S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Dec, 2022

By Karin Rives

| True carbon offsets should support projects that, ton-for-ton, remove greenhouse gases already emitted into the atmosphere, some argue. This direct air capture plant in Switzerland would be such a project. Source: Climeworks |

In early November, a group of former Shell executives and energy investment bankers proposed a novel idea: convince U.S. oil and natural gas producers to shut thousands of low-producing wells across the nation in return for high-quality and verifiable carbon credits.

|

Such offsets are in high demand as companies worldwide scramble to meet their climate goals and new project developers rush in to capitalize on a growing industry.

But their hunt for credits comes amid growing scrutiny of the voluntary and unregulated carbon market in the U.S. and beyond.

Inconsistent standards, varying quality of offsets, and accusations of greenwashing can make investments in offsets a risky proposition for companies that do not do their homework, observers warn.

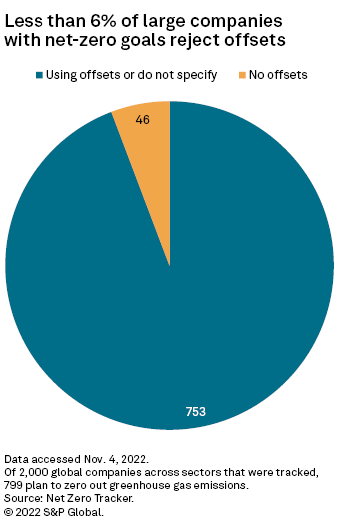

Just 6% of large companies shun offsets

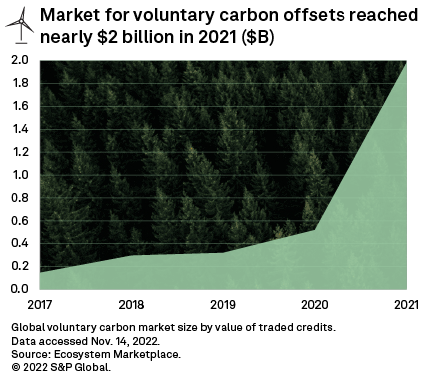

The credits issued by ZeroSix, the Houston-based venture focused on closing wells, will each represent 1 metric ton of avoided greenhouse gas emissions. The credits can then be traded on the sprawling $2 billion market for voluntary carbon offsets, via a blockchain platform.

"We'd like to provide an incentive and let the market do its work," ZeroSix CEO Martijn Dekker told S&P Global Commodity Insights. "People pay a lot in the voluntary carbon market for high-quality carbon credits."

For businesses that put their reputations on the line making ambitious climate pledges, the stakes are high.

A vast majority of publicly traded corporations across the energy, banking, insurance, mining and technology sectors have adopted climate goals, the latest Commodity Insights surveys show.

But just 6% of the world's largest corporations have explicitly said they plan to fully decarbonize without using offsets to reach their climate targets, according to data from the group Net Zero Tracker. And a vast majority of companies have not detailed any plans or strategies for using offsets and carbon credits to meet their goals, including cutting the 5%-10% of their emissions that technology cannot abate.

"There's certainly going to be business and reputational risks if you're offsetting your emissions now and not concentrating on direct emissions reductions," John Lang, a Net Zero Tracker project lead, said in an interview. "If it's fit for purpose, offsetting should be only used for residual emissions."

Voluntary carbon markets allow companies and people to purchase credits to neutralize their greenhouse gas emissions, for example, to offset business air travel or personal driving. Such options fall outside compliance markets like the European Union's Emissions Trading System or the Regional Greenhouse Gas Initiative, which require emissions reductions from certain high-polluting industries.

'Inflated climate benefits'

In the U.S., the voluntary carbon market grew in the absence of government climate policies and a national carbon market, serving as a complement to corporate efforts to cut their own emissions, proponents say.

But it has become a fragmented market guided by different standards and no central oversight, prompting seven Democratic senators in October to ask the U.S. Commodity Futures Trading Commission to adopt rules governing carbon offsets.

|

"Extensive research indicates systemic and persistent issues with offsets, including inaccurate or exaggerated promises of the positive effects, inflated climate benefits, and weak or unenforceable regulations," the senators wrote.

The commission held its first-ever hearing on the topic in June, where Chairman Rostin Behnam announced a "request for information" that he said could lead to new guidance or regulations.

Efforts are also underway outside government to shore up the voluntary carbon credit market. Two organizations — the Integrity Council for the Voluntary Carbon Market and the Voluntary Carbon Markets Integrity Initiative — are developing new global standards and guidance for buyers of carbon credits.

The Verified Carbon Standard program is the leading standard worldwide for voluntary offsets. It is managed by Verra, a nonprofit that has warned against a "blunt, one-size-fits-all approach" to revamp the rules. Verra spokesperson Steve Zwick pushed back against what he says has become a negative narrative about a market that has delivered results while steadily improving over the past two decades

The market soared in 2021, reflecting newfound interest in voluntary carbon credits but catching Verra off-guard. New proposed projects seeking to qualify for credits were streaming in, creating a massive backlog for the small staff whose rigorous process to vet a project can take several weeks, Zwick said.

"All of a sudden there was money in it and people started parachuting in," Zwick said in an interview. "All these bankers and techies were saying, 'the markets are broken, we need to fix them.' But the markets have worked well, as well as they could, for as long as they have. It's an evolving process."

