Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Dec, 2021

Wind turbines in Iowa help power Meta's data centers, which are contracted for 100% renewable energy. ESG investors must weigh Meta's and other tech companies' strong environmental commitments against their social and governance struggles.

Source: Meta Platforms

Many of the biggest technology and telecom companies have set ambitious environmental goals, although their social and governance issues complicate their appeal to ESG investors.

The top five biggest technology companies by market capitalization — Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc. and Meta Platforms Inc. — have spent the past decade or two achieving carbon neutrality and even moving into carbon negative territory. The top three U.S. telcos — AT&T Inc., Verizon Communications Inc. and T-Mobile US Inc. — subsequently joined the bandwagon, setting their own carbon neutrality and renewable energy targets over the past three years.

|

These companies have also consolidated their power in their respective sectors, which has increasingly led to regulatory scrutiny, consumer backlash and shareholder activism. Those risks to the business are reflected in lower scores for social and governance metrics compared with the companies' environmental scores, which are used by ESG-conscious investors to guide their decisions.

"Managing your environmental profile in some ways is easier and less messy than managing your social and governance profile," said Natasha Lamb, a managing partner at activist investment firm Arjuna Capital.

All told, 25 of the top 30 technology, media and telecommunications companies by market cap have set a net-zero goal of some kind, according to an analysis by S&P Global Market Intelligence. All five without a pledge are semiconductor companies. The analysis includes the top 30 companies by market capitalization as of Sept. 30, 2021, in the TMT sectors and the internet and direct marketing retail subsector operating in North America or developed Europe.

ESG scores

Looking at ESG scores tabulated by S&P Global, the top five tech firms by market cap all have higher scores for the environmental category than for the social or governance and economic categories.

For instance, Apple's environmental score of 52 is more than five times its social score of 10 and well above its governance and economic score of 31. Similarly, Facebook-parent Meta Platform's environmental score of 47 is almost four times its social score of 12 and more than four times its governance and economic score of 10.

Google LLC parent Alphabet, which claims to have been the first major company to commit to and achieve carbon neutrality in 2007, has an environmental score of 73, more than twice its governance and economic score of 35. Microsoft was not far behind, having been carbon neutral since 2012. Its environmental score was 72, versus scores in the 50s for the other two metrics.

Microsoft declined to comment, while Apple and Alphabet did not respond to inquiries from S&P Global Market Intelligence.

Among the top 30 tech, media and telecom companies by market cap, the average environmental, social and governance scores are 55.7, 41.6 and 45.0, respectively, according to data from S&P Global.

Slap in the Facebook

Meta Platforms, formerly known as Facebook, has perhaps become the poster child of a tech company struggling with social and governance issues, even though it has a robust net-zero pledge.

Leaked documents from Facebook whistleblower Frances Haugen showed earlier this year that Facebook knew about the ill effects of its platforms — including the propagation of hate speech and misinformation, as well as its use by gangs and human traffickers — but chose to prioritize growing usage and profits over erecting safeguards.

At the same time, the company has strong environmental goals, having committed to reaching net-zero emissions across its value chain in 2030. In 2020, it achieved its goal to source 100% renewable energy for its global operations.

"We understand the responsibility that comes with operating a global platform where we must address some of the most complex issues impacting the environment, society and the internet at large," a Meta spokesperson said in response to Market Intelligence's request for comment. "That's why we've made significant investments in this area and will continue doing so."

Meta previously called Haugen's accusation that it willfully ignored research deemed inconvenient "just plain false." It has also taken steps to improve safety on its platform and remove hate speech.

Overweight vs. underweight

Still, Haugen's revelations and the resulting scrutiny have led ESG fund managers to largely underweight their holdings in the company.

"Facebook is the largest underweight the portfolio has … that's not eliminated," said Ed Rosenberg, senior vice president and head of exchange-traded funds for American Century Investments.

American Century has actively managed ESG funds, which means portfolio managers are constantly looking at the funds' constituents and how they are performing, Rosenberg said in an interview. Stocks can be neutrally weighted, overweighted if they have strong ESG commitments, or underweighted if the portfolio manager has concerns.

