S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Apr, 2021

By Declan Harty

A retail trading renaissance has injected optimism into the brokerage business, at least for now.

Droves of mom-and-pop investors have hit the financial markets over the last year. The perfect storm of pandemic-induced boredom, low interest rates and thousands of dollars in stimulus checks helped lead retail investors to buy everything from meme stocks to call options to Bitcoin over the past 12 months. Some 20% of U.S. equities traded in 2020 could be traced back to retail investors, according to Bloomberg Intelligence data. That number stood at 22% after the first quarter of 2021.

Legacy and upstart investing platforms alike have seen stunning levels of activity as a result, with some executives calling it the beginning of the next era for retail trading. And yet, as the pandemic begins to fade with COVID-19 vaccinations accelerating across the country, others on Wall Street question whether the boom is a new normal among retail investors or just a passing fad — and if so, whether the new class of brokerages now in the limelight will be thinned out by M&A.

"We're sowing the seeds for the next round of consolidation at this point," UBS analyst Brennan Hawken said in an interview. "This industry has been consolidating as long as it's been around."

Rewind just two years and the retail brokerage business looked considerably different than it does today.

Charles Schwab Corp. and TD Ameritrade Holding Corp. were still separate companies. A fledgling Robinhood Markets Inc. had a valuation that was a fraction of what it is expected to reach when it goes public later this year. E*TRADE Financial LLC was only six months removed from its board announcing plans to press ahead as an independent company, with no Morgan Stanley tie-up in sight. And the average cost to trade a U.S. stock online through Schwab, TD Ameritrade, E*TRADE or Fidelity Investments was about $6.

Then, in late 2019, the industry moved to match Robinhood's free-trading model after years of combatting pricing pressures, kicking off a wave of deals as scale became more critical than ever.

"It’s the cheaper and better ones that always win the competition," said Interactive Brokers Group Inc. founder and Chairman Thomas Peterffy, who expects further industry M&A in the coming years, in an interview. "What you're selling is the customer base. What we do is not so complicated. It's basically bookkeeping."

One of the few remaining publicly traded retail brokerages founded before the 2008 financial crisis, Interactive Brokers saw daily average trades on its platform spike 53% in March from the same month of 2020. It is not alone. New brokerage accounts at Schwab hit 1.2 million in February, more than 93% higher than the 626,000 new accounts it added in December 2020. The stocks of both companies are currently trading near all-time highs.

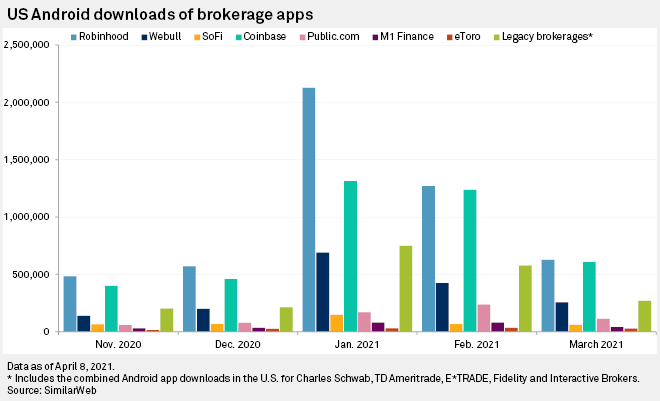

While incumbents have marked significant growth, younger and sleeker platforms tailored for investors buying and selling assets from their phones have been some of the biggest beneficiaries of the rush of new money hitting the market.

Chicago-based M1 Finance LLC, which has nearly doubled its client assets to almost $4 billion in six months, recently completed its third fundraising round in the last year. Public.com raised $220 million in its series D funding round in February, lifting its post-money valuation to $1.2 billion. And Robinhood, whose app has become synonymous with the rise of retail trading over the last year, confidentially filed for an IPO with U.S. securities regulators in March. Weeks earlier, the brokerage had raised $3.4 billion following a GameStop Corp.-sparked margin call from its clearinghouse.

For the nearly decade-and-a-half-old eToro Group Ltd., the last year has marked an important step toward its goal of becoming one of the only brokerages to offer commission-free trading around the world.

The Cyprus-based brokerage, which is gearing up to begin trading in the U.S. public markets once it completes a planned reverse merger with blank-check company Fintech Acquisition Corp. V, currently offers its users the ability to trade cryptocurrencies, commodities and a mix of other assets. And though it does not yet offer stock trading to U.S. customers, a capability it plans to roll out in the second half of 2021, eToro still expanded its count of registered users by more than 50% to 18.7 million between the end of 2019 and the end of January. More than 6% of that came in January alone.

"We're looking at this as a tipping point of people discovering capital markets," eToro founder and CEO Yoni Assia said in an interview. "In following the footsteps of giants like Warren Buffett. It's becoming clearer to a whole new generation that in order to preserve your wealth and increase your wealth you need to do something with your money."