This is the fourth of a five-part series exploring oversupply in the power sector and the factors driving a glut of natural gas-fired power plants.

At an investor conference in New York in 2015, NextEra Energy Inc.'s then-CFO, John Ketchum, delivered a striking assessment to Wall Street: Solar power had become so inexpensive that the company might be finished building natural gas plants in Florida, the state where it is headquartered and where it owns an electric utility.

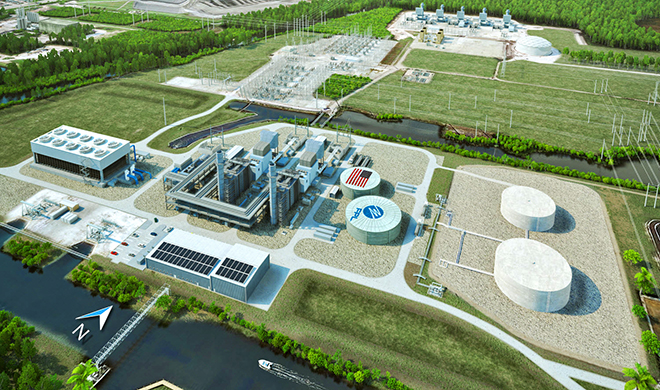

At the time, NextEra's utility, Florida Power & Light Co., had just asked state regulators for permission to invest — and recoup from customers — more than $1 billion to build a gas plant about 80 miles southeast of Orlando. The Okeechobee Clean Energy Center, which started operating in early 2019, could be the last of its kind that NextEra would pursue in the Sunshine State, Ketchum said.

"The reality is, when you look at economics and you look at the dramatic technological change that's going on in the renewable business and in the battery storage business, you're going to see tremendous disruption of the traditional generation fleet in this country," NextEra Chairman, President and CEO James Robo told another group of investors in 2018. Most people have not "come to grips" with that yet, he said.

|

NextEra is well positioned to spot emerging energy trends. In addition to FPL, its monopoly utility, the company owns a competitive power business, NextEra Energy Resources LLC. In 2018, it was the top producer of wind and solar power globally, according to NextEra's annual report to the U.S. SEC.

But events in Florida played out differently than Ketchum suggested they might. In early 2018, Florida regulators gave FPL the go-ahead to spend nearly $1 billion on another gas plant, the Dania Beach Clean Energy Center near Miami.

By replacing older, less efficient units, the new facility is expected to save FPL customers at least $337 million over 40 years, executives said. Opponents, however, say the new plant, scheduled to come online in 2022, likely will shut down much sooner due to the very market forces NextEra has been flagging for investors in recent years. The units being replaced were only 24 years old when FPL proposed their retirement. If the new plant closes early, FPL's customers could be on the hook for its costs as well as a return on investment for the utility.

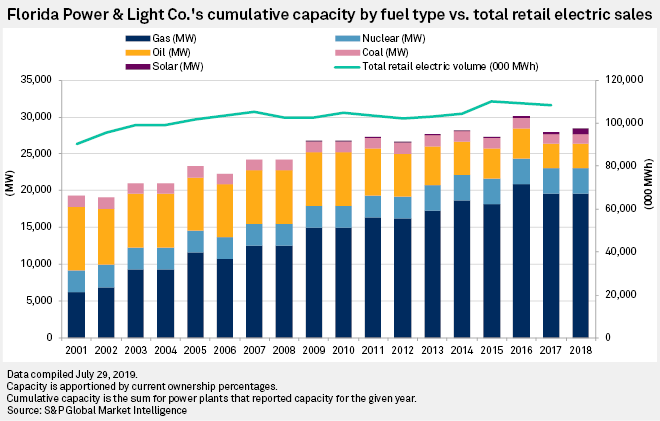

In Florida, FPL developed outsize exposure to natural gas despite executives' concerns about the dangers of overdependence and the dramatic transition to renewables and batteries that they see coming. As FPL's reliance on the fuel grew, NextEra plunged deeper into the gas market, investing in pipelines and attempting to push FPL's captive electricity customers into the unpredictable business of gas exploration and drilling — moves the company said were aimed at reducing supply and pricing risks.

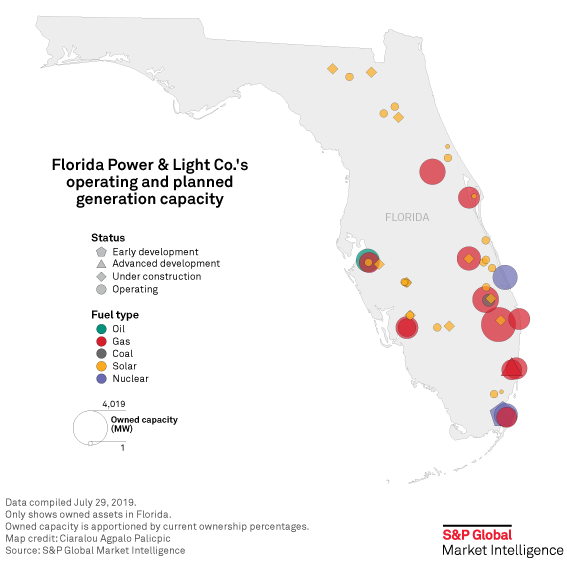

Using ratepayer-backed money, FPL has built a power system that in 2018 generated about three-quarters of its electricity burning natural gas, making the utility more than twice as reliant on the fuel than the U.S. as a whole.

