Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Dec, 2022

By Sanne Wass and Harry Terris

| Major North American and European banks' introduction of emission reduction targets has generated questions about whether they are credible and sufficiently ambitious. Source: Getty Images |

Banks' decarbonization goals for high-emissions portfolios lack standardization and transparency, raising questions about their credibility with climate activists and investor groups.

|

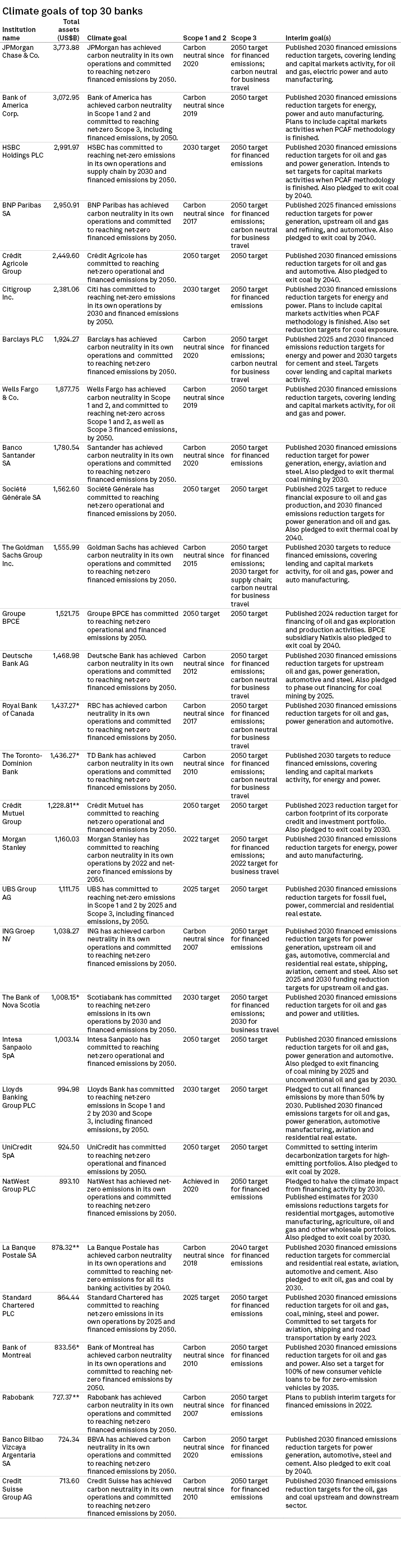

Twenty-six of the 30 largest banks in the U.S., Canada and Europe have published their first 2030 emissions reduction targets for financing portfolios across sectors such as oil and gas, power and transport, according to S&P Global Market Intelligence research.

But it is "very difficult" for investors and other stakeholders to compare those targets to one another and ensure they are "credible and can deliver the intended goal," said Xavier Lerin, senior banking analyst at ShareAction, which organizes shareholder campaigns.

Climate activists also argue the targets contain loopholes and flaws, like not including some important parts of banks' business, such as capital markets underwriting.

Different goalposts

All 30 banks in this analysis have signed onto the Net-Zero Banking Alliance, a U.N.-convened coalition launched in April 2021. Members of the group state that they are committed to achieving net-zero emissions across their lending and investment activities by 2050, consistent with the Paris Agreement goal of limiting global warming to 1.5 degrees C. Banks also pledge to publish a first round of interim sectoral targets within 18 months of joining.

To date, most banks have released 2030 targets covering their oil and gas and power generation financing portfolios. Some have also included sectors such as commercial and residential real estate, automotive, cement and steel.

Targets range from reducing exposure to oil and gas by 9% to 71% across the Net-Zero Banking Alliance members that have submitted goals in this sector, according to the coalition's November progress report. In power generation, decarbonization figures range from 23% to 76% reductions.

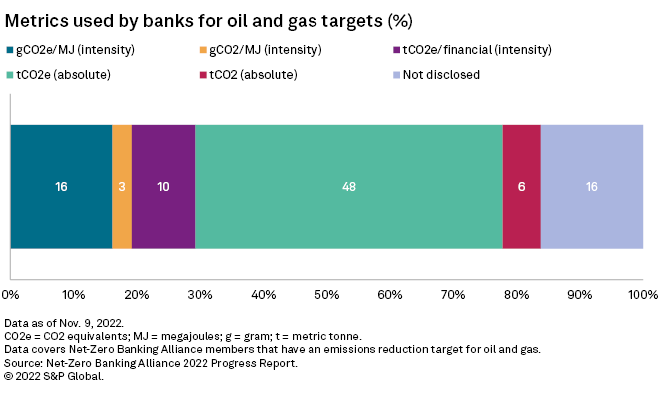

However, the scope, boundary, sector coverage and use of metrics "vary greatly," the report stated, which may mean the figures are not truly comparable to one another, the report said. Within oil and gas, for example, some banks use metrics covering all greenhouse gases, while others focus only on CO2. Still others have unspecified metrics. Targets also vary in that some apply to absolute emissions and some to emissions intensity in proportion to clients' physical emissions or financing provided.