US utilities tread carefully

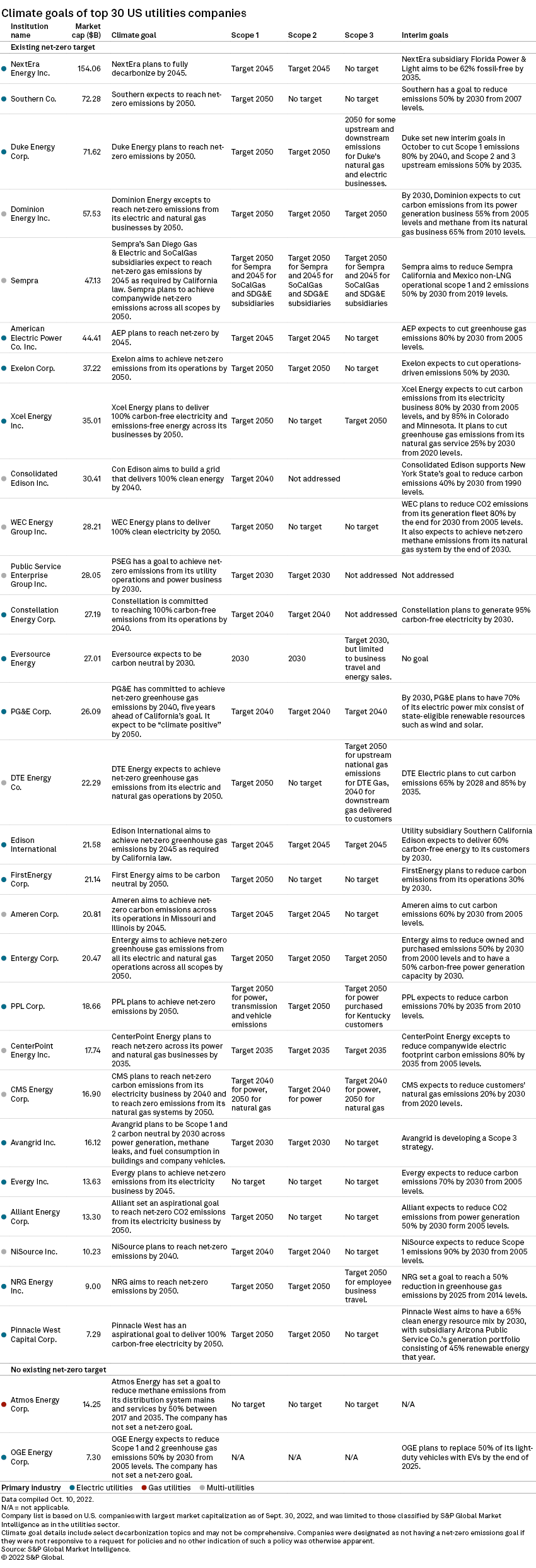

NextEra Energy Inc., the largest U.S. electric utility by market cap, announced this year that it would reach "real zero" by 2045 because, unlike most of its peers, it will get there without using carbon offsets.

"For us, true decarbonization [means] not leaving our children and grandchildren with a mess," Chris McGrath, a spokesperson for NextEra subsidiary Florida Power & Light, said in an interview. "We believe we're at a juncture now where we can see the technology path that will take us there."

In 2001, FPL burned more oil to produce power than any other utility in the country. Since then, oil plants have been replaced with natural gas-fired plants that in the not-so-distant future will run on green hydrogen, McGrath said. "It's going to be a journey."

NextEra is not alone. Consolidated Edison Inc., Pinnacle West Capital Corp. and Atmos Energy Corp. also told Commodity Insights that they plan to reach their climate goals without having to tap into carbon credits.

Others expressed caution about offsets.

"The optimal net-zero strategy requires reduction of our own emissions as much as possible through portfolio transformation and integration of low- and zero-carbon technologies," Entergy Corp. spokesperson Neal Kirby wrote in an email. "Any remaining emissions will be carefully vetted for offset opportunities."

CenterPoint Energy Inc. echoes that approach on its website, saying it plans on a "minimal reliance on carbon offsets."

Avoid or remove?

As the demand for offsets grows, there is also increasing debate over what makes a carbon credit trustworthy.

Companies that shop for carbon credits today find a market flooded by so-called avoidance offsets that prevent emissions from being released into the atmosphere. Rather than removing greenhouse gas emissions that already trap heat, avoidance offsets may instead prevent logging in rain forests or — as with the ZeroSix venture — the drilling of oil.

Only about 3% of offsets today represent actual removals of emissions from the atmosphere, according to Carbon Direct, a carbon management firm helping companies plan and execute net-zero strategies.

Removal projects could include the reforestation of mangroves and tidal marshes that can absorb carbon, or projects using direct air capture technology, which sucks climate-warming pollution out of the sky, said Micah Macfarlane, Carbon Direct's head of commercialization.

"One way of measuring quality is the question of leakage," Macfarlane said in an interview. "Have you done something to remove that ton of carbon, and did it stay removed from the ecosystem?"

If an oil company, for example, shuts down some wells only to increase production elsewhere, how will that be accounted for?

"Yes, we need to remove CO2 because it's higher than it's ever been," agreed Dekker with ZeroSix. "But if we're only focused on removals, a lot of those technologies are not ready yet. Are we going to wait 10 years until we can remove CO2 at mass scale?"

The low-producing wells ZeroSix is targeting account for 11% of methane emissions from all U.S. oil and natural gas production, the company says. If closed down, they could avoid 1 gigaton of greenhouse gas emissions annually, nearly one-fifth of what the U.S. emits in a year.

"Let's just get going," Dekker said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.