S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Sep, 2021

By Tom Jacobs

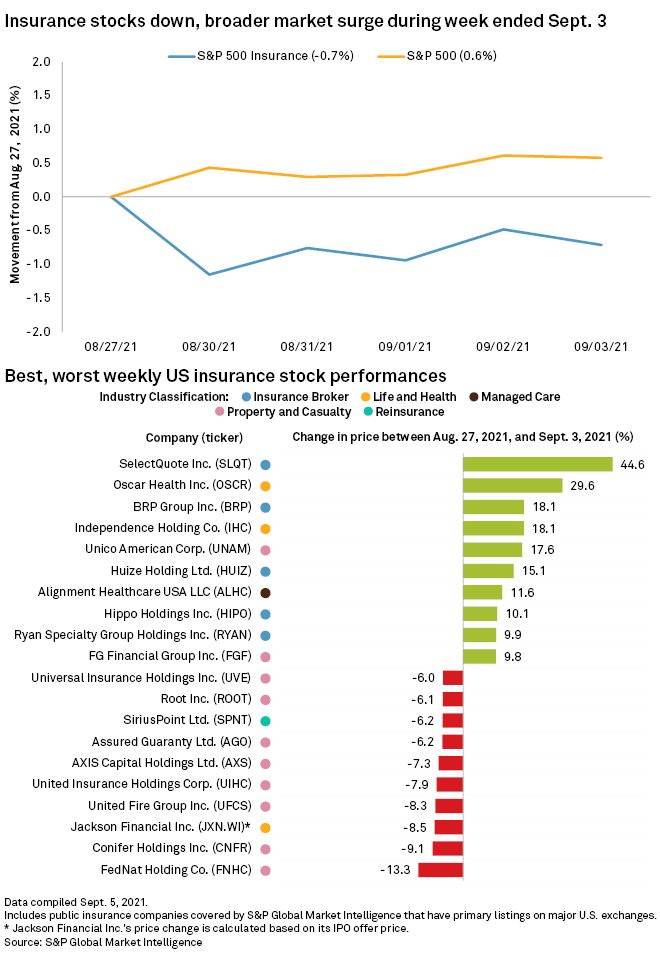

Insurance companies' share prices dipped in the wake of Hurricane Ida and the broader market lost ground after the release of an August jobs report that missed expectations.

The S&P 500 closed the week ending Sept. 3 up 0.58% at 4,535.52, even as the Labor Department said 235,000 jobs were added in August. That was well short of a consensus expected increase of 733,000 and the 1.1 million jobs the economy added in July.

The S&P 500 Insurance Index dipped 1.15% on Aug. 30, the day after Ida made landfall on the southeastern coast of Louisiana as a Category 4 storm. The index stemmed some of those losses but finished down 0.71% at 529.69.

Ida in the middle of the week caused catastrophic flooding in the mid-Atlantic and Northeast that killed at least 46 people. CoreLogic estimated insured and uninsured losses of between $27 billion to $40 billion from damage to residential and commercial properties in Louisiana, Mississippi and Alabama from wind, storm surge and inland flooding. AIR put its estimate at between $17 billion and $25 billion, but that was before the remnants of Ida deluged the Northeastern U.S.

Piper Sandler analyst Paul Newsome said the effects from Ida could have been worse if not for the strengthening of the New Orleans levee systems. Those levees failed when Hurricane Katrina hit, causing record industry losses and a death toll of 1,800.

"The news from the storm is what didn't happen," Newsome said in an interview. "It could have been one of the most horrible catastrophe events in recent memory, but the infrastructure in New Orleans held."

After lashing the Gulf Coast with high winds and heavy rains, Ida moved northeast through Tennessee, Kentucky, Virginia and West Virginia before drenching the mid-Atlantic states on Sept. 1. The storm caused record flooding in New York as the city issued its first-ever Flash Flood Emergency.

Central Park had its highest one-hour rainfall, 3.15 inches, and a record 24-hour total of 7.19 inches, while 8.92 inches fell in Staten Island. In New Jersey, Newark had its wettest day ever with 8.32 inches of rain.

Newsome said the widespread damage in the Northeast indicates a "weak point" in the U.S. infrastructure in that region.

"The losses that you're seeing in damage in New York and New Jersey shows most states are really not prepared for hurricanes at all," Newsome said. "Hurricanes have struck that area in the past, but it's just been a very long time since it's happened."

A significant number of property and casualty insurers saw their share prices drop, including AXIS Capital Holdings Ltd., down 7.29%, Universal Insurance Holdings Inc., down 6.06%, James River Group Holdings Ltd., down 5.15%, and Kemper Corp., down 2.25%.

Most reinsurers also saw their stocks fall. Enstar Group Ltd. was off 5.56%, RenaissanceRe Holdings Ltd. fell 4.03%, Everest Re Group Ltd. dipped 4.21% and Alleghany Corporation finished down 3.25%.

Newsome said losses of unknown size from an event like Ida usually put downward pressure on underwriters' stocks, but brokers are viewed as a safer bet after a catastrophe hits.

High-flying broker

One of the top-performing insurance stocks during the week was in the brokerage sector, as Goosehead Insurance Inc shot up 8.38%. Newsome in a note said Goosehead is a "rare growth story" in the industry, reporting organic growth of 51% in 2020 and 59% in 2019.

"Their salesforce's focus is just selling, to sell new products and find new clients," Newsome said. "Once they've done that, they hand off the customer, essentially, to a back-office operation that just handles all of the maintenance."

Newsome reiterated his "overweight" rating of Goosehead and raised his target price to $155 from $145.

Other brokers turning in positive weeks were Ryan Specialty Group Holdings Inc., up 9.85%, and Willis Towers Watson PLC, up 4.20%.