Some 68% of oil and gas targets issued by Net-Zero Banking Alliance members cover clients' Scope 1, 2 and 3 emissions, while others include only some of those scopes. As for climate scenarios used, 55% of banks rely on the International Energy Agency's roadmap, while the rest have used scenarios developed in house or by the Network for Greening the Financial System.

"There isn't a really clear apples-to-apples comparison," said Dan Saccardi, program director at Ceres, a U.S.-based organization that works with companies and investors on sustainability issues.

Several major banks, including Bank of America Corp., JPMorgan Chase & Co., Citigroup Inc. and Standard Chartered PLC, did not make executives available for interviews after requests from S&P Global Market Intelligence.

In some cases, banks have not been transparent about the choices they made when designing their goals. Of the Net-Zero Banking Alliance members with oil and gas targets, 32% failed to disclose which scenario they use, while 29% have not revealed what asset classes are included, according to the group's progress report. A ShareAction analysis of 43 of the largest Net-Zero Banking Alliance members globally also found that 24% of banks have not disclosed the emissions baselines for their targets.

Comparing emission reduction targets was never the aim of the climate alliance, nor will it necessarily be useful given the variation in bank size, business model and geographic location, said Remco Fischer, climate lead at the UN Environment Programme Finance Initiative, which convenes and provides the secretariat for the Net-Zero Banking Alliance.

The initial alliance progress report only a superficial evaluation of the banks' interim targets, Fischer said. The secretariat will conduct a more in-depth analysis of individual members at a later stage.

While the banking group's target-setting instructions offer some flexibility to accommodate its diverse membership, each bank must provide a path for no/low overshoot of the 1.5 degrees C global warming target and so are showing a "high level of ambition," Fischer said.

Disclosures in the spotlight

Scrutiny from investors and environmental groups is likely to rise as banks start to report on progress against their targets; they also have another 18 months to release interim goals for the remaining carbon-intensive sectors.

So far, most climate targets cover only on-balance sheet assets, while ignoring off-balance sheet capital markets activities such equity and debt underwriting. The Net-Zero Banking Alliance guidelines do not require members to set targets for these so-called "facilitated emissions" because a common accounting methodology does not exist, Fischer said.

Only a small number of banks, including JPMorgan, Barclays PLC and The Toronto-Dominion Bank, have set targets for off-balance sheet activity, though lenders such as HSBC Holdings PLC, Citigroup and Bank of America have promised to do the same when a methodology is available through the Partnership for Carbon Accounting Financials. The Net-Zero Banking Alliance is also committed to updating its guidelines to include facilitated emissions once the PCAF standard is built and tested, Fischer added.

Banks will face pressure to supplement intensity-based targets with absolute emissions reduction goals. Intensity metrics have been preferred by banks, who say they are useful to compare companies within each sector and against decarbonization trajectories, among other benefits. But used in isolation, such metrics could "mask real progress," said ShareAction's Lerin.

U.S.-based environmental organization Sierra Club has said intensity targets for oil and gas are "fundamentally misaligned" with a 1.5 degrees C pathway because they allow for new financing in the sector. Four of the six largest U.S. banks have not set absolute reduction targets for oil and gas, the group said.

Tracking progress

While the metrics used to set targets are flexible, banks in the climate alliance will have to report on their financed emissions in both intensity and absolute terms every year, said Fischer.

Some institutions have already started to release such data. Bank of America, for instance, recorded a drop in estimated absolute financed emissions across energy, power and auto manufacturing by 4.3% between 2019 and 2020, when global emissions plummeted amid the onset of the COVID-19 pandemic. Emissions intensity within power jumped 9.2% to 367.2 kilograms per megawatt-hour, compared with its 2030 target of 100.9. The bank attributed this increase to the roll-off of a single credit "entered into under unique circumstances."

Banks have also begun the "very hard work of engaging with clients, starting to identify those opportunities for transition and accelerating them," said Val Smith, chief sustainability officer at Citi.

"We're now really focused on execution," Smith said in late November at the FT Global Banking Summit. "What's happening behind the scenes now is this deep focus on implementation of the commitments that have already been set out."

Bank executives have previously warned it will take time before their financed emissions drop materially as they prioritize helping polluting clients through the transition rather than exiting them. The war in Ukraine and the related energy crisis may slow the decarbonization process further. In a recent survey among 27 large European banks, 54% said they expect the energy crisis to negatively impact their short-term ability to stay on track with their climate transition agenda.

It may take time before banks' efforts translate into lower emissions, but "it will be incumbent upon the banks to show that that engagement is happening" and demonstrate that this is driving meaningful change to clients' business strategies, said Ceres' Saccardi.