Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jun, 2022

| Operations at Intel Malaysia are harnessing solar energy to help power six buildings. Source: Intel |

A $52 billion plan to boost U.S. chipmaking also presents a chance to make the industry more environmentally sustainable.

|

The CHIPS for America Act will pump federal money into raising the number of U.S. fabrication facilities, easing a global supply crunch and the nation's reliance on imported semiconductors. The legislation became law in 2021 but still needs funding. It provides financial assistance for the construction, expansion or modernization of semiconductor fabricators in the U.S. As new facilities are built domestically, firms can invest in zero- or low-emission technologies.

"It's a great opportunity," said Sujai Shivakumar, director and senior fellow of the Renewing American Innovation Project at the Center for Strategic and International Studies. "We need to make sure that we're making the investments to make it greener because we are in the process of reinventing the way in which the system works."

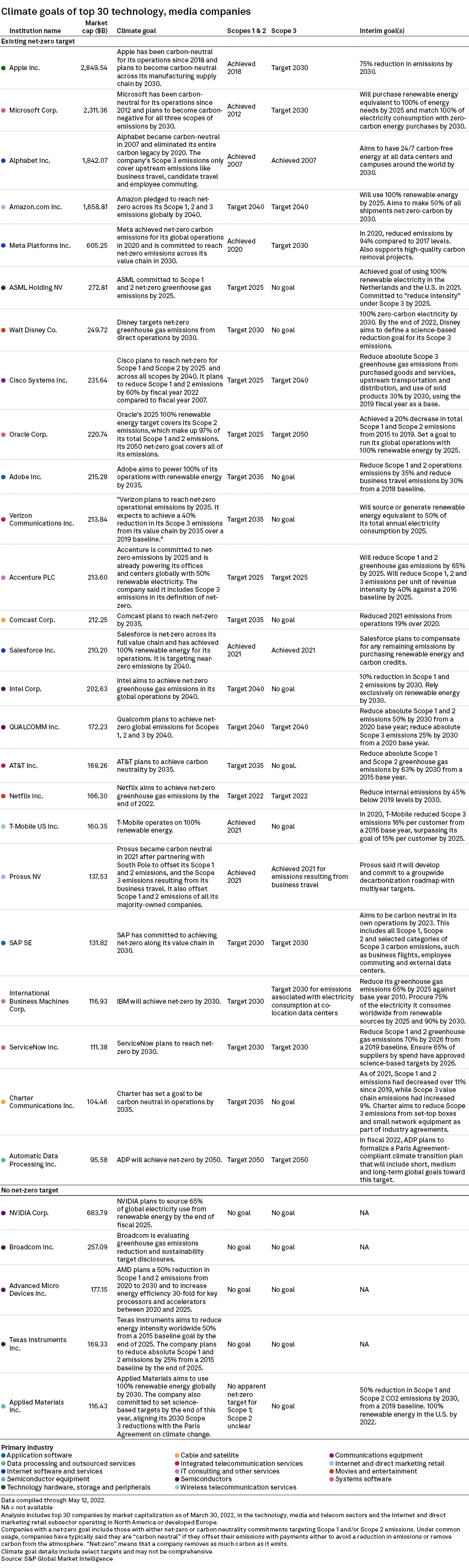

Chipmaking generally relies on pollutants to create intricate circuitry patterns on silicon wafers and to rapidly clean tool chambers for chemical vapor deposition. The difficulty in replacing these fluorinated compounds from both a cost and development perspective has complicated efforts within the industry to reduce emissions. In the U.S. and developed Europe, chipmakers Nvidia Corp., Broadcom Inc., Texas Instruments Inc., Advanced Micro Devices Inc. and Applied Materials Inc. are the only five companies without a net-zero target among the 30 largest technology, media and telecom businesses by market capitalization.

"There's a big focus on just 'How do we get this thing to work?' and probably less focus on, 'How do we make it work in a sustainable way?'" said Peter Hanbury, partner at Bain & Co.

Nvidia, Broadcom, Texas Instruments and AMD did not respond to requests for comment. An Applied Materials spokesperson said the company has committed to set science-based targets by the end of this year.

