Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Jun, 2021

By Karin Rives

| U.S. utilities are investing billions in clean energy, but an economywide transition requires a more rapid deployment, say proponents of Biden's 2035 plan. Source: Robert Nickelsberg/Getty Images News via Getty Images |

.

|

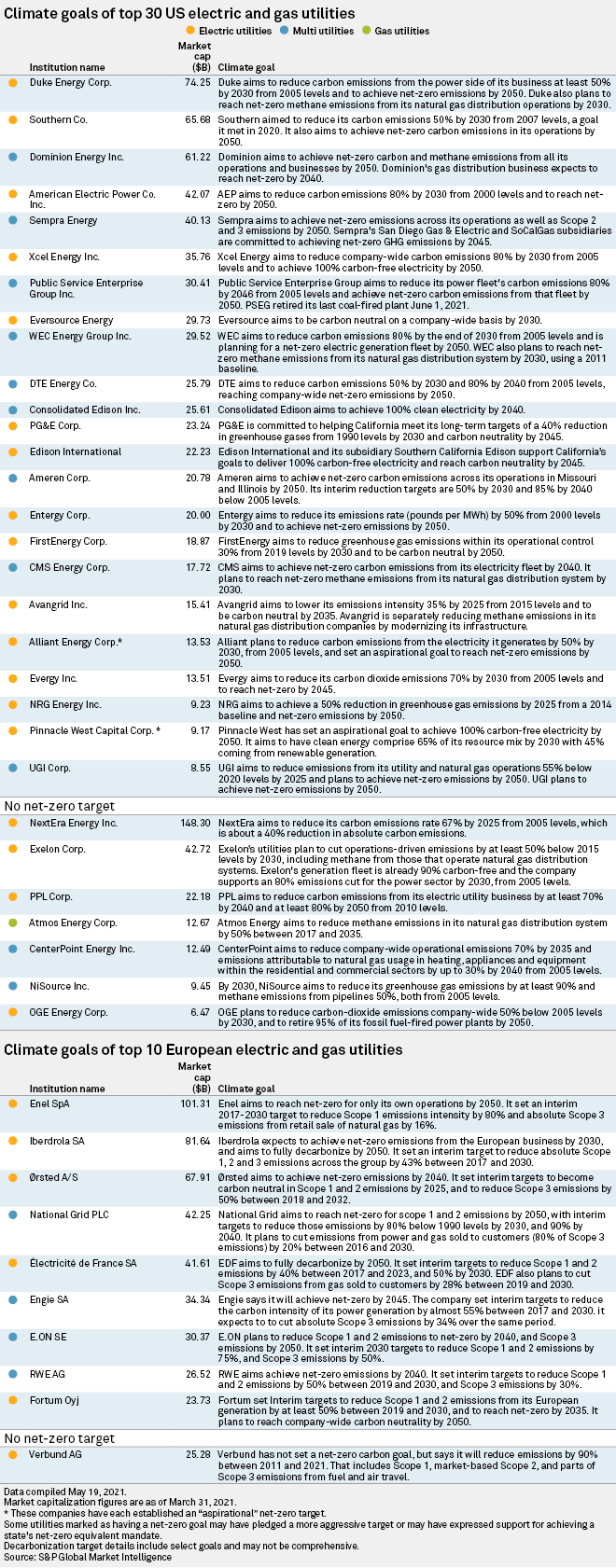

Although several U.S. utilities have raised their climate ambitions since U.S. President Joe Biden was elected, only two of the nation's 30 largest power companies by market capitalization said they will reach the administration's goal of net-zero greenhouse gas emissions by 2035. And seven large-cap utilities have yet to formally announce any net-zero target, much less a plan to get there over the next 15 years.

By and large, power companies are sticking to their midcentury decarbonization goals, with 23 of the largest utilities having announced a net-zero plan, according to the latest review by S&P Global Market Intelligence. Two of those companies describe their targets as aspirational. As of May 19, six of the 30 utilities said they were on track to reach previously announced goals of net-zero emissions by 2040 or 2045. The rest were still aiming for 2050.

"Generally speaking, utilities are continuing at the same plodding pace they've moved to approach climate change for years," said David Pomerantz, executive director of the Energy and Policy Institute, a utility watchdog group in San Francisco. "They do seem concerned with the growing pressure from investors, but what we haven't seen yet is that concern getting translated into broader policies."

Net-zero easier said than done, companies say

Utilities counter that they cannot promise more than what current technology allows, regardless of what is called for by the president.

