S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Jun, 2023

By Dylan Thomas and Annie Sabater

Earnout provisions are increasingly likely to factor in M&A deals when the seller is a private equity firm.

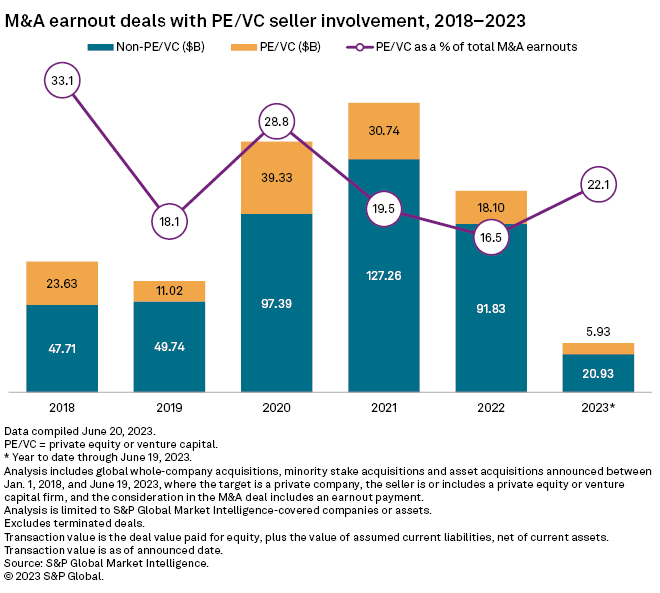

Earnout payments were included in deals totaling $26.86 billion globally between Jan. 1 and June 19. Private equity (PE) exits accounted for more than 22% of that total, their highest share since 2020, according to S&P Global Market Intelligence data.

An earnout in M&A involves the seller of a company receiving additional payments depending on the future performance of the acquired company.

A growing portion of private equity exit value is being made contingent on the exited company hitting post-deal benchmarks, reflecting the challenging M&A environment. Earnouts are often used to bridge a gap between a buyer and a seller, and private equity exits with earnout provisions accounted for 6.3% of private equity exit value between Jan. 1 and June 19. That is above the annual rates in 2021 and 2022 but behind the rate in 2020, when exits with earnouts amounted to 9.1% of private equity exit value.

"An earnout is another way that maybe buyers get comfortable with the deal overall, knowing that if there's a recession that comes along or if interest rates continue to go up and that might have a negative impact on the target's business, the buyer has a little bit of protection built in," said Kip Wallen, senior director of thought leadership at M&A specialist SRS Acquiom Inc.

Behind the trend

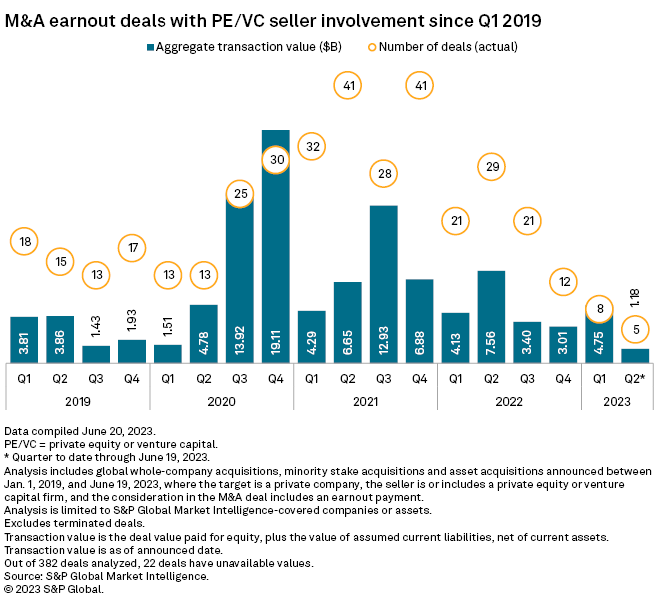

The pandemic had the most significant impact on recent earnout trends in M&A, when a suddenly very uncertain economic outlook pushed buyers and sellers apart on valuations, Wallen said. In the third and fourth quarters of 2020, the value of PE exits with earnout provisions spiked to its highest level in four years.

