S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Dec, 2022

By Bill Holland

|

A member of the environmental coalition Protect Our Water, Heritage, Rights stands near a construction area on the Mountain Valley natural gas pipeline right of way. Gas pipeline companies, producers and utilities are under public and investor pressure to report their greenhouse gas emissions. |

The push is on to standardize emissions reporting so investors can more directly compare the emissions reduction programs across oil and gas companies.

|

"As it stands, there is no uniform, mandatory reporting methodology, which means that different companies can apply somewhat different approaches in their in-house sustainability reports," Raymond James & Associates oil, gas and renewables analyst Pavel Molchanov said. "The more standardization there will be in emissions reporting, the more straightforward it will be to compare company A to company B."

The rationale for publicly held oil and natural gas companies to report their emissions is simple. Emissions scores have become a required report if companies want their stocks included in the exploding number of funds that screen stocks for specific environmental, social and governance criteria.

"I actually think investor pressure is one of the most powerful motivators for company action," former Colorado Oil & Gas Association President and CEO Tisha Schuller said. Through her firm Adamantine Energy, Schuller advises oil and gas companies on how to navigate society's transition to low-carbon energy.

There is big money at stake. A new emissions reporting standard, such as one provided in a proposed rule from the SEC, and how a company compares to its peers under this standard could guide billions of dollars of investment in oil and gas companies.

"Many investors have made a clear statement in the last five years that they want to protect people and the planet," said Ted Dhillon, CEO of carbon accounting and ESG strategy advising firm FigBytes Inc. "They're making this statement with real dollars — a record $649 billion was poured into ESG-focused funds worldwide in 2021."

Approximately $20 trillion of funds have announced a divestment strategy from fossil fuels, and a substantial amount could move to ESG-focused funds, but a standard format for emissions reporting is needed, Molchanov said.

Schuller agreed. "You can't compare apples to oranges, it's not truly effective," Schuller said. "I think it undermines a sense of public confidence if you don't see one set of standards, one set of expectations."

Patchwork of standards

Shell PLC is among the companies leading the move toward more reporting. The supermajor participates in a selection of ESG surveys, and its emissions disclosures are "informed by a number of voluntary reporting standards and frameworks," spokeswoman Anna Arata said in an email.

Arata listed a dozen reporting formats used by Shell, illustrating the wide variety of protocols.

|

But the multitude of reporting protocols are on display in the long list of standards used by Shell.

"Shell's emissions reporting is informed by a number of voluntary reporting standards and frameworks, such as the [International Petroleum Industry Environmental Conservation Association] Sustainability Reporting Guidance and the Global Reporting Initiative," Arata said.

"In addition, we map our disclosures against Task Force on Climate-related Financial Disclosures [TCFD], Sustainability Accounting Standards Board (SASB), and the World Economic Forum's Stakeholder Capitalism Metrics, and are a founding member and a signatory of the United Nations Global Compact," Arata added.

In the global oil and gas business, operators are governed by differing local and national reporting requirements. The U.K. and the EU have adopted a common format derived from the TCFD. The U.S. SEC is digesting public comments on its proposed rule for emissions reporting by publicly traded companies.

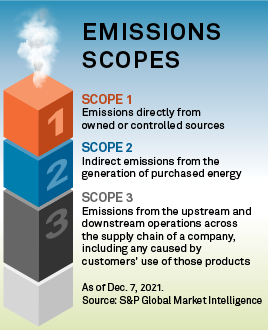

Scope 3 emissions — released when consumers use an energy company's products to do things such as heat their homes, drive or fly — make up the bulk of any oil and gas company's greenhouse gas impact. The category represents the largest amount of carbon emitted into the atmosphere. The reporting of Scope 3 emissions has proved to be a dividing line between European oil and gas producers and their American counterparts. European authorities such as the TCFD require Scope 3 reporting from producers.

American oil and gas companies have taken the stance that reporting Scope 3 emissions would misplace the responsibility for carbon emissions, putting it on fossil fuel producers rather than carbon users. Additionally, the American companies have said, Scope 3 reporting would invite double counting, because the same emissions could be attributed as direct emissions from another company under the Scope 1 category, or to that company's supply chain under Scope 2 as indirect emissions from purchased electricity, steam, heating and cooling.

The proposed SEC rule would require Scope 3 emissions to be reported only if the disclosure is "material" to a company's performance or if the company already has a program to reduce Scope 3 emissions.

