S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Jan, 2022

By Bill Holland

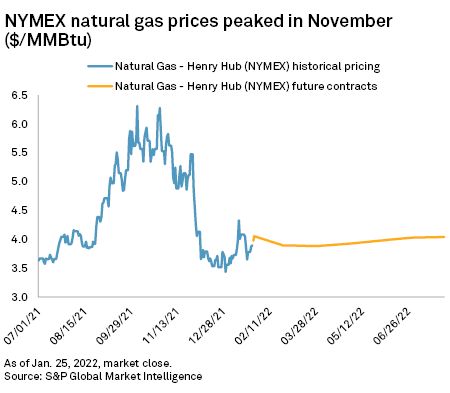

Pennsylvania's shale gas drillers matched a November 2021 spike in Henry Hub gas prices by producing a record 21.26 Bcf/d, a 3.1% increase over the preceding month and a 6.4% year-over-year increase.

The extra juice to break out of the 20 Bcf/d range, where Pennsylvania production lingered for most of 2021, appeared to come from the state's smaller operators as Henry Hub prices rose above $6/MMBtu.

Pennsylvania's five largest producers — EQT Corp., Chesapeake Energy Corp., Coterra Energy Inc., Range Resources Corp. and Southwestern Energy Co. — accounted for just over 71% of the total gas volumes, down slightly from 72% in the prior month, according to the latest data from the Pennsylvania Department of Environmental Protection on Jan. 26. The producers' spending on new wells was closely monitored by investors who want firms to hold off on production growth in favor of generating operating profits to send cash back to shareholders as dividends or stock buybacks.

|

The shape of drilling activity in Pennsylvania's shale gas play — a barbell weighted by counties in the northeastern and southwestern corners of the state — changed little. But Greene County, in the liquids-rich portion of the shale south of Pittsburgh, had a 5.4% increase in volumes month over month, while Susquehanna County, in the dry gas window in the northeast, saw its volumes grow by 4.7% to 4.7 Bcf/d. Susquehanna has been the state's top-producing county since monthly reporting began in 2015.

While EQT remained the largest gas producer in Pennsylvania and the nation, Chesapeake — recommitted to shale gas after a trip through bankruptcy court — had the largest year-over-year change in volumes, with its 3.4 Bcf/d of production marking a 23% increase.

Chesapeake stands to add roughly 1 Bcf/d of gross production when it acquires Chief Oil & Gas LLC for $2.6 billion in a deal expected to close before the end of the first quarter. As part of its shift back into natural gas, Chesapeake closed on its $2.26 billion purchase of Hayneville Shale driller Vine Energy Inc. in November 2021 and announced the sale of its shale oil assets in Wyoming's Powder River Basin to Continental Resources Inc. alongside the Chief deal Jan. 25.

Operators have 45 days from the end of each month to submit their monthly data to the Pennsylvania Department of Environmental Protection, which accounts for the lag in reporting.