Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Dec, 2022

By Ben Dyson

| An excavator removes topsoil in an open cast mine in Juechen, Germany. Berlin has restarted coal-fired power plants amid an energy crisis sparked by the fallout of Russia's invasion of Ukraine. Source: Andreas Rentz/Getty Images News via Getty Images |

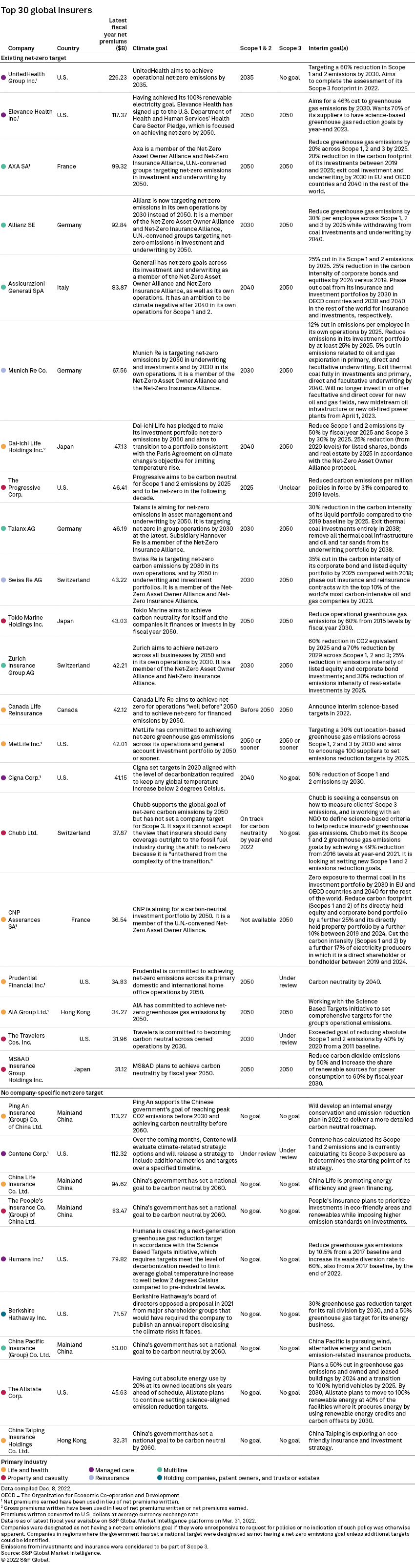

European insurers' and reinsurers' shorter-term goals to cut underwriting emissions are under pressure as several countries across the continent return to fossil fuels to stave off energy shortages triggered by the Russia-Ukraine war.

|

Despite this unexpected policy shift, companies such as Zurich Insurance Group AG and Swiss Re AG say they are sticking to pledges to reduce greenhouse gas emissions across their underwriting portfolios.

Staying the course

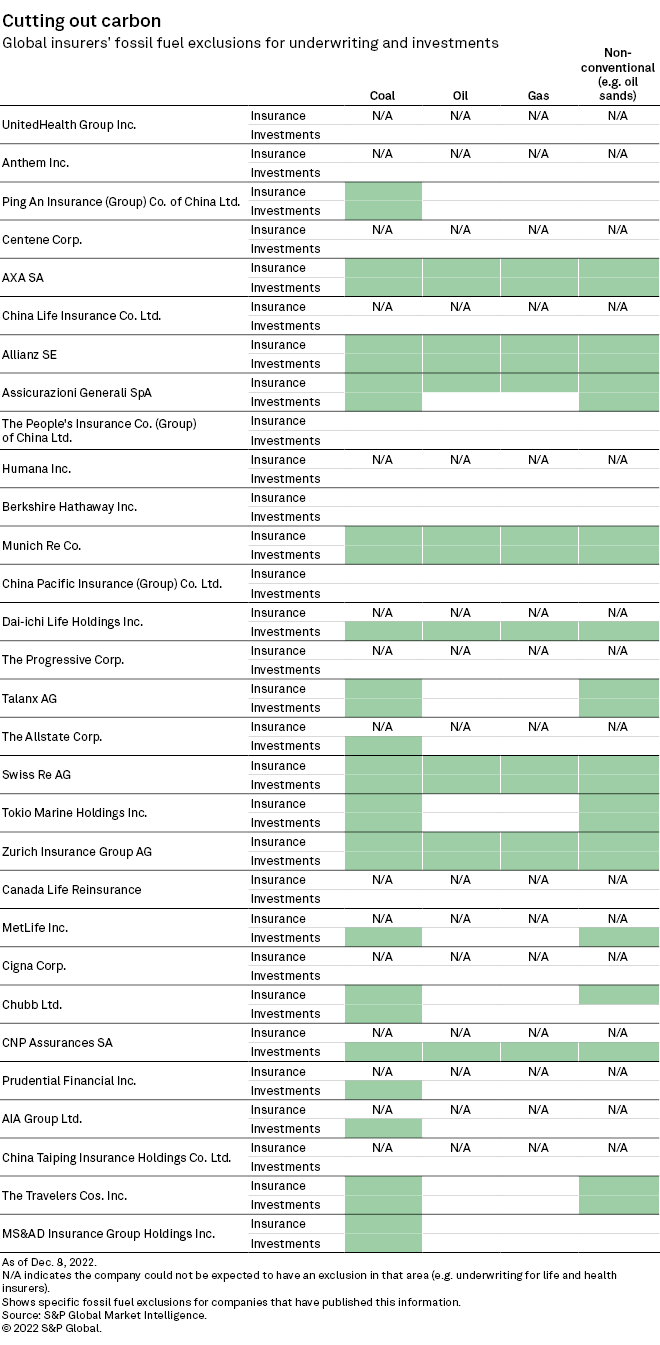

Germany has begun restarting coal-fired power plants, and France has put a coal plant that was closed in March back online. As coal use increases, insurers face pressure to relax their underwriting restrictions. Insurance buyers and brokers "should be engaging with insurers who have ceased to write new coal business, to acknowledge that for a number of European countries, the 'Social' element of ESG currently outweighs the 'Environmental' considerations," broker Willis Towers Watson said in its 2022 power market review.

