S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Sep, 2021

By Maera Tezuka and Drew Wilson

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity's appetite for insurance sector investment hit $19.28 billion in the year to August, capped by Apollo Global Management Inc.'s planned $11 billion merger with Athene Holding Ltd., announced earlier this year. Blackstone Inc. was also active, agreeing to acquire Allstate Life Insurance Co. and certain other subsidiaries of The Allstate Corp. for $3.05 billion and, separately, buying a 9.9% stake in SAFG Retirement Services Inc.

The big five listed private equity firms have all been buying insurance companies in recent years, but not all the deals are traditional investments. Some are acquisitions that will go on the firms' balance sheets with the aim of providing a source of permanent capital.

Read more about private equity's insurance sector activity here.

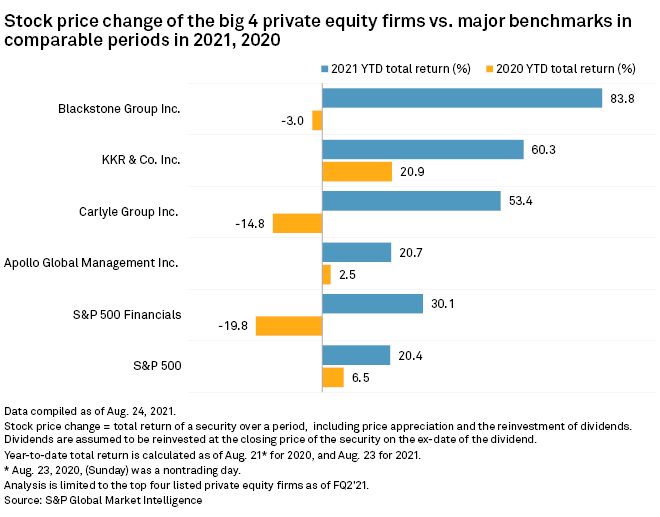

CHART OF THE WEEK: Private equity's hot public stock

➤ Blackstone's stock price has dramatically outpaced the S&P 500 and peer private equity firms in the year to Aug. 23, up 83.8%, according to data from S&P Global Market Intelligence.

➤ Some of the momentum comes from the conversion to the traditional C-corp model from a publicly traded partnership to tap into a larger pool of potential investors. Additionally, investors expect Blackstone's market share in the retail channel will bring "potentially higher and more durable organic growth versus peers," added Rufus Hone, an analyst at BMO Capital Markets.

➤ However, KKR & Co. Inc. had the highest revenues in the first half among listed private equity peers at about $14 billion.

FUNDRAISING AND DEALS

* Thoma Bravo LP completed its purchase of cybersecurity and compliance company Proofpoint Inc. for approximately $12.3 billion.

* Advent International Corp. is considering taking payments specialist Xplor Technologies public via an IPO or a merger with a special purpose acquisition company, Bloomberg News reported, citing people familiar with the matter.

* Bain Capital LP acquired a minority stake in e-commerce company Berlin Brands Group Holding Gmbh from Ardian.

* Vista Equity Partners Management LLC will provide a strategic growth investment in sales and marketing messaging platform Drift.com Inc.

ELSEWHERE IN THE INDUSTRY

* Centerbridge Partners LP is in advanced talks to buy British supermarket chain J Sainsbury PLC's banking unit Sainsbury's Bank PLC in a deal that could be valued at about £200 million, Sky News reported, citing sources.

* GI Manager LP wrapped up its approximately $1.1 billion acquisition of internet-of-things service provider Orbcomm Inc.

* Monomoy Capital Partners divested Friedrich Air Conditioning Co. Ltd., which manufactures room air conditioning, dehumidification and air purification products, to Rheem Manufacturing Co. Inc.

* SunTx Capital Partners LP exited specialty construction risk manager and insurer NationsBuilders Insurance Services Inc. in a deal with Align Financial Holdings LLC.

FOCUS ON: MEDIA

* Funds managed by Apollo's affiliates closed their purchase of Verizon Communications Inc.'s media assets in a $5 billion deal.

* CVC Capital Partners Ltd. and TA Associates Management LP agreed to buy advertising platform Mediaocean LLC from Vista Equity Partners Management LLC.

* General Atlantic Service Co. LP formed a joint venture with Swiss digital platform provider TX Group AG, Swiss media company Ringier AG and Swiss insurer La Mobilière to establish an online marketplace covering the real estate, vehicle, financial services and general marketplace sectors.