Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jun, 2022

|

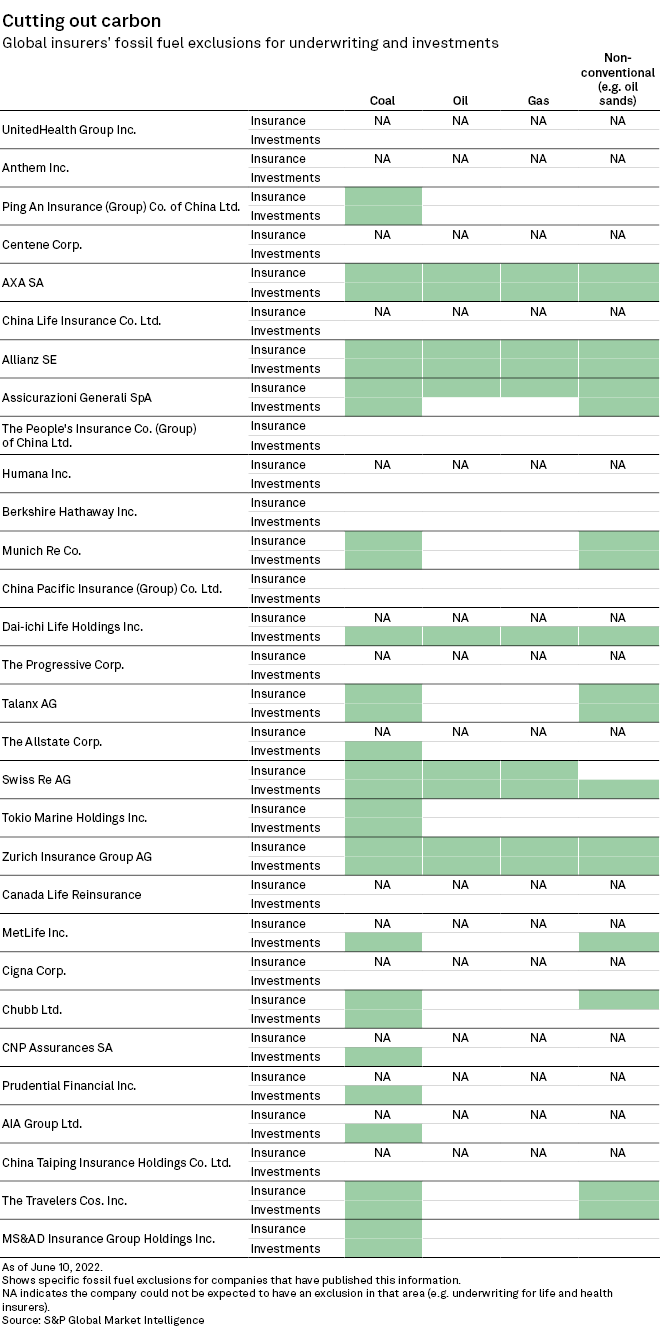

Cutting thermal coal from investment and underwriting portfolios is a cornerstone of many top insurers' net-zero strategies, but they are just getting started on oil and gas. |