The number of private equity exits with earnout provisions increased in 2021, but in a record year for private equity dealmaking, they accounted for a smaller share of overall exit value than the prior year, just 4.8%. That portion grew to 5.2% of private equity exit value in 2022 as higher interest rates, inflation and geopolitical instability prompted a widespread drop in corporate valuations and slowed dealmaking.

– Read about private equity's growing role in the SPAC market.

– Catch up on private equity headlines.

– Download a spreadsheet of data from this story.

Tighter lending conditions are an additional factor driving the rising use of earnout provisions in 2023. Earnouts come into play when "the buyer can't get 100% there between its equity check and the debt financing," helping to close the gap between the buyer's offer and the seller's asking price, said Gregory Fine, co-chair of the private equity practice at law firm Mintz.

Largest earnout deals

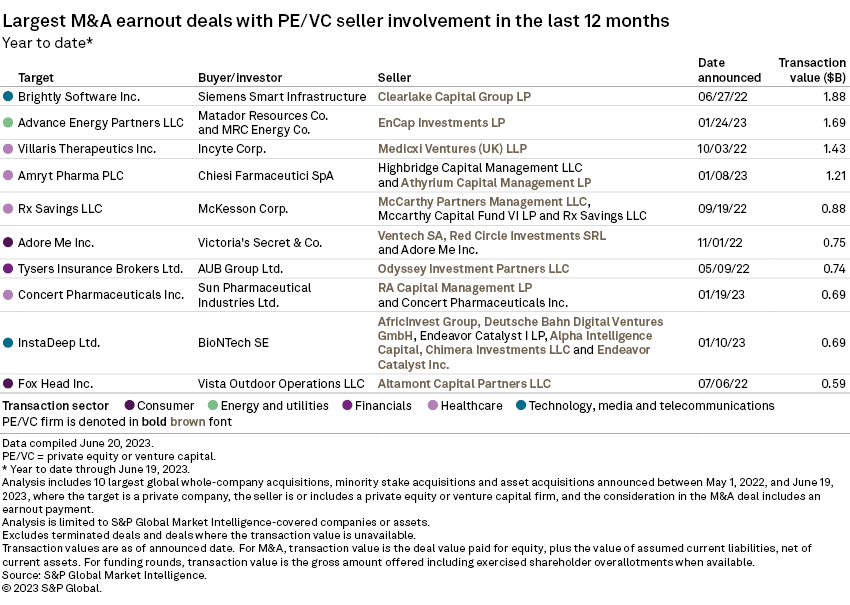

The portion of total deal value contingent on future performance ranged from 5% to 78% among the 10 largest private equity exits to include earnouts over the last 12 months, according to Market Intelligence data.

Three of the top 10 transactions were in the biotechnology and pharmaceutical sectors, including the deal at the high end of the earnout range: the acquisition of Medicxi Ventures (UK) LLP-backed Villaris Therapeutics Inc. by Incyte Corp., which made an up-front payment of $70 million for the biotechnology company but tied the rest of the $1.43 billion deal to Villaris hitting development, regulatory and commercial milestones.

Earnouts are much more common in life sciences M&A, since so much investment activity takes place early in the development of a drug or therapy before there is a clear path to commercialization, Wallen explained, adding that earnouts featured in about two-thirds of deals in the sector in 2022. By comparison, earnouts were relatively uncommon in technology M&A in 2022 — a phenomenon Wallen chalked up to sinking tech valuations.

"Sellers were just insisting on, whatever amount they could get, they wanted it all up front. They didn't want to risk it by tying it to an earnout," he said.

Outlook

Use of earnouts would be expected to fall as M&A activity picks up. In a more competitive environment, buyers willing to offer the full price up front have an edge over buyers requesting an earnout provision, Fine said.

"Typically, sellers view earnouts less favorably than [an offer from] another buyer who would pay full price, cash on the barrelhead," Fine said.

Buyers may prefer to avoid earnouts in many cases, too, Fine added, noting that they can become a contentious point in M&A negotiations.