Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Dec, 2022

| Amazon has ramped up its investment in clean energy projects. Source: Amazon |

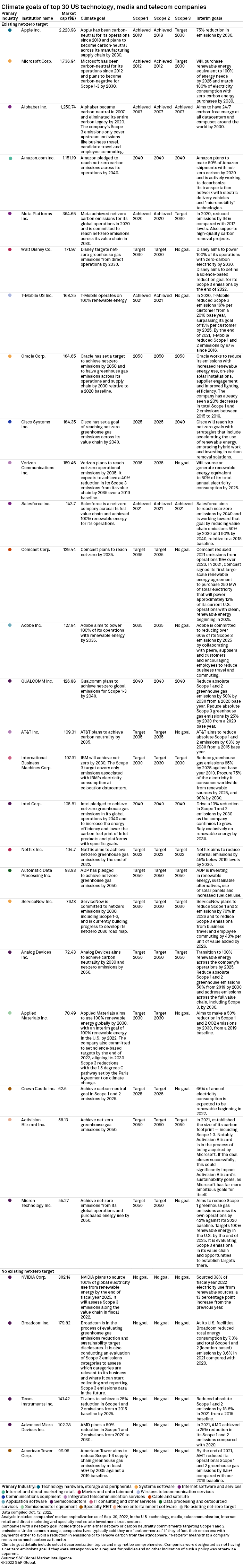

Big Tech companies' overall emissions have continued to rise despite heavy investment in renewable energy projects. Now, growing pressure from shareholders and lucrative federal tax benefits are likely to drive those investments significantly higher.

|

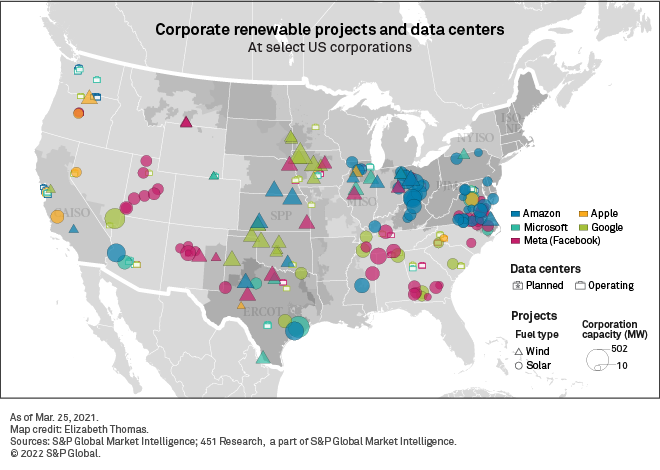

From 2014 to 2021, the largest clean energy customers by announced megawatt volume were Amazon.com Inc., Meta Platforms Inc., Google LLC and Microsoft Corp., according to data from the Clean Energy Buyers Association. Amazon, which has a goal to power its operations with 100% renewable energy by 2025, announced 25 clean energy projects in the first four months of 2022 alone. That is the same number of projects Amazon announced in all of 2021.

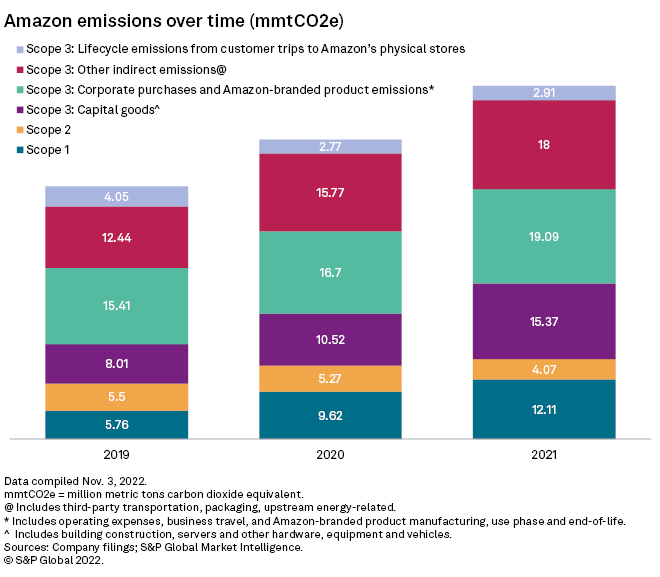

Despite this investment, Amazon's overall emissions have risen to 71.54 million metric tons of carbon dioxide equivalent in 2021, up almost 18% from 2020. Amazon attributed that increase to its growth, noting it doubled the size of its fulfillment network during the pandemic.

Energy and policy experts say a confluence of factors — including clean energy tax incentives created by the Inflation Reduction Act — will result in a steep increase in investment in renewable energy from Big Tech firms in the coming years, which should lead to emissions declines.

"Amazon ... and other leaders have primed the pump to bring in more renewables in a very big way," said Andrea Ranger, shareholder advocate for Green Century Capital Management, a mutual funds company that engages with Amazon on environmental issues.

Green motives

U.S. businesses are not required to buy clean energy, but companies like Amazon are motivated to voluntarily purchase the energy to power services and lower costs, said Misti Groves, vice president of market and policy innovation for CEBA.

"Companies, in general, are looking to provide services, so they are looking for a clean, resilient, reliable affordable grid," Groves said.

