S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

29 Oct, 2021

By Maera Tezuka and Drew Wilson

S&P Global Market Intelligence offers our top picks of global private equity news stories published throughout the week.

In the year to Oct. 18, private equity has invested about $1.51 billion in digital music rights globally, according to S&P Global Market Intelligence data for disclosed deals.

The spike in digital streaming subscriptions during the pandemic resulted in an opportunity for private equity to take stakes in music royalty catalogs. Music streaming can provide stable royalty revenue and a recurring cash flow potential that makes it a comparatively lower-risk investment.

The top deal this year was KKR & Co. Inc. and Dundee Partners LLP's $1.10 billion acquisition of KMR Music Royalties II portfolio, which is made up of more than 62,000 music publishing copyrights. Another big player, Blackstone Inc., bought the music business in Canada of Entertainment One, a unit of Hasbro Inc., for $385.0 million.

Read more about private equity involvement in music catalog investment here.

CHARTS OF THE WEEK: US, Europe PE deal-making continues

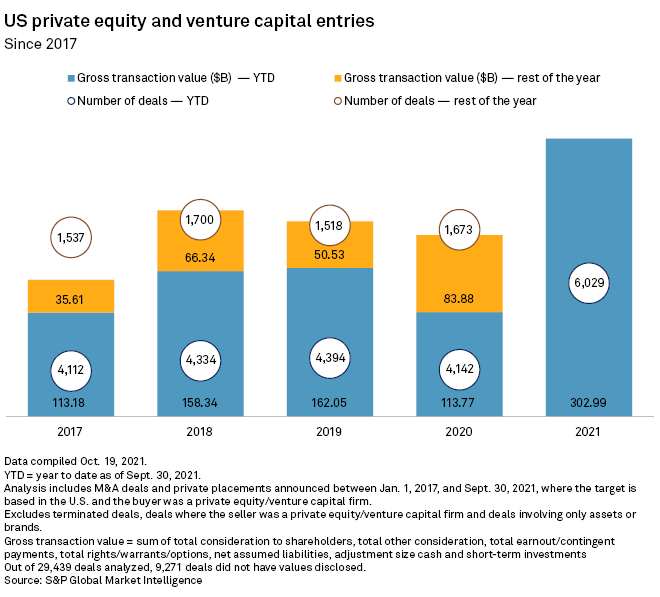

➤ In the first three quarters, U.S. private equity and venture capital deal volume and value hit an all-time high for the period, recording 6,029 deals with a total value of $302.99 billion.

➤ During the same period in Europe, deals rose 22.6% year over year to 4,321, while value more than doubled to $156.2 billion.

➤ Information technology remained the top targeted sector in both regions.

FUNDRAISING AND DEALS

* Brookfield Business Partners LP and its institutional partners agreed to purchase the global lottery services and technology arm of Scientific Games Corp. for approximately $5.8 billion in a transaction slated to close in the second quarter of 2022.

* KKR will buy Clearway Energy Inc.'s thermal business, known as Clearway Community Energy, in a $1.9 billion deal, which is set to close during the first half of 2022.

* Hellman & Friedman LLC teamed up with EQT Partners AB's EQT IX fund to support Zorro Bidco SARL's increased and final offer to acquire German pet product e-commerce company zooplus AG for €480 per share in cash.

* Ares Management Corp. set up its wealth management arm, Ares Wealth Management Solutions, which will be led by former Black Creek Group LLC CEO Raj Dhanda.

ELSEWHERE IN THE INDUSTRY

* Tiger Global Management LLC raised $8.8 billion for its Tiger Global Private Investment Partners XV LP venture fund at first close, investors told Bloomberg Markets. The fund, which has a $10 billion target, will deploy capital into internet technology startups in the U.S., China and India.

* KSL Capital Partners LLC is seeking to obtain $3 billion in capital commitments for its KSL Capital Partners VI LP vehicle, Bloomberg Markets reported, citing people with knowledge of the matter.

* Fortino Capital Partners NV/SA sold SigmaConso SA, a Belgian developer of corporate performance management software, to HgCapital LLP-backed Prophix Software Inc. for an undisclosed amount.

* Middle-market investor Great Hill Partners LP made a strategic growth investment in digital patient engagement platform provider Clearwave Corp., with Frontier Growth retaining a significant stake in the business.

FOCUS ON: IT SERVICES

* H.I.G. Capital LLC affiliate H.I.G. Europe Realty Partners will sell its majority interest in German IT services company Conet Technologies AG to IK Partners.

* Pamlico Capital Management LP invested in IT decision-making platform provider Avant Communications Inc., while the latter's co-founders and management team will keep a significant stake in the business.

* Sverica Capital Management LP acquired a majority stake in systems integration company Automated Control Concepts LLC.

Theme

Segment