To its critics, NextEra's divergent strategies illustrate the problems that arise when regulators leave monopoly utilities to pursue their own bottom line rather than customer preferences and environmental goals.

"It's a classic case" of regulatory capture, said Karl Rábago, a senior policy adviser at the Pace Energy and Climate Center at Pace Law School in New York and a former Texas utility regulator. "Nothing has forced them out of the mold" of building gas plants in Florida.

Coal, nuclear, now gas

In April, FPL outlined plans to trim its reliance on natural gas by investing billions of dollars in solar power over the next decade. For the foreseeable future, however, the utility expects to remain heavily gas-dependent.

"You need gas for home heating, you need it ... for baseload" power, Robo told investors in October when asked about a recent pipeline acquisition by an affiliate of NextEra. Referring to anti-gas positions adopted by some Democratic presidential candidates, he said the industry was caught "a little flatfooted by this 'never gas' stuff."

At other times, Robo has said a shakeup in the power sector is raising questions about the future of natural gas. By the early 2020s, the combination of renewables and batteries will be able to provide "nearly firm" power that is cheaper than the cost of operating "less fuel-efficient" gas plants, he told investors in January. That outlook echoes a forecast from market researcher BloombergNEF, which has said new wind and solar farms in the U.S. will undercut the cost of existing standard gas plants by the late 2020s. Indiana regulators this year blocked construction of a gas plant due in part to the risk that it could become a stranded asset.

"I don't think that the wave of gas infrastructure that could be stranded in a decade to come is any different than the coal and nuclear plants that are being taken down before the end of their life because they're uneconomic," said Elizabeth Levy, a senior vice president and research analyst at Trillium Asset Management LLC. "Everybody's piled into gas. [But] is anybody really thinking about, is gas going to keep being ... this economic when you've got these other technologies [that] we can see are on a downward cost curve?"

Recent climate change reports have also increased pressure on companies and governments to move more aggressively to reduce emissions of carbon dioxide, which could negatively affect fossil fuel investments. A bill filed in the Florida Legislature proposes generating all of the state's electricity from renewable sources by 2050, which would limit the useful life of any new gas-fired power plant.

"At FPL, we focus on one thing — doing what's best for our customers," FPL spokesman Jeff Ostermayer said in an emailed statement. "That relentless focus has saved our customers nearly $10 billion in avoided fuel costs since 2001 due to our decision to convert our coal and oil-burning facilities to highly efficient power plants that run on clean, American-produced natural gas."

Now, FPL is "undergoing one of the largest solar expansions ever in the U.S.," Ostermayer said. "The company's vision will deploy cutting-edge technologies that by 2030 will generate energy that is 67 percent cleaner than the U.S. electric company average."

NextEra declined to make Robo available for an interview. The company did not respond to messages seeking comment for this story. In public statements, executives and lawyers for both companies have said FPL's investments are good for its customers and NextEra shareholders alike.

A sharp rise

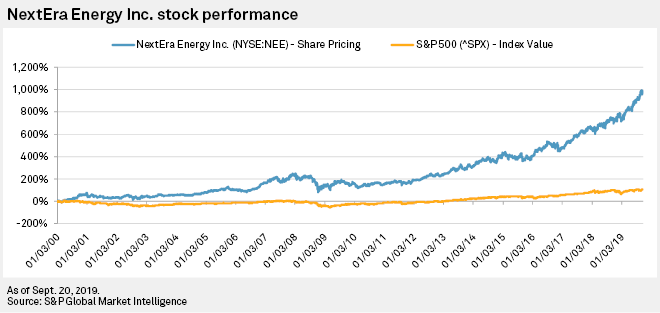

There is no question that, for shareholders, NextEra's strategy at FPL has been a success.

Since 2000, NextEra's stock price has risen by more than 1,000%, compared to a 114% increase in the value of the S&P 500 index, thanks in no small part to FPL and Florida regulators. The utility, which collects a regulated return on invested capital, generated 71% of NextEra's operating revenue in 2018. FPL also accounted for a majority of NextEra's earnings in recent years, until NextEra Energy Resources reaped windfall profits from federal tax reform and the deconsolidation of another business unit in 2017 and 2018, respectively.