According to the latest data available from the International Renewable Energy Agency, costs for renewable technologies have fallen. Concentrating solar power costs fell by 16% in 2020, while onshore wind fell by 13% and offshore wind declined by 9%.

The Inflation Reduction Act is expected to further bring down costs of solar panels, batteries and wind turbines due to economies of scale as demand for these products increases.

Tax credits provided by the Inflation Reduction Act will also help to lower costs of renewable energy facilities. The legislation allows tax credits as high as 50% for projects that use ample U.S.-made equipment or are located in areas with historically high coal, oil or gas employment. The credits can be claimed on projects that are completed during 2022 through some time in the early 2030s. Companies like Amazon can also buy tax credits from renewable developers who are not in a position to use the tax credits directly.

"It expands the options for customers and the financial community to participate in investments in renewable, directly or indirectly," said Lillian Federico, research director for energy at S&P Global Commodity Insights.

|

Even if the White House changes hands after the 2024 election, it would be difficult to repeal the legislation after companies and developers have moved to make investments based on the incentives in it, said Keith Martin, a tax and project finance lawyer with Norton Rose Fulbright. Much of the new utility-scale renewable energy development is located in red states, he noted.

"I think there's a sense in Washington that we've lost valuable time in trying to tackle climate change and now we have to throw everything at it that we have," Martin said.

Pressure all around

Increasing pressure from stakeholders, institutional investors and rating agencies is also motivating companies to set targets for renewable energy goals and meet them. According to 451 Research's “Voice of the Enterprise: Datacenters, Sustainability 2022,” 66% of respondents stated that their organizations have set sustainability goals.

"The pressure is very much on net zero Scope 1 through 3," said Daniel Stewart, energy and climate program manager for As You Sow, a Berkeley, Calif.-based non-profit organization that represents Amazon shareholders. As You Sow has been working with Amazon to highlight and better manage the company's climate risks since 2019 and its waste risks since 2013.

Companies can more easily tackle Scope 2 emissions by purchasing renewable power. "It's the easiest thing to dip your toe into and start things off," Stewart said. "When you see Amazon, Google, and Meta setting these really high targets for purchase power agreements, that can help improve their marketing of how sustainable they are but also it's helping them from a risk point of view with fluctuating and volatile energy prices."

Notably, Scope 2 is the one emissions scope where Amazon saw its emissions decrease between 2021 and 2020, falling to 4.07 MtCO2e from 5.27 MtCO2e.

Datacenter demands

Amazon and other tech companies have invested heavily in renewable energy projects that are close to their datacenters. These energy-intensive buildings can consume up to 200 times as much electricity as standard office space, according to the U.S. Department of Energy.

There is "a very close relationship" between where hyperscalers such as Amazon, Microsoft, Google and Meta have built their datacenters and where their solar and wind energy projects are, said Dan Thompson, principal research analyst with 451 Research.

A key example is Northern Virginia, where there is a large concentration of Big Tech datacenters. There were nearly 300 leased facilities as of the second quarter, according to 451's Datacenter KnowledgeBase. The datacenters in Northern Virginia are currently using 2,500 megawatts of power, according to 451 Research. In the next two years, the datacenter industry is hoping to add another 1,000 megawatts.

To help power these centers, there is a large cluster of renewable energy projects in southern and central Virginia.

Companies are also investing to make their datacenters more energy efficient.

Efficiency is not the only important variable in the sustainability equation for datacenters, but it is a crucial one, said Thompson. 451's Voice of the Enterprise survey found that among IT leaders whose companies planned to open a new datacenter, 32% said improving the organization's carbon footprint was a reason for the new build.

Moving to locations with a greener energy mix and increasing efficiency were all cited by survey respondents as ways the new datacenter builds would improve an organization's carbon footprint.

While Big Tech datacenters all operate more efficiently than the industry average, Amazon has been particularly proactive about sustainable design for its datacenters, taking actions such as reducing the amount of water used to cool the facilities. According to a 451 study commissioned by AWS in 2019, AWS infrastructure is 3.6 times more energy efficient than the median of U.S. enterprise datacenters surveyed.

Investor concerns

Despite Amazon's sustainability strides in its Scope 2 emissions, investors remain concerned about the company's total emissions rising, particularly when it comes to Scope 3.

"Companies have moved from just caring about Scope 1 and 2 to also about Scope 3," Thompson said.

Amazon does not include transportation carbon emissions from the sales of its third-party sellers, which make up the bulk of Amazon's sales.

"They don't measure and disclose it and they are also not including it in their net zero target," said As You Sow's Stewart. "If your business is contingent upon the sale of these goods, then you should be accountable for the supply chain emissions of them."

Ranger, of Green Century Capital Management, also noted that Amazon does not report emissions coming from the sale of products such as Tide laundry detergent or Samsung TVs.

The e-commerce company must improve its Scope 3 emissions by encouraging its suppliers to lower emissions, said Simon Fischweicher, head of corporations and supply chains for CDP North America, which works with companies to drive down carbon consumption.

On average, supply chain emissions are 11.4 times higher than direct emissions across all industry sectors, he said.

"These are companies ... with extensive supply chain emissions and for us to truly address the climate crisis, they are going to have to engage their suppliers to reduce emissions," Fischweicher said.

451 Research is part of S&P Global Market Intelligence.