration has urged the company to submit trial data on a rolling basis while third-dose studies in young children are still underway.

M&A tinderbox

For the full year 2021, Pfizer's revenue grew 92% from the year before, although revenue grew only 6% in the core business without sales from the two pandemic-related products.

On top of the $54 billion in COVID-19 vaccine and therapy sales, the core business is forecast to generate between $45 billion and $47 billion in sales.

Pfizer's pipeline progression — particularly with regard to the company's respiratory syncytial virus vaccine — and business development are more likely to determine the company's long-term future as questions remain about the long-term sustainability of COVID-19 related sales, according to J.P. Morgan's Schott.

In addition to drug development deals announced in January, the pharmaceutical giant is looking to add at least $25 billion in revenue to 2030 top-line expectations through business development, Pfizer CEO Albert Bourla said on the call.

"The focus of our business development efforts will continue to be on compelling external science in the form of both later-stage assets as well as earlier medical innovations, but have the potential to be breakthroughs for patients," Bourla said. "Our focus will largely be in the therapeutic areas and platforms where we have the scientific skills and acumen to add substantial value and select the most successful targets."

The revenue from COVID-19 sales will likely mark a sea change for Pfizer as M&A becomes more feasible and necessary to stay ahead, Schott said.

"Relative to pre-COVID, the company clearly appears to be looking to accelerate its levels of capital deployment, which we see as a logical step given the enhanced cash flows of the business as well as the longer-term [patent] challenges Pfizer is facing," Schott said.