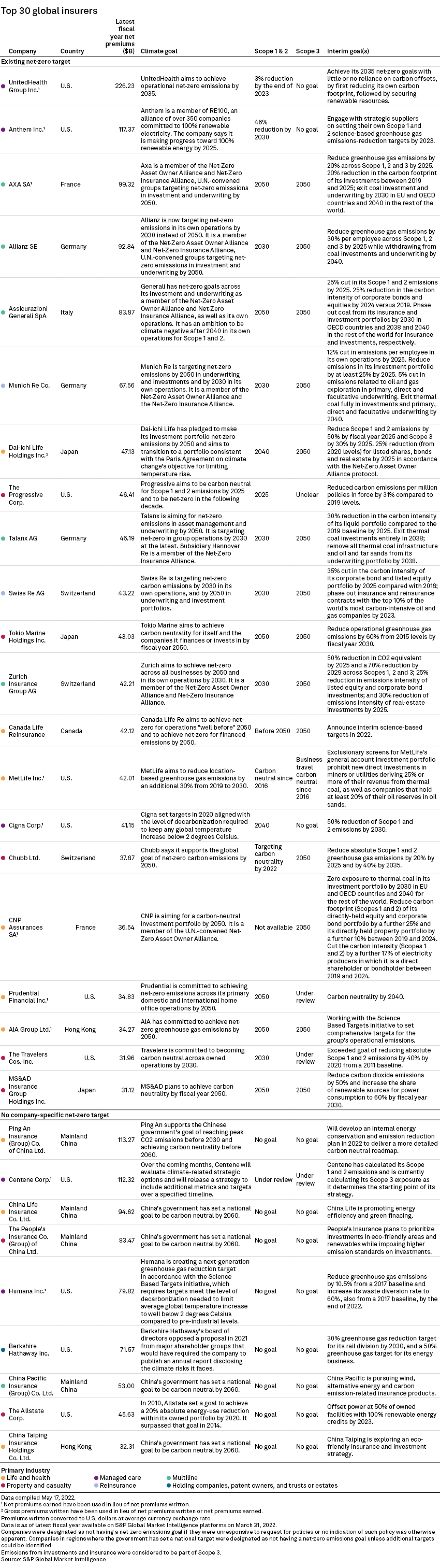

Several global insurers have recently announced more ambitious strategies to cut carbon emissions from their underwriting and investment portfolios, but exceptions and gaps in their policies cast doubt on the likely effectiveness of those targets.

|

In recent years, European insurers have taken the lead in establishing net-zero goals. Most European companies in the top 30 global insurers by total premiums have targets to phase out thermal coal underwriting and investment by 2040 and are also members of the Net-Zero Insurance Alliance and Net-Zero Asset Owners Alliance, United Nations-convened groups committed to achieving net-zero greenhouse gas emissions in underwriting and investment by 2050.

In addition, Allianz SE, Axa SA, Swiss Re AG and Zurich Insurance Group AG have expanded their exclusion policies to include oil and gas. The Allianz oil and gas policy is "best in class" given its detail, clarity and breadth, said Lindsay Keenan, the European coordinator for the Insure Our Future network, a group of about 27 activist organizations dedicated to stopping the industry from insuring or investing in fossil fuel industries.

U.S. insurers have been slower to adopt net-zero policies, but several big names, including The Travelers Cos. Inc. and American International Group Inc., have made commitments to curb their exposure to coal. Japanese insurers Sompo Japan, MS&AD Insurance Group Holdings Inc. and Tokio Marine Holdings Inc. have also issued coal exclusion policies.

"Asian insurers are rapidly adopting best practices around targets and sustainable initiatives and we expect this momentum to continue in the future, as the region remains one of the most exposed to the impact of climate change," Elias Ghanem, global head of Capgemini's Financial Services Market Intelligence Group, said via email.

Further progress is also expected globally. The Net-Zero Insurance Alliance's members account for more than 11% of global premium volume, and more are likely to join, Sean Kevelighan, CEO of the Insurance Information Institute, said via email.

Mind the gaps

While the industry is making progress on net-zero, it is "not at all on target" to achieve the Paris Agreement's aim of limiting global warming to 1.5 degrees C above pre-industrial levels, said Keenan of Insure Our Future.

The insurance industry has been slower to start on its net-zero journey than sectors that directly control their emissions, Ghanem said, referring to a May 2022 Capgemini study that showed only 43% of global insurers have announced a net-zero emissions target and some do not have a clear mandate or tangible goals. Still, insurers have a "real opportunity" to help drive climate resilience, Ghanem added.

Several insurers' fossil fuel exclusion policies have gaps or caveats — get-out clauses allowing carriers to insure coal mines or drilling rigs. None of the U.S. companies in the top 30 have excluded conventional oil and gas from their underwriting or investments. Sompo Japan's coal exclusion policy states that it may consider insuring and investing in projects if its greenhouse gas reduction efforts are expected to align with the Paris Agreement.

