Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Apr, 2022

Pension risk transfer deals continued at a brisk pace in the first three months of 2022, following strong demand for such transactions in 2021.

U.S. companies in the first quarter disclosed roughly $2.08 billion in pension obligations transferred to life insurance companies operating in the domestic market, according to a review of public documents by S&P Global Market Intelligence. The information was compiled on a best-efforts basis and excludes U.S. companies transferring offshore pension programs as well as longevity reinsurance transactions with U.K.-based insurers.

Prudential tops in Q1

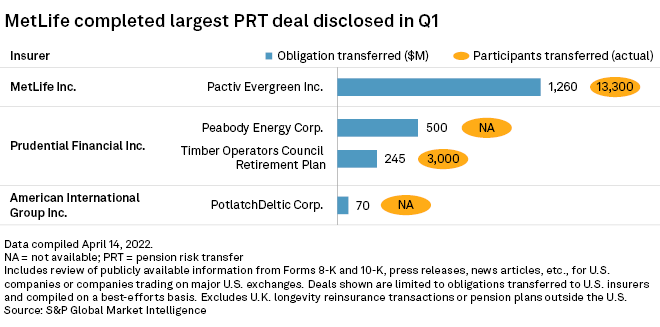

The largest pension risk transfer deal during the first quarter looks to have been MetLife Inc.'s transaction with Pactiv Evergreen Inc., which saw the food packaging company move $1.26 billion in obligations covering almost 13,300 plan participants.

Prudential Financial Inc. was involved in at least two transactions in the first three months of the year, totaling $745 million in obligations. Also disclosed in the first quarter of the year, PotlatchDeltic Corp. will ship $70 million of its obligations to American International Group Inc.

Athene led the way in 2021

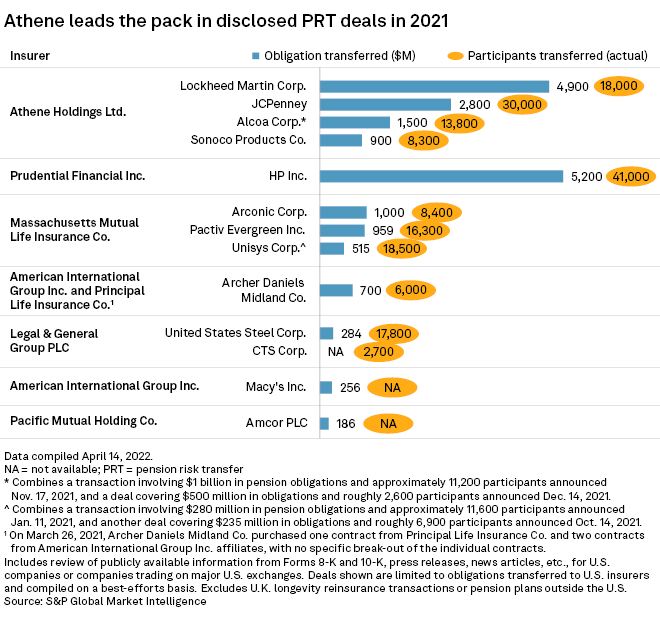

Companies disclosed approximately $22.7 billion in pension obligations transferred to U.S. life insurers or affiliates in 2021. Athene Holding Ltd. had the largest share of disclosed deals for the year, with five transactions totaling $10.10 billion in obligations transferred. Those deals covered approximately 70,100 plan participants.

Athene's deal with Lockheed Martin Corp., worth $4.9 billion, was its largest in 2021. Its other disclosed 2021 transactions involved JCPenney, Alcoa Corp. and Sonoco Products Co. In total, Athene reported an aggregate principal amount for pension group annuities of $13.8 billion in 2021.

HP Inc. moved approximately 41,000 participants to Prudential Financial in August 2021. That deal alone totaled roughly $5.2 billion in liabilities, the largest disclosed transaction in 2021.

Massachusetts Mutual Life Insurance Co. completed at least four pension risk transfer deals in 2021, totaling almost $2.47 billion in liabilities. The transactions were deals with Arconic Corp. and Pactiv Evergreen and two deals with Unisys Corp.

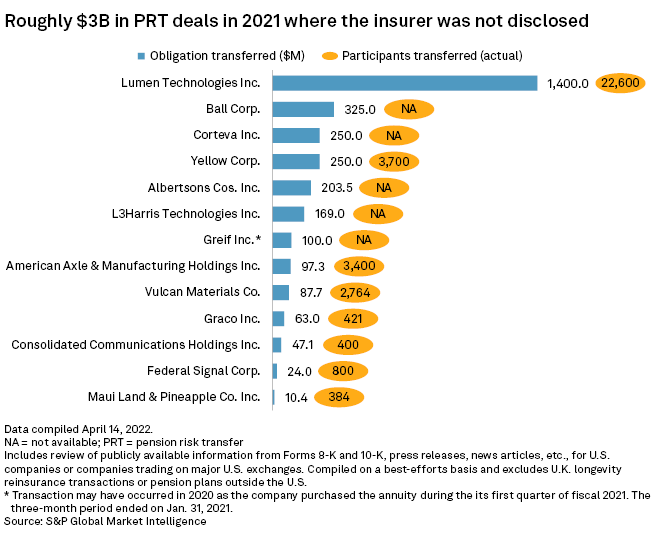

Nearly a dozen pension risk transfer transactions were reported in 2021 without specific insurers listed as being responsible for future obligations. In aggregate, those deals show $3.03 billion in transferred obligations, with the $1.4 billion deal by Lumen Technologies Inc. as the largest.

Buyout sales hit highest levels since 2012

Information collected by Limra's Secure Retirement Institute reported that pension buyout sales totaled $34.15 billion in 2021, an increase of roughly 37% compared with the prior year.

That was the largest annual sales figure since 2012, when two large pension risk transfer transactions involving Prudential Financial accounted for the bulk of a sales total of $36 billion.