"We are definitely mindful of and reviewing the goals the Biden administration has stated for the energy sector and for the economy," Cindy Tomlinson, a spokesperson for Alliant Energy Corp., told Market Intelligence.

Alliant Energy set a net-zero target for 2050 but described it as "aspirational." Market Intelligence previously classified companies with self-described aspirational targets as not having a net-zero plan but is now including these companies on the list of companies with net-zero goals.

Tomlinson noted that Alliant may set a firm net-zero goal for 2050 and possibly earlier, but it would depend on whether energy technologies such as utility-scale energy storage and green hydrogen advance over the next decade.

Ryan Hill, a spokesperson for PPL Energy Holdings LLC, stressed that PPL pledged to cut emissions by at least 80% by 2050, a goal the company deemed to be "both credible and achievable given current technology regulation and legislation."

"Achieving the remaining 10-20% of reductions, however, is a gap that no one knows how to close right now," Hill said.

Similarly, some utilities that pledged to reach net-zero by 2050 or earlier predict they will not get there on their own.

"With our new net-zero carbon reduction goal, any remaining emissions in 2050 would be offset," said Tammy Ridout, spokesperson for energy giant American Electric Power Co. Inc. The company still relies on coal-fired power plants for 43% of its power generation.

Boosting targets

AEP and Evergy Inc. both have newly minted decarbonization goals that moved them into the net-zero club, based on the latest Market Intelligence survey.

Two other utilities boosted their emissions targets. WEC Energy Group Inc., for instance, set an interim goal to cut emissions from its electricity fleet by 80% from 2005 levels by 2030, up from its earlier goal of 70%. The utility also announced in May that it will phase out methane pollution from its natural gas distribution system by 2030, upping an earlier 30% reduction goal.

|

|

Sempra Energy broke new ground by detailing reduction targets for all direct and indirect categories of emissions associated with its energy production, known as Scope 1, 2 and 3 emissions. Unlike European utilities, American power companies have historically avoided such granular climate targets.

Sempra, like other California utilities, is required by state law to have its Golden State subsidiaries achieve net-zero emissions by 2045.

A nebulous goal

With no national policy in place, U.S. utilities' goals vary widely, as do the metrics companies set for themselves, making comparisons difficult.

Avangrid Inc., for example, expects to lower its carbon intensity by 35% by 2025 from 2015 levels before it hits net-zero at 2035, whereas Ameren Corp. expects to hit a 50% reduction from 2005 levels in total emissions by 2030. Which company set the tougher targets is hard to determine at first glance.

Avangrid and Eversource Energy, both of which invest heavily in renewables, are the only two major utilities that have aligned with Biden's 2035 plan today, although Exelon, already 90% emissions-free thanks in part to its nuclear fleet, may also be on track to get there.

Ameren, on the other hand, plans to reach net-zero by 2050 and has been criticized by environmental groups for its plans to burn coal until 2042.

A spokesperson for the Edison Electric Institute, the investor-owned utility industry's main trade group, said its members are setting goals according to the Paris Agreement on climate change, under which the U.S. set the goal of having its entire economy be fossil-free by 2050.

"Ultimately, technology is driving the timeline, and federal policy will be a catalyst of the innovation we need to achieve our ambitious goals," Edison Electric Institute spokesperson Brian Reil told Market Intelligence.

Others noted that Biden set the 2035 deadline for the energy sector for a reason: Critical parts of the economy, especially transportation and buildings, cannot reach net-zero without abundant clean energy, which means the power industry needs to move first. That approach could require a national clean electricity standard mandating a faster transition, proponents of Biden's plan argue.

"The decarbonization of the utility sector is the linchpin of everything we need to do," Pomerantz said.

In Europe, a 'complete transformation'

Elsewhere, the European Union set a 55% emissions-reduction target for 2030 that, in the words of one EU official, will require a "complete transformation" of the way the continent produces and consumes energy. Such ambitious policies have also given European utilities a head start in the race toward net-zero.

Five of the 10 largest European power and gas utilities included in the latest Market Intelligence survey have set a 2050 decarbonization goal, and four others plan to reach it even earlier.

And unlike their American peers, many European utilities account for all categories of emissions — including hard-to-eliminate Scope 3 emissions that arise from the products they sell and trade, such as natural gas.

Only one of the large European utilities, Austria's Verbund AG, has not set a firm net-zero goal, although the company says it will have cut emissions 90% from 2011 levels by the end of this year.