S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Jun, 2022

By Karin Rives

| A solar farm under construction in Victorville, Calif. The state's utilities expect to deliver 60% fossil-free power by 2030 and help California's economy decarbonize by 2045. Source: Edison International |

In 2018, Xcel Energy Inc. was praised by environmental advocates and Jared Polis, Colorado's progressive governor-elect, for being the first major utility to set a net-zero emissions reduction goal for its power business.

The Minneapolis-headquartered utility, which serves 3.7 million electricity customers and 2.1 million natural gas customers in eight states, this year upped that pledge. It has promised to cut carbon emissions from its electric utility businesses in Colorado and Minnesota by 85% in 2030 from 2005 levels and to reach net-zero emissions from both its power and natural gas operations by 2050.

That is an ambitious target for a utility that in 2021 relied on coal and natural gas for 51% of its power generation.

But Xcel Energy has also come under fire for planning to expand its use of natural gas and has been forced to walk back some of those plans.

Along with other large power suppliers such as CMS Energy Corp. and Edison International, Xcel Energy exemplifies the challenges the industry faces as it seeks to decarbonize. Executives with those utilities interviewed for this story insist their carbon reduction goals are achievable, but only if promises of new technology and more federal support come true.

"It's understandable that utilities want to make these longer-term plans and commitments, and they should," said Barry Rabe, a University of Michigan professor focusing on public and environmental policy. "But how realistic pledges made in 2022 will be in 2035, 2040 and 2050 is really uncertain. Emissions reduction pledges are relatively easy to make; they're harder to deliver. And that's been true for a long time."

Energy transition remains uneven

Over the past five years, virtually all leading U.S. utilities have gone from business as usual to setting greenhouse gas emissions reduction targets to making net-zero announcements.

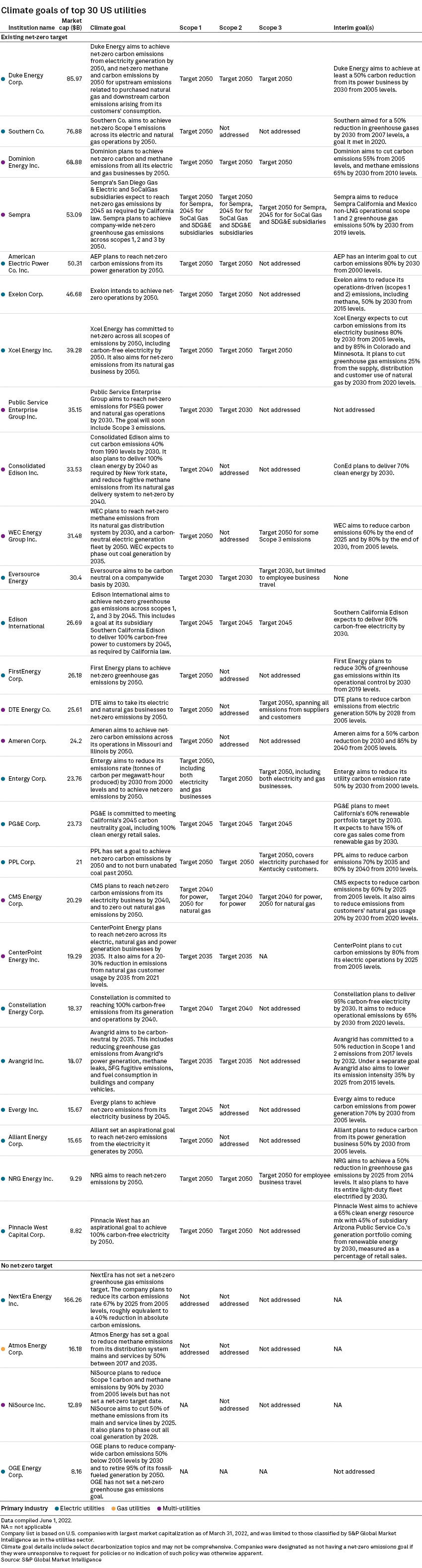

Twenty-five of the country's 30 largest power and natural gas companies by market cap have set interim carbon reduction milestones, a new survey by S&P Global Commodity Insights shows. Two of those companies, Public Service Enterprise Group Inc. and Eversource Energy, have promised to phase out all their greenhouse gas emissions by 2030, rendering an interim target superfluous.

Still, 16 of the nation's 30 largest utilities do not expect to be fossil-free until 2050, far later than the 2035 goal required under the Paris Agreement on climate change. Four utilities still have no net-zero emissions goal.

Undeterred, utility executives with bolder strategies stuck to their promises.

"We have plans we think are implementable," said Jeff Lyng, Xcel Energy's area vice president for energy and sustainability policy. "By 2030, we think we'll remove about 80 million tons [of carbon] from our states' economies. I think we are on track."

85% carbon cut by 2030, plus natural gas

In February, the Minnesota Public Utilities Commission approved Xcel Energy's integrated resource plan for the Upper Midwest. It authorized investments in renewables and extended nuclear operations to help the utility cut carbon emissions by a projected 85% by 2030 from 2005 levels.