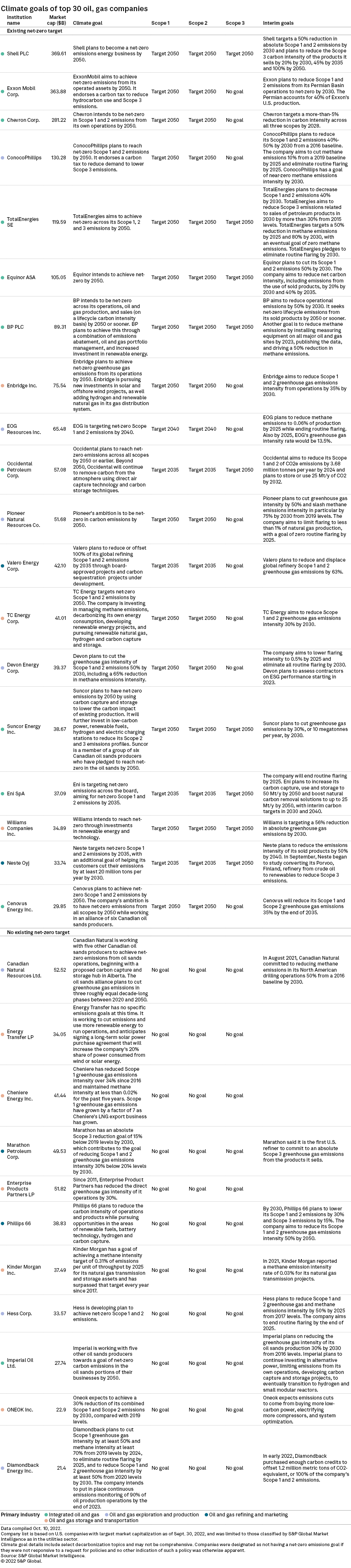

A November survey by S&P Global Commodity Insights of the largest oil and gas companies in Europe and North America showed little change in the industry's net-zero emissions goals

SEC reviews comments with an eye on Supreme Court

Emissions-reporting frameworks have become increasingly common. A variety of reporting frameworks is offered by companies, trade groups and nongovernmental organizations.

In one example, two U.S. trade groups representing oil and gas drillers — the American Petroleum Institute and the American Exploration and Production Council — each have their own suggested emissions reporting formats. Both asked the SEC to regulate using general principles with few specific rules. They wanted a light hand that would exclude Scope 3 reporting and let individual companies choose the format that works best.

The SEC rule would be costly, especially to smaller operators, API said in June comments. "The SEC's proposed disclosure rule is a solution in search of an information problem that doesn't exist," API Chief Advocacy Officer Amanda Eversole said in a statement. "The SEC's prescriptive and inflexible proposal would likely lead to more confusion than clarity among investors."

Nick Volkmer, director of product and ESG at energy research firm Enverus, recommended that the SEC look closer at existing reporting regimes, particularly the U.S. Environmental Protection Agency's Greenhouse Gas Reporting Program.

"Most ESG-focused companies try and align with as many formats as possible, with Sustainability Accounting Standards Board, Carbon Disclosure Project, TCFD being some of the most common," Volkmer said. "For U.S. emissions data, the EPA's Greenhouse Gas Reporting Program is the gold standard most people rely on. Is it perfect? No. But it is a standardized way of looking at emissions across all major industries throughout the country."

General Electric Co.'s former director of sustainability, Brandon Owens, expected the SEC rule will look much like what it proposed in March. Owens, now the vice president for sustainability at procurement consulting firm Insight Sourcing Group LLC, would make one change: Scope 3 emissions reporting should be mandatory.

"TCFD makes Scope 3 optional if it is not material," Owens said. "These reporting requirements should be mandatory because for many industrial and manufacturing organizations, this is where the bulk of their emissions will come from."

Ellie Dawson, an environmental litigator in law firm Crowell & Moring LLP's environmental and natural resources group, said she thinks the SEC knows what it wants but has slow-walked its rule to avoid crossing swords with the U.S. Supreme Court. The SEC might be cautious in the wake of a June decision by the high court that hemmed in the EPA's greenhouse gas emissions regulations for power plants. But some top-down pressure from policymakers will be needed to get to net-zero by 2050, Dawson said.

"I would say with 100% certainty that [disclosure] will not get us all of the way" to net-zero, Dawson said. "I don't think anyone is under the impression that investor pressure alone can make this happen."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.