"Facebook's always had average social at best," Rosenberg said. "As the course on Facebook started to alter in that area, the weightings dropped really quickly in the portfolio."

The stock has not been eliminated entirely from the fund, however, because it would need to be replaced by another company in the communications services sector as defined the Global Industry Classification Standard.

"What's interesting is it's not just Facebook, it's also AT&T and Verizon. They're underweight — all of them — because of their social issues," Rosenberg said.

Telecoms go green

Like the Big Tech firms, the three leading U.S. telecoms have set ambitious environmental targets.

|

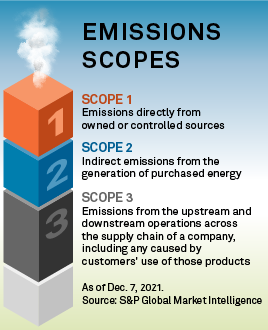

AT&T has committed to be carbon neutral across its entire global operations by 2035. Verizon previously said it would achieve net-zero operational emissions by 2035, and more recently announced science-based emissions reduction targets, committing to a 53% reduction in its Scope 1 and 2 emissions, or operational emissions, between 2019 and 2030, and a 40% reduction in its value chain, or Scope 3, emissions between 2019 and 2035.

T-Mobile aims to reduce its combined Scope 1 and 2 emissions by 95% by 2023 from a 2016 base year, with a 15% reduction per customer in Scope 3 emissions targeted by 2025. By the end of this year, it aims to source 100% of its total electricity usage with renewable energy.

T-Mobile's time-sensitive and practical goals appeal to Green America, a nonprofit promoting environmental awareness and conscious consumerism. The organization gave T-Mobile an "A-" rating on a scale mimicking an academic grading system in the U.S. Competitors AT&T and Verizon received a "B" and "D", respectively. Green America praised T-Mobile's transparency in its journey to reach 100% renewables by 2021.

"Consumers have a clear choice between telecoms when it comes to clean energy, with T-Mobile still in the lead," said Todd Larsen, executive co-director of Green America. "While AT&T and Verizon have made important first steps towards powering their networks with 100% renewable energy, they still have a long way to go to get to the 100% needed to protect people and the planet."

On the social and governance front, however, T-Mobile faced a setback this year with its handling of a massive data breach that impacted more than 54 million people, including current, former and prospective customers.

"Issues like cybersecurity and data privacy continue to be a priority for businesses like ours and that is why we have also long considered these key components of our ESG framework," a T-Mobile spokesperson said in an email to Market Intelligence. After the attack, the company partnered with experts at the cybersecurity firm Mandiant Inc. and consulting firm KPMG to enhance T-Mobile's security and create more oversight.

Late to the party

Of course, not all large companies in the tech and telecom sectors lead on environmental goals. Semiconductor manufacturers are among the most notorious emitters of greenhouse gases, yet have some of the most modest reduction goals. In November, QUALCOMM Inc. announced a net-zero target of 2035. Qualcomm's U.S.-based industry peers have also announced energy-saving goals since last year, though no other major player with a market capitalization over $100 million has committed to becoming carbon neutral. ASML Holding NV, which manufactures equipment for chip makers, in 2019 set a net-zero target of 2025.

Other companies in the tech sector have simply been slower to disclose their emissions. Charter Communications Inc., in particular, has faced shareholder activism around its long refusal to disclose its emissions. Earlier this year, the company faced a shareholder proposal calling for it to disclose its greenhouse gas emission levels in a manner consistent with the Task Force on Climate-related Financial Disclosure recommendations.

The measure failed, with almost 52% of shares held voting against the proposal, but Charter set its first climate-related goal in 2021. Charter now aims to be carbon neutral in its Scope 1 and 2 operations by 2035.

"This goal simultaneously delivers on our responsibility to our communities and drives efficiencies for our network and operations while mitigating against potential future impacts of a price on carbon emissions," the company said in both its 2021 CDP report and 2020 ESG Report. Charter declined to comment beyond its ESG report. Notably, 2021 was the company's first year of participation in CDP.

READ MORE