Soon after, Xcel Energy reached a broad settlement to set the same emissions goal for Colorado, its largest customer state. Under the deal, which has yet to be formally approved by state regulators, Xcel Energy also agreed to close its last Colorado coal plant by 2031.

Utility customers "want to see specific plans, programs and targets that are not just about mid-century," Lyng said. "They ask, 'What are you going to do by 2030 or sooner?'"

Minnesota customers in 2021 pushed the utility to shelve plans for an 800-MW natural gas plant. Under the plan regulators approved in February, the company will instead rely on four smaller natural gas plants in the Midwest to meet peak demand. Those plants will only produce power 5% of the time.

"Finding the right role for gas is going to be a challenge," said Emily Fisher, general counsel and senior vice president of clean energy for electric utility trade group the Edison Electric Institute. "In the near term, it's really about bringing on more renewables and closing coal. I see companies actually being very moderate in what they're proposing with respect to gas."

A leap of faith

Three of the nation's 30 largest utilities — CMS Energy, Dominion Energy Inc. and Duke Energy Corp. — this year expanded their climate targets to include all emissions connected with natural gas, including hard-to-measure Scope 3 emissions. Their moves came after pressure from shareholder groups, which insist that U.S. utilities must step up their game to help the world combat climate change.

|

|

Michigan-headquartered CMS Energy acknowledged that its commitment to zero out all natural gas emissions by 2050 requires a leap of faith.

"We're making a commitment to do the things we already know we can do, and then work on developing things that have yet to emerge … whether that be carbon capture, hydrogen, hydrogen blending or beyond hydrogen blending," said Greg Salisbury, the company's vice president of gas engineering and supply.

A growing number of companies are piloting the production and distribution of hydrogen as a possible fossil-free replacement for natural gas, but how soon the fuel can be widely marketed remains uncertain.

Pollution from suppliers and customers burning natural gas makes up as much as 50% of a utility's total greenhouse gas emissions, according to the Interfaith Center on Corporate Responsibility, the shareholder group that urged CMS Energy to expand its targets.

Electrification on hold

Still, full electrification is not a consideration for CMS Energy. The company's natural gas business powers appliances and heats homes and businesses for 1.8 million customers during the long and cold Michigan winter.

"We don't see a way to have equitable energy resources for all of our customers in a fully electrified environment," Salisbury said. "So, in this climate, where winter temperatures are often below 20 degrees [Fahrenheit], we see natural gas as being an important part of an affordable energy solution."

For now, CMS Energy plans to reduce Scope 3 emissions from natural gas usage by 20% by 2030. Duke Energy and Dominion Energy have not yet specified interim Scope 3 goals for their customers of natural gas supply chains.

The power of mandates

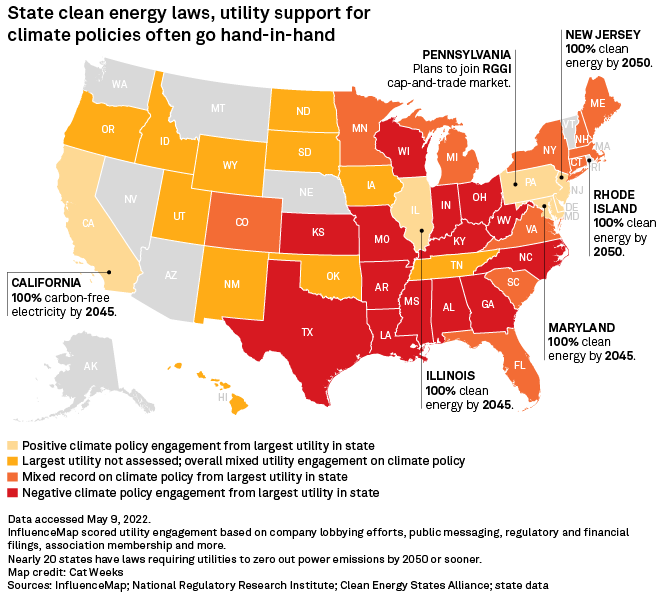

What is doable and what is not looks different for companies that operate in states with ambitious climate laws. Such states tend to have their utilities on board, a recent report by InfluenceMap found.

But even Edison International, whose Southern California Edison Co. subsidiary, which serves about 5 million customers, is required by California law to be fossil-free by 2045 and is often held up as an industry climate leader, says it needs more state and federal help to reach its goals. The company also looks to emerging carbon capture technology as an "essential tool" to offset emissions from fossil fuel plants still operating past 2045, according to company spokesperson Jeff Monford.

Edison International estimated in a 2019 white paper that California must invest up to $250 billion in the grid and clean energy by 2045 to meet its economywide decarbonization goal.

The state may not get there without more efficient permitting of new transmission lines needed to make room for renewables, Drew Murphy, Edison International's senior vice president of strategy, corporate development and sustainability, said. An average transmission project takes 10 years today, a time span incompatible with California's climate mandates. Expanded clean energy tax credits are also a company priority.

From Murphy's perspective, overcoming technology and regulatory challenges is not optional. In 2021, Edison International raised its ambition by adding Scope 3 emissions to its enterprise-wide emissions climate target.

"I don't think we actually have a choice," Murphy said. "The stakes are too high."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.