CHIPS Act goals

Under the Creating Helpful Incentives to Produce Semiconductors, or CHIPS, for America Act, private or public entities can qualify for grants of up to $3 billion. While there are several conditions that must be met, including commitments to worker and community investment, the act does not specify any conditions for environmental targets.

Rather, the law and its funding counterpart — currently in conference between the House and Senate — focus more on making the U.S. competitive with Asia for the manufacturing of chips. While the U.S. leads the world in semiconductor research and development and chip design, Asian producers such as Taiwan and South Korea lead in manufacturing process technology, particularly in advanced chips below 10 nanometers.

Still, the law comes at a time when the U.S. has committed to getting halfway to net-zero carbon emissions by 2030 and to net-zero by 2050.

"I think it would be a mistake to see environmental degradation as the price we pay for increased financial security and access to semiconductors," said Mary Brooks, a fellow for the Cybersecurity and Emerging Threats team at R Street, a Washington, D.C.-based think tank that focuses on promoting free markets. "Because environmental degradation, to me, is a national security risk."

Models for net-zero

Semiconductor companies have a decadeslong history of trying to mitigate the environmental impact of the business.

|

Companies have for years focused on their water usage and waste management. More recently, some set net-zero goals after pressure from Big Tech partners such as Alphabet Inc., Apple Inc. and Microsoft Corp., who wanted net-zero-friendly supply chains, according to Dean Freeman, principal analyst at 3D InCites.

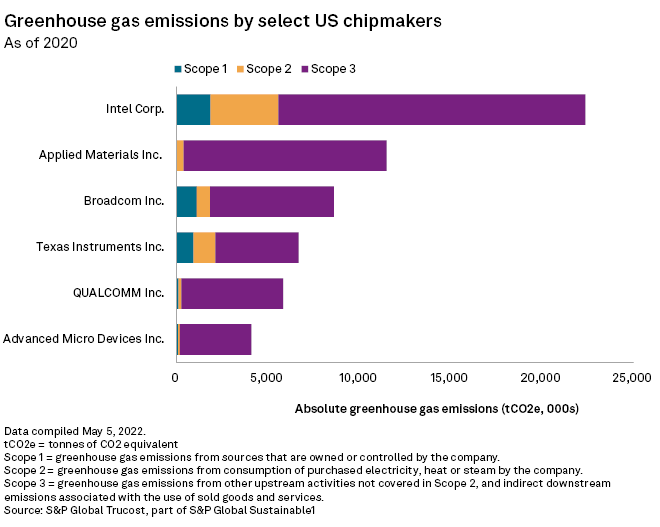

Qualcomm Inc. and Intel Corp. have taken different approaches in being early adopters of net-zero goals, but both have presented their competitors with a potential road map toward a more sustainable semiconductor industry. Qualcomm concentrates on the research and development of its chips while outsourcing the manufacturing, whereas Intel's fabs are devoted to manufacturing and testing their own chips.

Qualcomm set a target of net-zero greenhouse gas emissions across Scopes 1, 2 and 3 by 2040. While the chipmaker is predominantly fabless, meaning it mostly designs chips, it does have some manufacturing plants.

Qualcomm has reduced Scope 1 and Scope 2 greenhouse gas emissions by 20% since 2014. Its three-part emissions mitigation strategy includes transitioning to renewable energy in key regions via long-term power purchase agreements; replacing so-called high global warming potential gases in its manufacturing processes and reducing natural gas usage at its San Diego headquarters; and a minimal amount of renewable energy credits and carbon offsets.

In line with these goals, in 2021, a Qualcomm spokesperson said the company signed a 10-year renewable energy agreement with Shell Energy North America (US) LP that provides access to approximately 115,000 MWh of 100% renewable energy annually. This energy will power the San Diego headquarters.

The company also completed the test phase of a project to reduce the environmental impact of its chamber clean processes. The test, conducted at Qualcomm's German manufacturing facility, replaced gases such as sulfur hexafluoride and nitrogen trifluoride, which have high global warming potential, with a fluorine-based gas mixture that has a global warming potential of zero.

