S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Jan, 2022

By Eric Oak

2021's unprecedented year for global trade sets a high bar — for better or for worse — for 2022. Companies and governments will be looking closely at international trade as both a solution and a problem, depending on the issue, and may be considering some of the scenarios presented in this report.

One of the first benchmarks for 2022 will be the Lunar New Year holiday celebrated across Asia. Many businesses shut down during this time, and export activity mostly ceases. There is also a significant amount of travel expected during the period, which might be more complicated in 2022 amid the ongoing spread of the coronavirus omicron variant.

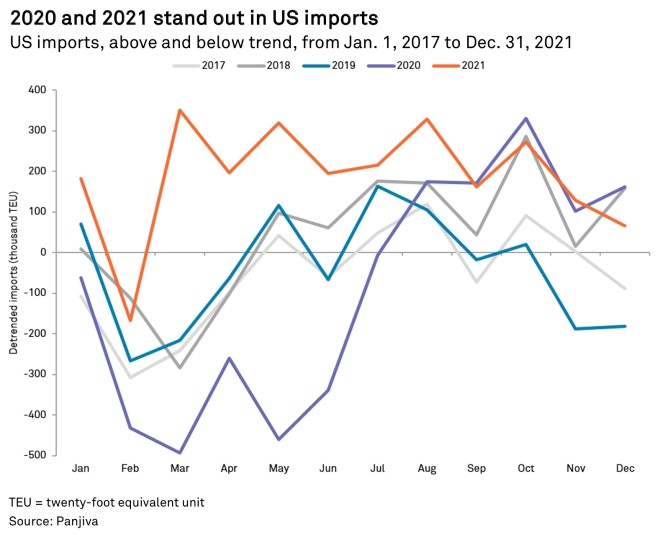

Removing the rising trend in U.S. seaborne import data shows the effects of the holiday clearly, with data for 2020 and 2021 showing anomalies during the early spring. Data on the upcoming holiday could provide insights into how imports will trend for the rest of the year. Many shipping companies have been waiting for the event to see what 2022 will hold as well, with carriers like Matson Inc. previously citing the period as a key turning point.

It stays the same

One scenario for 2022 could easily be more of the same. Built-up congestion, even if demand wanes, could continue to pressure logistics networks and keep shipping rates elevated. This scenario assumes that ports, carriers and inland logistics networks are not able to find a way to alleviate bottlenecks. Carriers likely retain the most benefits under this possibility, with high rates and full ships increasing profitability. This increased profitability helps absorb additional costs, like fees for container overstays at ports, if they are not passed along to consumers. Sporadic lockdowns and slowdowns related to the COVID-19 pandemic may also continue throughout 2022, reducing the throughput of major logistics hubs, like the restrictions at the port of Ningbo, China, outlined in Panjiva's research of Jan. 10. Rate increases for shipments out of China in the first week of the year could lend credence to the "more of the same" scenario, with prices to the U.S. West Coast increasing 8.5% week over week as of Jan. 7.

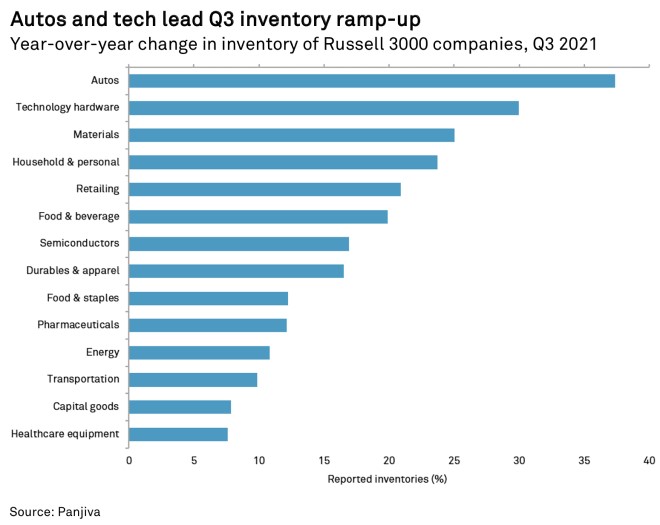

The status quo possibility will likely prompt the same corporate reactions seen in 2021. Companies will be more cognizant of supply risks and adjust their businesses to adapt to longer lead times and uncertainty. As outlined in Panjiva's research of Sept. 28, 2021, businesses wary of supply-related shutdowns or stockouts usually react with additional margins of safety to their processes. For manufacturers, retailers and other goods-focused companies, this usually means placing more orders to increase inventories, which in turn can feed a cycle that perpetuates congestion and inflation. The automotive industry showed one of the largest growths in inventories in the third quarter of 2021 at 37.4% year over year. This is likely directly related to the global chip shortage, with companies like General Motors Co. producing and storing work-in-progress vehicles until supplies come in.