Even Allianz's oil and gas policy allows the insurer's sustainability board to grant an exception to its new upstream oil and gas fields exclusion "in case a government decides on the development of a new gas field for energy security emergency reasons." What's more, while the policy applies to Allianz's €809 billion in proprietary investments, it excludes the €1.9 trillion of third-party assets managed by the company's asset management arms, Pimco and Allianz Global Investors GmbH.

In the reinsurance market, some fossil fuel exclusion policies do not apply to treaty reinsurance — a core product that covers whole classes and even some entire portfolios of insurance business. Munich Re's exclusion policy, for example, which currently covers thermal coal and oil sands, applies to its primary, direct and facultative business, although a spokesman for the company said via email: "We are also committed to develop a decarbonization strategy for our treaty business."

Coal dependence

The Chinese government has taken a unique approach to the issue — Beijing has set a 2060 carbon neutrality target but declined to attend the 2021 COP26 meeting where much of the international community embraced a 2050 goal.

"Under the guidance of the government, we will exit from the thermal power projects that do not meet the national standards and continue to lower the share of coal-fired plants alongside increasing the proportions of new energies such as photovoltaic and wind power," a spokesperson for Ping An Insurance (Group) Co. of China Ltd. said in an email, adding that it will not take a "one size fits all" approach.

Coal will remain a substantial percentage of China's energy mix in the coming decades, and state-owned insurers will undoubtedly continue to insure those projects.

In terms of investments, Ping An added that it plans to divest from companies with "more than 30% of revenue generated from thermal coal and coal-fired power businesses by the end of 2035."

The vigor of insurers touting their net-zero bona fides has also been somewhat undermined by affiliated trade associations that have pushed back on attempts to force insurers to make fossil fuel disclosures, said Cleo Rank, a sustainable finance policy analyst at InfluenceMap, a lobby group focusing on climate policies.

The American Property Casualty Insurance Association — whose members include AIG, Berkshire Hathaway Inc. and MetLife Inc. — has challenged legislative action calling for more transparency on disclosures in California and Connecticut, Rank said.

No blanket divestment

Despite outside criticism, insurers are not simply going to abandon the energy market.

Net-Zero Insurance Alliance Chair and Axa Chief Risk Officer Renaud Guidée told COP26 attendees the industry's role in cutting carbon emissions was "not about being an exclusion machine."

Generali, for example, has a target of engaging with 20 carbon-intensive companies by 2025. Terminating a business relationship is the "last option, preferably in agreement with the client and only if our engagement activities are unable to achieve a satisfactory result," a spokesperson said in an email.

Insurers hesitate to establish rigid fossil fuel exclusions "because it really inhibits you from then working with a firm that is committed to transition," Bronwyn Claire, senior program manager at ClimateWise, an initiative between the insurance industry and Cambridge University's Institute for Sustainability Leadership, said in an interview.

Exclusion of coverage "is not going to make the world better," Heike Schmitz, a partner at law firm Herbert Smith Freehills, said in an interview. A lack of insurance would probably not drive a company to go out of business as long as commercial demand for its products is high, Schmitz said.

Russia's invasion of Ukraine has also heightened energy security concerns. "There needs to be a responsible transition to lower carbon, as you only need to look at Russia and Europe to see what can come from having to shut off fossil fuels overnight," said Kevelighan of the Insurance Information Institute.

Regulators are also urging caution. The Bank of England warned in its May 2022 climate stress test that banks' and insurers' plans to cut finance and cover for carbon-intensive industries could have negative economic consequences if they outpace renewable energy expansion efforts. A gradual transition away from carbon-intensive, less economically viable sectors is in everyone's interest, the bank said.

Insurers must also focus on their role in covering the technologies to enable the energy transition. "[It's] not just about not insuring something but also insuring something to make sure it becomes viable," Schmitz said.