S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Jun, 2022

As regulators look to increase disclosure requirements around climate risk and emissions data, pressure to step up disclosure details and set net-zero targets is spreading up and down the supply chain.

Source: George Pachantouris/Moment via Getty Images

Publicly traded companies have been slow to adopt net-zero emissions goals, but corporate peer pressure combined with regulatory changes is beginning to turn the tide.

Only 37% of about 5,300 companies reviewed in the 2021 S&P Global Corporate Sustainability Assessment had announced plans to reduce Scope 1 or Scope 2 emissions. However, some of the largest companies in high-emitting sectors around the world are among those already disclosing emissions and setting net-zero targets. For example, an S&P Global Commodity Insights review found that 21 of the top 30 mining and metal companies by market capitalization have set a net-zero goal. In the less emissions-intensive banking sector, only about half of the 30 largest companies reported setting an emissions target.

But more businesses appear ready to shrink their carbon footprints.

Pressure from investors, regulators and other stakeholders to carefully document and disclose emissions up and down the supply chain is drawing more companies into the broader discussion about greenhouse gas emissions. With U.S., European and other regulators around the world backing the investment community's push toward a more granular disclosure of corporate ambition and progress on climate issues, more companies will soon need to reduce their emissions.

"If you have a client base that is setting net-zero commitments, I think that's a really strong impetus for some of these smaller companies to start addressing the net-zero objective as well," said Jennifer Grzech, responsible investing director at global investment manager Nuveen.

Pressure moving down the supply chain

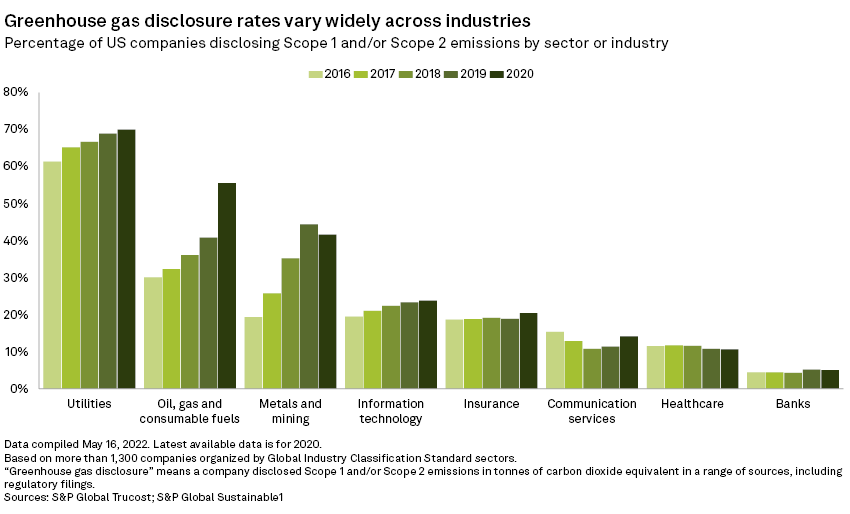

Companies in some of the heaviest-emitting sectors are also among the earliest adopters of greenhouse gas emissions disclosure practices. By 2020, 70% of utilities and 56% of oil and gas companies in the U.S. already publicly disclosed Scope 1 and/or Scope 2 emissions, according to S&P Global Sustainable1 data. In the same year, only 5% of banks and 11% of healthcare businesses disclosed greenhouse gas emissions.

As investors increasingly focus on environmental, social and governance issues, more companies have begun thinking about Scope 3 emissions targets, a broadly defined set of emissions that encompasses companies' entire supply chains. When larger companies such as Shell PLC or BP PLC start to set Scope 3 targets, they spread some of the pressure for more transparency around emissions and climate risk to the smaller companies that contract with them.

"[Companies are] finally under the realization that this is real and it's not going away," said Keith Fortson, global head of ESG at risk management provider Riskonnect.

A move toward 'regulatory ESG'

|

Financial regulators around the world, including those in the European Union, have tightened disclosure requirements related to emissions data and targets.

In March, the U.S. Securities and Exchange Commission followed suit and proposed a rule that will require publicly traded companies to annually report direct, or Scope 1, emissions, and those related to energy purchases, or Scope 2 emissions. Some companies would also be responsible for reporting Scope 3 emissions – produced throughout the company's supply chain and by customers — if such emissions are deemed material to its business and if it has a goal to reduce emissions.

"These requirements are basically as big as the stuff that companies already disclose in their annual reporting," said Margaret Peloso, a partner at the law firm Vinson & Elkins LLP who focuses on climate change risk management and environmental litigation. "It's almost like stapling a whole second annual report onto your annual report." The proposal, as is, would radically alter the securities law landscape, moving the U.S. toward "regulatory ESG," said Peloso.

Now, with companies increasingly viewing climate change as both a potential creator and destroyer of value, regulators are demanding that disclosures around the topic become deeper and more comprehensive.

"I do anticipate that the mandatory requirements are going to go forward," Fortson said. "I've spoken to 100-plus companies since [the SEC rule was proposed], and a lot of them are nervous."

Impacts of the proposed SEC rule have the potential to reverberate far beyond publicly traded companies.

For example, organizations representing agriculture, livestock, poultry farmers and ranchers across the U.S. wrote to the SEC to express concern that the rule could "create multiple, new sources of substantial costs and liabilities." New reporting obligations, technical challenges and other disruptions could beset even those that are not directly under the SEC's jurisdiction, the coalition warned.

|

|

Similarly, the National Federation of Independent Business said that the rule should not require companies regulated by the SEC to obtain climate information from unregulated companies.

Reporting the data

However, investors need more accurate data about climate risk to ensure they are meeting their investment objectives around climate. Accumulating and assessing that data can be a resource-intensive task, and there are plenty of thorny questions around calculating some of the more complex data points, including assessing Scope 3 emissions far down a company's supply chain or customer base.

Scope 1 and Scope 2 emissions can be challenging to document and even more difficult to eliminate. However, pressure to calculate the even more complex set of Scope 3 emissions is rising, and companies are working to boost headcount and leverage technology to tackle the complex issue."Frankly, I think some of those gaps will be filled with real data, and some of those gaps will be filled with data that are estimates," Peloso said.

Thousands of solutions are being marketed to companies for ESG reporting, and venture capital is pouring into the space, Fortson said. Industry associations may also be able to devise ways to help alleviate the burden for individual companies.

"It doesn't matter if you are a heavy emitter. What everyone is looking for is transparency around it," Fortson said. "Pricing unknown risk is really expensive. Everyone has to assume the worst."

Best-effort estimates and assumptions may need to be made, but they must be documented and justified, said Gilman Callsen, founder and CEO of Rho Impact, an ESG planning, consulting and reporting company.

"We're getting beyond where you can just make some lofty claim," Callsen said. "People are more and more looking at that as greenwashing and actually expecting companies to have some actual data behind it."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.