S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Apr, 2021

By Peter Brennan and Tayyeba Irum

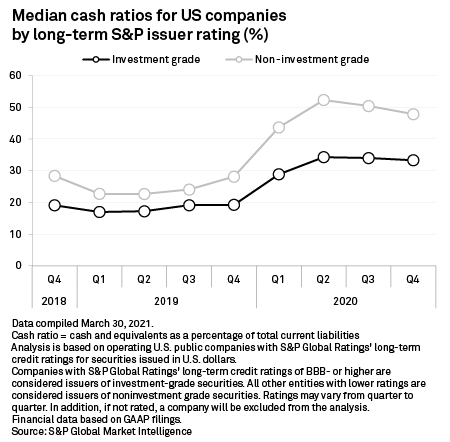

For investment-grade rated companies, the median cash ratio, a closely watched measure of liquidity that compares a company's cash and cash equivalents to its current liabilities, was 33.3% at the end of the fourth quarter of 2020, according to the latest data available. That is far higher than the 19.3% at the end of 2019 but below the 2020 peak of 34.3% in the second quarter.

U.S. companies with lower credit ratings have even higher cash ratios. The median level for companies rated BB+ or lower by S&P Global Ratings was 47.9% in the fourth quarter of 2020 compared with 28.1% a year earlier.

|

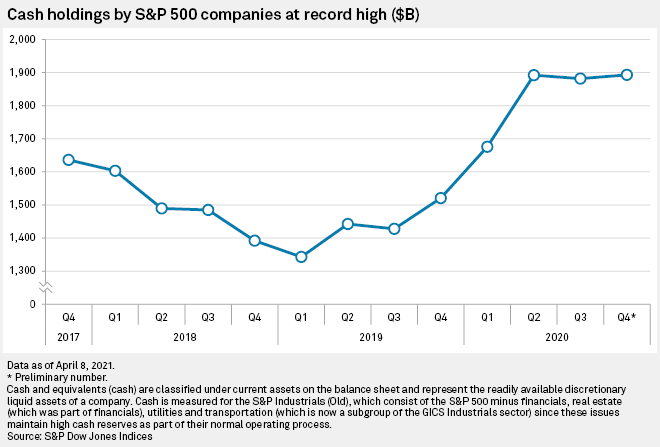

Borrowing fueled the surge in cash holdings. Bond issuance by investment-grade rated U.S. companies jumped to a record $1.687 trillion in 2020 — up from $1.057 trillion in 2019 — as companies embarked on a dash for cash.

That issuance has slowed in 2021, as expected, though companies are continuing to issue debt to fund M&A and share buybacks. Some $192.30 billion was issued in March 2021, down 26.4% on the March 2020 total when companies began their pursuit of liquidity, according to data from LCD, an offering of S&P Global Market Intelligence.

With the outlook for the U.S. economy rapidly improving, buoyed by vaccine rollouts and a $1.9 trillion government stimulus, companies can turn their attention from securing liquidity to unwinding their cash savings. That can take the form of paying down debt, shareholder payments — buybacks or dividends — or capital expenditure, according to Gregg Lemos-Stein, global head of analytics and research at S&P Global Ratings.

"We will have a mix of all three based on the company's particular circumstances, but certainly we don't expect debt repayment across the board based on those competing interests," Lemos-Stein said.

The prospect of a more predictable business environment once the pandemic passes will encourage companies to invest, according to Anik Sen, global head of equities at PineBridge Investments.

"There is plenty of pent-up demand and a need to replace obsolescence," Sen said.

Healthcare takes a lead

Improved business confidence in capital markets and a recovering economy led some sectors to take a lead in winding down their cash ratios in the fourth quarter of 2020.

The cash ratio for investment-grade-rated healthcare companies fell to 44.6% from a high of 56% in the third quarter, almost back to the pre-pandemic level of 40.7%.