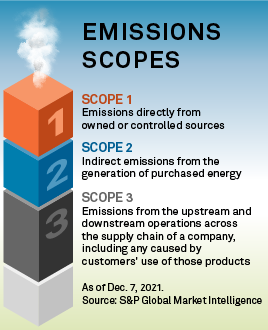

Not all gases are equal

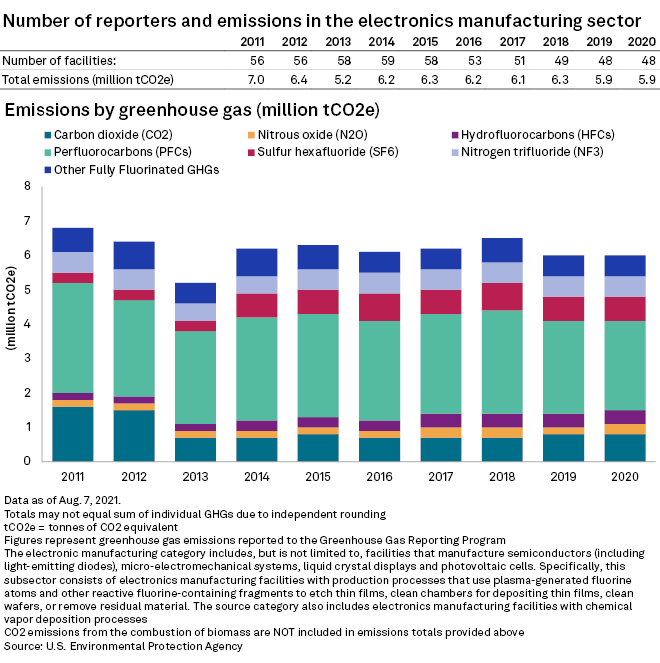

The global warming potential, or GWP, score compares how much heat different gases absorb over a given period of time. The higher the GWP, the more heat retained. CO2 has a GWP of 1, while the fluorocarbons used in chip production can have GWPs in the thousands or tens of thousands, according to the U.S. Environmental Protection Agency.

The vast majority of emissions reported by the electronics manufacturing category, which includes facilities that manufacture semiconductors, comes from fluorocarbon gases, EPA data shows.

Qualcomm plans to implement the gas replacement in all chamber cleaning processes at its German production site by the end of 2022. "This is in progress and we will likely report more in our next annual report," the spokesperson said.

"We are working to reduce our own greenhouse gas emissions footprint from our operations and across our value chain," Angela Baker, Qualcomm's chief sustainability officer, said May 10 during the CTIA 5G Summit in Washington.

Qualcomm employs nearly 41,000 people and is a much larger operation than most semiconductor makers.

"So for them to try and be carbon neutral is a big deal," said Harsh Kumar, managing director and senior research analyst at Piper Sandler. "That's the kind of model that the fabless companies will use."

Intelligence from Intel

Intel has 110,000 employees globally and has its own fabricators that require vast amounts of energy and resources.

"That's a much harder thing to do," Kumar said of net-zero goals for companies such as Intel that operate their own fabricators.

Intel is also targeting net-zero by 2040 across Scopes 1 and 2. The company's cumulative greenhouse gas emissions over the past decade of its operations are nearly 75% lower than they would have been without investing to improve its footprint, said Todd Brady, Intel's chief sustainability officer.

Intel's facilities in the U.S., Europe, Israel and Malaysia operated on 100% renewable energy in 2021, and they achieved 80% renewable electricity globally.

Challenges ahead

Reducing Intel's remaining emissions will be challenging, Brady added, because the abatement equipment solutions do not exist or must be refined to minimize or eliminate environmental trade-offs. Intel sees this as an opportunity to reduce its carbon footprint while maintaining performance.

"Reaching net-zero greenhouse gas emissions will require significant research and development collaboration throughout our value chain and long-term innovation," Brady said. "That's why we're committed to solving this in partnership with the industry, through an [research and development] initiative to identify greener chemicals and develop new abatement equipment."

"They are caught between a rock and a hard place," Kumar said. "They are first going to deal with the fire that's at their front door, which is getting the supply chain under control. And then after that, they will figure out the ESG goals. Because in the near term, they're fighting a different war."