Despite this new energy reality, several of Europe's top insurers said they will not budge on either their short- or longer-term commitments. Swiss Re is not planning any changes to its ESG and sustainability-related policies, including its fossil fuel underwriting thresholds and interim goals, Martin Weymann, the reinsurer's group head of sustainability, said in an interview. The company wants to remain consistent with what it has told its own underwriters and the outside world, Weymann said, and the reinsurer has given clients and brokers "quite a bit of [lead] time" about its intentions.

Swiss Re does not offer direct and facultative reinsurance to companies or projects that have more than 30% exposure to thermal coal. From 2023, treaty reinsurance business that exceeds certain thermal coal exposure thresholds, which are specific to each line of business, will be gradually lowered. The company plans to exit coal underwriting completely by 2030 in Organization for Economic Cooperation and Development countries and by 2040 in the rest of the world.

French insurer AXA SA "has not changed its policies in response to the energy crisis," a spokesperson said via email. A spokesperson for Zurich said in an email that the company has "no plans to change our approach." Asked how the company would respond to client and broker pressure for fossil fuel cover, the spokesperson said, "We have made clear and strong sustainability commitments, and the group does not intend to change its path."

Italy's Assicurazioni Generali SpA excludes cover for the construction of new coal mines and coal-fired plants and continues to reduce its existing coal exposure, which is "well below" 0.1% of the group's property and casualty gross written premium, a spokesperson said in an email. In addition, Generali's risk appetite and focus on retail customers and small and midsize businesses mean it has no ambition to develop coal business.

"We do not expect significant impact coming from the energy crisis and the effort to ensure energy security in our underwriting portfolio," the spokesperson said.

Munich Re did not say explicitly whether it would make changes to its policies in response to the energy crisis, but it highlighted that it had set "strict underwriting guidelines to regulate the phase-out of oil, gas and thermal coal from our facultative, direct and primary insurance business by 2050."

Short-term shifts

There is also flexibility in some insurers' and reinsurers' fossil fuel exclusion policies that should allow them to accommodate short-term energy needs. Allianz SE's oil and gas policy, announced in April, contains an exception for new upstream gas fields if needed for emergency energy security reasons. An Allianz spokesperson said in an email that the oil and gas policy was set "taking careful account of geopolitical developments" and that the company would continue to monitor developments closely.

"Should the energy policy framework change as a result of a crisis emergency, we can react appropriately within our existing oil and gas guidelines and consider insurance coverage for critical new gas projects via a case-by-case review by the Allianz Group Sustainability Board," the spokesperson said, adding that the exception had not been triggered to date.

The energy crisis has curtailed some ambition in cutting fossil fuels from underwriting portfolios, according to Lindsay Keenan, European coordinator of Insure Our Future, a network of activist groups pushing the industry to stop insuring and investing in fossil fuels. But Keenan added that the industry has grasped the need to move away from fossil fuels toward renewable energy.

"I've heard people say, 'We're having tough discussions and feeling a bit of pressure also from some governments and some sections of the fossil fuel industry.' But I haven't heard anybody talking about stepping back on their policy," Keenan said in an interview.

Renewed push to renewables

One way the energy crisis will hit the insurance industry's decarbonization efforts is its short-term impact on energy-intensive policyholders' shift to renewables, according to Rohit Sharma, U.K. insurance ESG market lead at consulting firm Deloitte. But in the medium to long term, Sharma added, "the incentive has become stronger" to make the transition because of the energy squeeze.

There are signs that the fallout from the war in Ukraine will spur the renewables push. The European Commission, the European Union's executive arm, unveiled its RePowerEU plan in May, designed to achieve independence from Russian fossil fuels as soon as possible, in part by accelerating the move to renewable energy. The commission proposed a temporary emergency regulation Nov. 9 to speed up the deployment of renewable energy sources in response to a worsening of the energy crisis.

Insurers and reinsurers have been providing insurance cover to renewable energy projects but said they are keen to do more. The Zurich spokesperson said the company's approach to balancing the need for decarbonization and energy security included expanding its offering to the renewables sector. The Munich Re spokesperson said the company's Green Tech Solutions unit had underwritten projects worldwide totaling about 51 GW of generation capacity.

Swiss Re's Weymann said that while it was realistic to expect countries to reactivate fossil fuel power plants in the short term, over the next two to three years "we see a clear indication … that [the energy crisis] leads to an acceleration of the transition we are seeing now." Weymann said European countries had "ambitious climate goals" and it is "attractive for governments, for companies, for private households to really see how renewable energy can be ramped up very quickly."

The insurance industry "has to respond" to the short-term increase in demand for fossil fuels, but this does not mean companies have set aside their efforts to help the transition to cleaner energy, according to Gurpreet Johal, Deloitte's global lead partner for global reinsurance and the London market. Johal said companies were continuing to look at decarbonization initiatives with clients and projects such as insuring hydrogen plants. "I'm not seeing a slowdown."