Hospitals and healthcare providers have been spending more on expansion and equipment, with ventilators, X-ray machines and more floor space required amid the continuing high COVID-19 infection rate. Larger medical technology and pharmaceutical companies are expected to use their cash piles to fund increased M&A activity, though regulatory hurdles may be raised by a tougher antitrust environment under President Joe Biden.

|

The median cash ratio also fell sharply in the investment-grade real estate sector, dropping to 47.8% in the fourth quarter from 69% a year earlier.

U.S. equity real estate investment trusts issued a record amount of debt in 2020 as lockdowns hammered industries such as retail, hotels and casinos. But debt offerings tailed off in the fourth quarter as raising cash was no longer necessary.

Materials and industrials sectors also recorded year-over-year declines in median ratios in the fourth quarter of 2020. For materials, the median ratio dropped to 40.1% from 48.6%, and in industrials it shrank to 41% from 46.3%.

One contributing factor is an increase in capex. Demand for durable goods — a key indicator of capex in the manufacturing sector that includes machinery and equipment — rose for nine consecutive months before a weather-affected 1.1% decline in February.

Consultancy Oxford Economics expects the recovery in durable goods to persist alongside a broader expansion in business investment. It forecasts nonresidential business investment to grow at the fastest pace since 2012, bouncing back from a decline of 4% in 2020 to grow by 8.4% in 2021.

Buybacks ramp up

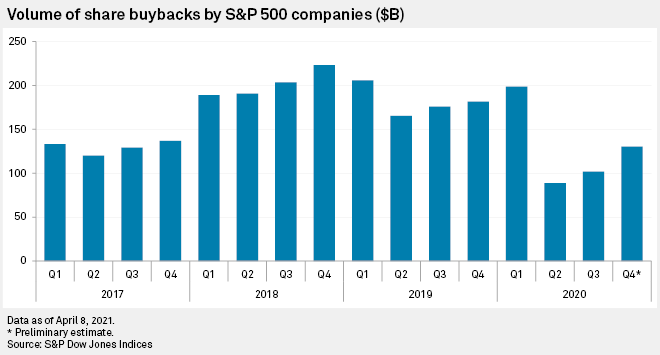

Share buybacks, badly hit during the pandemic, are expected to recover in 2021.

Buybacks by all S&P 500 companies totaled $130.59 billion in the fourth quarter of 2020, according to preliminary data, bouncing back from a low of $88.66 billion in the second quarter as companies became more confident about their cash positions.

The healthcare sector was among those to increase its purchases of shares. Buybacks by S&P 500 healthcare companies rebounded to $15.02 billion in the fourth quarter of 2020 from a low of $7.55 billion in the third quarter, according to S&P Dow Jones Indices. That still represented a 25.1% year-over-year decline but suggests a direction of travel for returning capital to shareholders.

Buybacks are expected to pick up in 2021 as the year goes on. The financials component of the S&P 500 is typically the second-largest proponent of buybacks after the cash-rich information technology sector, but buybacks by financials groups totaled just $15.02 billion in the fourth quarter, a year-over-year decline of 72.9%.

"Big-banks, which received approval [from the Federal Reserve] to resume buybacks, are expected to significantly increase their 2020 expenditure," wrote Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, in a market commentary.

But Sen of PineBridge Investments expects that, besides banks, buybacks will be less of a priority than before the pandemic.

"Given the high valuation on which stocks are trading in most industries, companies would rather deploy cash for increasing scale, increasing their productivity, and adding diversification if there are perceived risks surrounding concentration in manufacturing or in supply chains," he said.

Gradual normalization

In other sectors, the cash ratio remains high. Among non-investment-grade companies, the median ratio for the communication services industry is 84.1% versus 35.5% before the pandemic, while the median consumer discretionary ratio of 60.2% was nearly double the pre-pandemic level of 33.4%.

Lemos-Stein expects cash ratios to fall across the board, though the extent of the decline will depend on the individual circumstances of each company.

"The other important factor is that the opportunity cost of holding cash is not high — that is, holding debt and cash at the same time isn't that punitive because the cost of debt is so low," he said.