Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Sep, 2022

By Brian Scheid

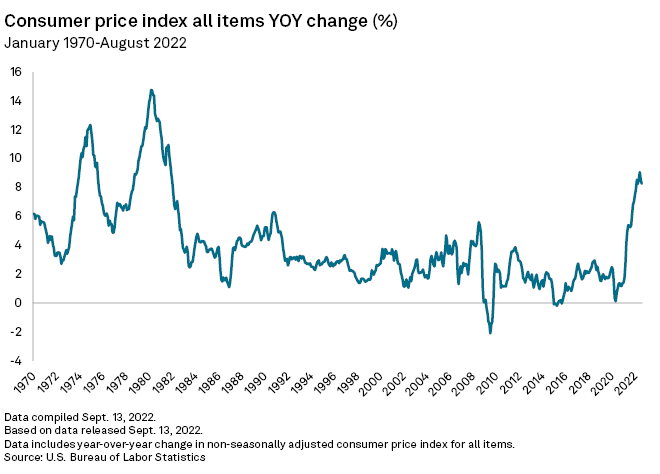

Six months into the most aggressive interest rate hiking cycle in decades, Federal Reserve officials this week will push rates even higher. The question is just how hard they plan to step on the gas.

It is a near certainty that the rate-setting Federal Open Market Committee will agree to hike the benchmark federal funds rate by at least 75 basis points by the time its meeting wraps Sept. 21. And expectations of where the central bank might stop hiking rates continue to push higher as the latest inflation data showed persistently high prices.

"From a Fed standpoint, obviously they cannot even think about stopping until this [inflation] number gets down to something more tenable," said Tom Essaye, a trader and founder of financial research firm The Sevens Report.

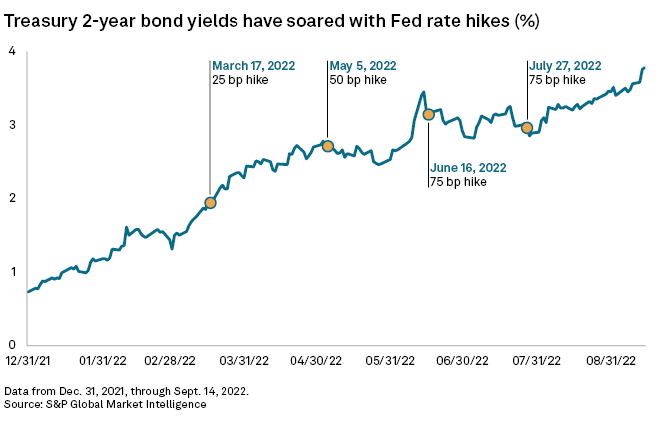

The Fed's push to tame inflation through higher rates has elevated borrowing costs across the economy, driving up shorter-term bond yields. The 2-year Treasury bond yield, for example, has risen more than 300 basis points since the start of this year. Inflation, however, has yet to come down, forcing Fed officials to consider more sizable rate hikes that could increase the odds of a recession.

Since March, the Fed has raised rates by 225 basis points, including two 75-basis-point hikes following the past two meetings, pushing the federal funds rate to a range of 2.25% to 2.5%. Most investors are expecting a third 75-basis-point hike, though speculation of a larger 100-point increase began to emerge after August inflation data came in above economists' expectations.

Market odds of a 75-basis-point hike were at 80% as of Sept. 16, while odds for a 100-point hike were 20%, according to the CME FedWatch Tool, which measures investor sentiment in the Fed funds futures market. Some investors were expecting a smaller increase, though the odds of that milder 50-point hike evaporated after the release of updated inflation data Sept. 13.

Fed Chairman Jerome Powell and other central bank officials have called for tight monetary policy to continue until inflation cools. Even so, they are unlikely to approve a 100-basis-point hike without clearly signaling their intention to do so before a meeting. During an August speech at the central bank's annual economic symposium, Powell said higher rates will likely remain "for some time" until inflation is brought under control, and Fed officials this month have indicated that another 75-point hike was expected.

"It's not clear that you need that shock and awe right now where we are," said Karthik Sankaran, a senior market strategist at Corpay Cross-Border Solutions, referring to a surprise 100-basis-point hike.

Higher peak forecast

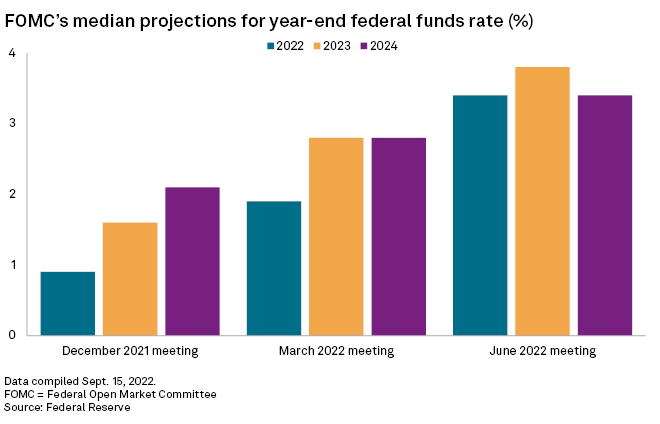

The Fed appears unlikely to slow its hiking cycle anytime soon. Expectations of where the federal funds rate will top out have risen to about 4.5%, with some forecasts going as high as 5%.

Larry Meyer, CEO of Monetary Policy Analytics and a former Fed governor, wrote in a Sept. 13 note that he now sees the Fed targeting a range of 4.25% to 4.50% as the peak of its hiking cycle. That would be reached after a 75-basis-point hike in September, a 50-basis-point hike in November, a 25-basis-point hike in December, and then two more 25-basis-point hikes in early 2023, Meyer said.

Fed expectations for the rate path will be revealed in the latest Summary of Economic Projections on Sept. 21.

The most recent projections, released after June's Federal Open Market Committee meeting, showed the committee's median projection for the federal funds rate to be at 3.4% at the end of this year and at 3.8% at the end of 2023, before falling back to 3.4% at the end of 2024.

"The question is what happens with the rate in 2023 and beyond," said Steven Ricchiuto, managing director and chief economist at Mizuho Securities.

While many Fed watchers expect rates to peak in 2023, persistently high inflation could force a different path. The Fed could hike aggressively into 2023, then pause and restart with more gradual increases of 25 or 50 basis points every quarter, Ricchiuto said.

"The market still has this perception that the Fed, after it pauses, will then cut rates," Ricchiuto said. "I don't see that happening."