S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Sep, 2021

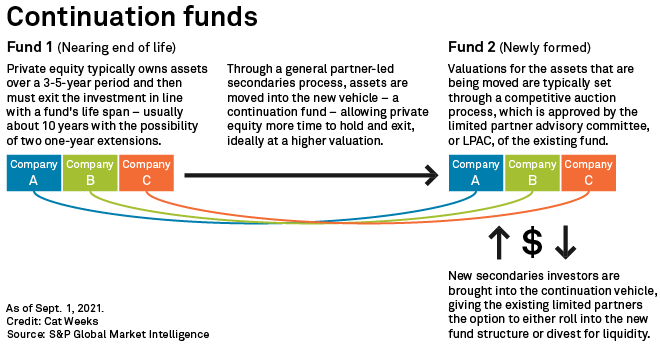

Private equity has long had a problem with expiring hold periods for "jewel in the crown" assets, and general partner-led secondaries are increasingly becoming a solution.

Once referred to as zombie funds, GP-led secondaries, or fund restructurings, were viewed as solutions used for those vehicles that were struggling in the aftermath of the global financial crisis. But prior to the pandemic, a number of quality GP names began to tap the secondaries market, market participants said.

Examples include Warburg Pincus LLC's sale of a portion of its Asian investments from its $11.2 billion 2012 vintage Warburg Pincus Private Equity XI LP in a $1.2 billion transaction. BC Partners, also completed a secondary transaction involving assets in Europe and the U.S. that were housed in its €6.7 billion 2011 vintage BC European Capital IX LP fund. The firm received an approximate $1 billion capital commitment. Both secondaries transactions were completed in 2017.

|

The coronavirus pandemic was a catalyst for the development of GP-led secondaries. As private equity grappled with the slowdown of the exit market, GPs increasingly turned to the secondaries market for continuation fund solutions to hold assets that they were unable or unwilling to sell on as vehicles reached the end of their lifecycles.

There's been a general realization among the GP community that secondary capital can be used strategically "to help grow their business and their businesses. And I think prior to 2019 it probably wasn't fully appreciated," Nigel Dawn, head of Evercore Inc.'s private capital advisory group said in an interview.

"Everybody recognizes that [private equity] fund structures create some constraints, and general partners historically have looked to monetize and liquidate assets within that time horizon. But now general partners could look at their best assets and actually say, we don't need to sell," said David Atterbury, managing director and co-head of HarbourVest Partners LLC's secondary investment activity in Europe.

GP-led liquidity solutions surpassed 60% of secondary market deal volume in the first half of 2021 according to a survey from Evercore — marking the first time it was that high since the company started its secondary market report. The figure was also up from 50% in 2020.

For the secondaries buyers themselves, the risk/return profile of investing behind an existing owner of assets is attractive, CPP Investments Ltd.'s head of secondaries Dushy Sivanithy said in emailed comment. "The GPs have typically pre-identified the next few years of value creation and can enact those plans immediately. That’s a different type of investment opportunity than backing a GP to buy new companies for the first time."

A new path to exit

The real growth driver across the past year has been the acceleration of single asset transfers, market participants said. According to Evercore's report, single-asset deals accounted for 41% of GP-led secondaries continuation fund transactions with the remainder multi-asset deals. This is up from single-asset deals making up 30% of volume over the same period in 2020.

A number of sources S&P Global Market Intelligence spoke with labeled single asset deals another exit option for top-performing assets in a fund in addition to a sponsor-to-sponsor sale, a trade sale or an IPO.

There are situations where single asset deals are "completely valid," Alex Shivananda, head of secondaries and co-investments at Cambridge Associates LLC said, adding that his firm has participated in transactions that provided strong returns. The secondaries team invests in and alongside secondaries funds and is also the recipient of GP-led secondary opportunities in an LP capacity.

|

Managing the chain

Continuation fund solutions offer a path to liquidity while also providing GPs and LPs with more hold options. But crucial to their success is GP management of the chain of stakeholders.

GP-led transactions are a case study on multi-variant negotiations, said Sunaina Sinha Haldea, managing partner of placement agent and secondaries adviser Cebile Capital LLP. Advisers have to manage the needs of existing LPs in the fund, the Limited Partner Advisory Committee of the existing fund, the GP itself where various individuals may be involved, as well as a new set of investors that have been brought to the table.

"All of these parties have to agree to a deal for that deal to go through," Sinha Haldea said.

"If you think about M&A, about one buyer, one seller, no conflict of interest, no nothing — that can [still] fall over. Think about even one of the pieces of the puzzle that I just enumerated. [If they] don't say yes, your deal is done."

Another key element of stakeholder management is transparency, which has increased over the years as secondaries transactions have become more efficient, said HarbourVest's Atterbury.

Existing LPs need to understand exactly what's happening, there needs to be "really good communication with them from the general partner, from the intermediaries that are involved ... a very clear sharing of information," he said.

|

Roll or sell?

As the process around GP-led secondaries improves, LPs are able to make rounded decisions on whether to roll or sell, Atterbury said. "It becomes easier to make those decisions because of the transparency and efficiency, but it does clearly create work as well for investors."

Secondaries investors entering into a new transaction are looking for the best returns, as are existing investors who are given the option to cash out. Fee allocation, prior management of the asset and its forward-looking business plan are crucial to such deals getting over the line. "I think that helps keep things honest, and the advisers surrounding it are getting more sophisticated in this as well," Cambridge Associates' Shivananda said.

The decision to roll or sell is an individual decision made by different LPs based on their current appetites for the manager offering the solution as well as their plans for allocations to private equity more broadly.

"If you think there is more upside and you think there's more value to be gained by staying in or you don't have other interesting alternatives to invest in, then you might opt to stay in," Shivananda said.

All sources S&P Global Market Intelligence spoke with believe GP-led secondaries are here to stay.

"There's probably more opportunity currently than the ability of the buy side to absorb, so we're almost in a transition period as the buy side creates capital to invest in these opportunities," Evercore's Dawn said, adding that some competitors are creating new teams specifically to take advantage of the opportunity.