S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Jan, 2021

Private equity managers are optimistic about deal-making and exit activity in 2021 and are gearing up to spend unallocated capital after a 2020 second quarter jolt and the subsequent onset of recovery.

The second half of 2020 has shown that deal-making will continue, Dechert LLP private equity partner Ross Allardice said in an interview. There is "a ton of dry powder out there," and Allardice believes deal-making will continue to be strong in the first half of 2021.

While there may have been a "backlog" in the second half of 2020 as managers sought to get halted transactions over the line, "with reduced uncertainty from positive momentum on a vaccine and the U.S. election behind us, I would expect to see activity levels stay stable or increase," Jason Barg, partner at financial services-focused Lovell Minnick Partners LLC, said in an emailed response. The majority of managers S&P Global Market Intelligence spoke with or received emailed comment from expect 2021 transaction volumes to increase on this year's levels, while one manager expects activity levels to stay stable or increase.

"I'm bullish about 2021, especially for companies that performed well through COVID," Stewart Kohl, co-CEO of lower-middle market-focused The Riverside Co., said. "Business and consumer confidence should be fairly high, and there will be M&A activity."

Asset bifurcation

Transaction volume has been bifurcated in 2020. Businesses in sectors that have withstood the effects of the pandemic and the lockdowns that came with it, such as technology and healthcare assets, commanded high prices in 2020 and are expected to continue to do so into 2021.

Richard Swann, partner and member of middle-market private equity firm Inflexion Pvt. Equity Partners LLP's executive committee, explained his firm's approach to high priced assets. Swann said managers need to maintain discipline both around pricing and in choosing businesses that they are confident can actually reap benefits through private equity ownership. "That sort of leads into the sector approach. So it's okay paying a full price for an asset as long as you know what you're going to do with it," Swann said in an interview.

While businesses operating in sectors impacted by the events of 2020, such as retail, leisure, hospitality and travel, have been difficult to price this year, managers expect more certainty for these assets moving into 2021. But there will be winners and losers.

Assets dependent on discretionary consumer and corporate spend must "demonstrate that they have gained market share or competitive advantages during the crisis to attract strong prices," Markus Golser, managing partner of U.K.-focused Graphite Capital Management LLP said.

News of viable vaccines has "made people feel just a little bit more positive about the outlook, especially in terms of the retail industry and other industries," Martina Colombo, funds senior associate at MJ Hudson Group PLC said. Those industries may "take a long time" to bounce back, but "people are social creatures" and these are industries that "people will always want to return to, so they're just going to have to find new ways of adapting," Colombo said. "I don't think that firms are going to avoid investing in those suffering industries. If anything, they're just going to find new ways of being able to find value in them."

Exit horizons

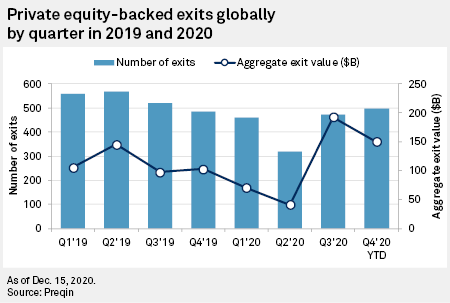

Likewise, private equity exits are expected to accelerate, but in some instances, there may be opportunities to hold assets longer if firms believe there is still opportunity to create value, while also avoiding being a forced seller.

There is "an awful lot of pent-up demand," which is creating "a lot of bilateral and very proactive buying opportunities," Inflexion's Swann said, adding that on the other side is someone selling.

Private equity firms also want to maintain distributions to their investors, which will continue to drive exit activity in the new year, Graphite's Golser said.

But not all assets will be exit ready, and MJ Hudson's Colombo expects some firms will opt to hold assets through products like continuation vehicles as 10- to 12-year fund lives come to an end.

Continuation vehicles, which allow limited partners to either cash out or reinvest and enable general partners to bring in other cornerstone LPs, offered an "interesting avenue for the short term, postmortem on COVID-19," said Dechert's Allardice. A number of processes were delayed or canceled in the months following the outbreak. "There's nothing wrong with these companies ... but ultimately the buyer, whether it was PE or strategic, was not able to get comfortable with spending large amounts of capital on these companies with the pandemic looming large and the uncertainty."

The secondaries market remains buoyant and offers "a nice alternative for certain PE funds that are selling," Allardice added. He expects the trend to continue in the first half "and let's see after that if things get back to normal."