It gets worse (for shippers)

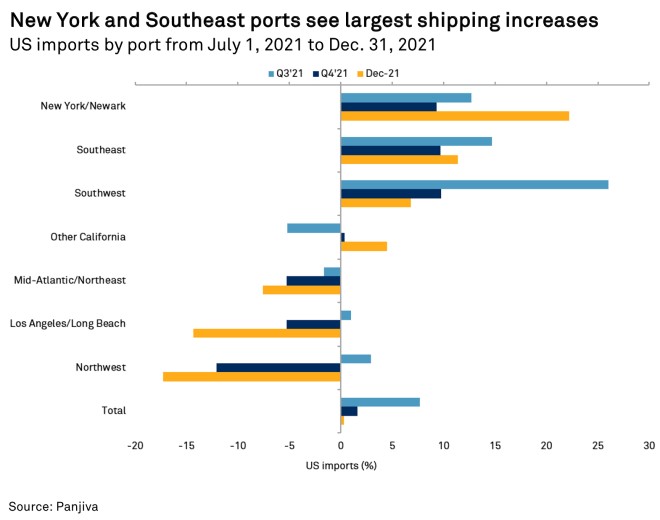

A 2022 that is even worse for shipping is hopefully avoidable, but there are several risks that could trigger more logistics issues. For instance, another event involving the blockage and closure of a major trade lane, such as the grounding of the Ever Given, could compound issues. With logistics networks now at capacity, any further restrictions add to the burden on other links. One event that may affect supply chains in 2022 is the renegotiation of the longshoreman contracts at The Port of Los Angeles and The Port of Long Beach, Calif. If negotiations break down, a strike or slowdown could be a major impediment to imports. The Los Angeles and Long Beach ports accounted for 32.0% of U.S. imports in 2021; removing that link for any period could send an overwhelming surge of traffic to other destinations.

Panjiva data on ports, including re-exports, shows that this may already be happening due to congestion, with the import share of the two ports falling to 28.5% of the U.S. total in December 2021 from 31.0% in the fourth quarter. Using this gauge of momentum, the largest gainers are ports in the Southeast and the New York/Newark areas, which increased their share by 1.1 percentage points and 1.4 percentage points, respectively. Additional traffic to U.S. East Coast ports, which were up 22.2% year over year in December 2021 in the case of New York, can put additional strain on resources like the Panama Canal, increasing the impact of any incidents.

Other risks to supply chains involve geopolitical tensions. The trade dispute between the U.S. and China entered a detente with the signing of the phase one agreement in 2020, but the two-year term on the additional, nonbinding, purchasing commitments concluded at the end of 2021 unfilled. Tensions have also increased with the passage of U.S. legislation restricting imports from the Chinese region of Xinjiang and conflicts over the financial disclosures of listed U.S. companies. China's application to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership — which follows the proposed Trans-Pacific Partnership Agreement that did not proceed — could also be viewed as an attempt by China to edge out any future participation in the agreement by the U.S.

Regardless of the cause, any escalations in the trade relationship between the two powers may cause ripples in supply chains. China still accounts for 40.3% of imports to the U.S.; imports from the region rose 2.7% year over year in the third quarter of 2021 and 3.4% year over year in the fourth quarter of 2021, exceeding levels seen before the height of the trade conflict in 2019.

It gets better

Not all events that could transpire in 2022 are bad for trade. Continued efforts by supply chain participants to streamline and resolve congestion could finally take root. Most efforts focus on efficiency, trying to squeeze an extra percentage out of each interaction and adding up in the end. One avenue is increased digitization of carriers, ports and inland logistics. Improvements in drayage processes around ports could add additional capacity, leveraging technology to streamline pickups. Port policies will also likely change as operators try new ways to increase throughput, like the increased stack heights and around-the-clock operations tried at the Los Angeles and Long Beach ports. Chassis pools may also become more popular, building off the example set by the port of Virginia.

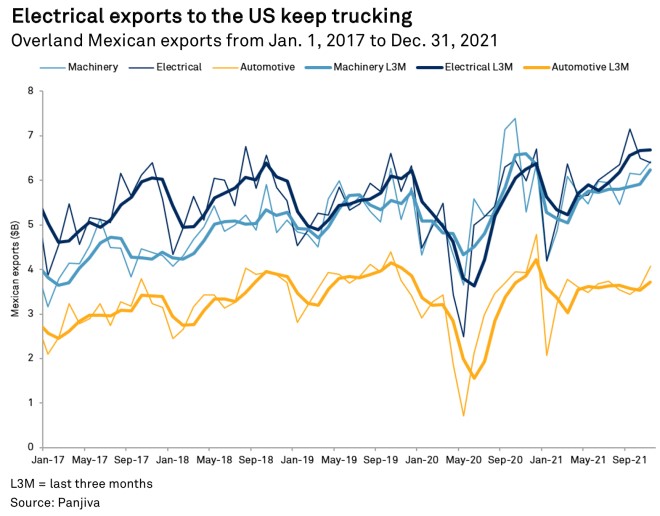

Panjiva analysis shows trucking activity lagging overall imports, with tonnage falling 0.7% year over year in the third quarter of 2021. Total seaborne imports were up 7.6% year over year in the same period. Trade with Mexico would likely benefit from streamlined trucking, with companies taking advantage of the United States-Mexico-Canada Agreement. Data on trucking exports from Mexico to the U.S. shows that the electrical and automotive industries took the most advantage of overland networks in the third quarter of 2021, up 16.6% year over year and 5.7% year over year, respectively. Mexican sources also have the advantages of near-sourcing while still providing a lower-cost environment than the U.S.

The event that may end up improving the shipping situation the most will likely indicate a contraction of other parts of the economy — a downturn in consumer demand, or a recession, could quickly flip the shipping market to the other direction. Ocean shipping has been a cyclical industry; essentially commoditized, carriers are mostly bound around a market price. A reduction in demand would drive rates down as carriers competed for market share, giving relief to shippers but putting more pressure on cost-saving practices like alliances and slow steaming. Carriers have been making record profits, however, with companies like Matson and Evergreen Marine Corp. (Taiwan) Ltd. increasing net income 282.7% and 735.5% year over year, respectively, in the third quarter of 2021. Like most exceptional periods, 2022 might end up being defined by a reversion to the mean.

Eric Oak is a researcher at Panjiva, a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.