NextEra's growth streak can be traced to December 1999 when, at the urging of state regulators, FPL and two other Florida utilities agreed to increase their reserve margins, or the cushion between power generating capacity and expected peak demand. A higher reserve margin improves the odds that power will stay on during storms and equipment failures. It also has been useful for justifying investments in new power plants.

But NextEra did not stop there. Searching for new investment opportunities, executives settled on a plan to vertically integrate around natural gas, moving upstream from power plants to the pipelines that move the fuel and, ultimately, the fields where it is produced. Pushing FPL into the drilling business would help alleviate the risks associated with its increasing reliance on a commodity prone to price swings, the utility said. It also deepened a conflict within NextEra, as the company stood to benefit by keeping FPL's customers hooked on gas.

"Are you really going to look at alternative sources of energy and clean energy when you have a strong investment in the production of gas, you have a big investment in the transport of that gas, and you have, obviously, a huge investment in the power plants you're building to burn that gas?" Bradley Marshall, a staff attorney for Earthjustice, a nonprofit environmental law group, said in an interview.

A rendering of FPL's Dania Beach gas plant near Miami, which is due online in 2022. The utility says the project will save customers at least $337 million over 40 years, but opponents say the facility is likely to close much sooner. |

'A clear departure'

The strategy of vertically integrating around natural gas is not unique to NextEra and FPL. Southern Co., Duke Energy Corp. and Dominion Energy Inc. — three other owners of big, monopoly utilities in the Southeast — also have shifted capital investments to natural gas production and delivery.

It was a "clear departure from the regulatory paradigm," Florida Office of Public Counsel lawyer Erik Sayler said at the time.

The Florida Public Service Commission signed off on FPL's proposal anyway in 2015, only to have its ruling overturned by the Florida Supreme Court.

The reversal, and FPL's failure afterward to win support for its plan in the Legislature, appear to have been rare setbacks for the company. "Anywhere FPL wanted to go, that's where the Republican leadership was going to go," said Nancy Argenziano, a former GOP lawmaker who served on the Florida Public Service Commission from 2007 until late 2010. Florida utility regulators are nominated by the governor and confirmed by the state Senate, which Republicans have controlled for more than 20 years, according to nonpartisan Ballotpedia.com.

"For the four years that I was on the commission, I think we took a little bit ... stricter look and certainly denied things ... when it was appropriate," said Nathan Skop, who served on the Florida Public Service Commission from 2007 until early 2011. In recent years, he said, the commission has been criticized "because it basically has gone back to approving everything that the utility puts forward."

Eluding competitive bidding

With that leeway from regulators, FPL has managed to sidestep one of the few checks on monopoly utilities: competitive bidding.

In the case of Okeechobee, the company said it settled on plans for the gas plant because the site is near where electricity was needed in southern Florida; it also sits alongside NextEra's newly built Florida Southeast Connection pipeline. Before proposing Okeechobee, FPL signed a contract for a majority of the pipeline's transportation capacity, a portion of which would ultimately serve the plant. The next-best option after Okeechobee was a site farther north, where a shuttered gas plant had run on fuel provided by another company's pipeline, according to FPL.

Whether or not FPL pursued Okeechobee as a result of the pipeline contract, the off-take agreement clearly influenced the manner in which the company pursued the power plant project. FPL did not solicit bids from other gas suppliers because the utility and its customers were already "on the hook for ... charges" from Florida Southeast Connection, Heather Stubblefield, an FPL official in charge of project development, told regulators.

Concerns about self-dealing in the power sector have grown as companies invest in pipelines that are slated to sell capacity to utilities they also own. Ensuring a pipeline's financial success may lead utilities to "overcommit to the new capacity or not to adequately analyze the alternatives to their gas-fired generation resources," Thomas Beach, a consultant at Crossborder Energy, said at a 2018 hearing for a proposed gas plant in Michigan.

When FPL evaluated the Dania Beach gas plant against alternative technologies, the solar options it considered were all smaller than 75 MW, in part to avoid having to solicit alternative proposals under a state bid rule, an FPL official acknowledged at a 2018 hearing.

"We thought ... we had gotten to the sweet spot of economies of scale," the official, Steven Sim, said of the size limit FPL used. "And it obviously has the added benefit of keeping us under the bid rule, which would add more costs and more time."

By not soliciting solar bids, FPL had not "market-tested whether third parties could provide these resources at lower cost than the company assumed," Ezra Hausman, a consultant testifying on behalf of the Sierra Club, said at a 2018 hearing for the Dania Beach plant.

FPL has a big incentive to avoid such an outcome. If it has to buy power from another company's solar plant, rather than invest capital building its own, regulations likely would bar the utility from earning a profit on the expenditure, FPL's vice president of finance, Robert Barrett, said at a 2016 hearing on utility rates.

According to Sim, "no third party has been awarded" a contract by FPL under the state bid rule.

Ostermayer, the FPL spokesman, declined to comment, pointing to an earlier statement in which he said the company seeks bids for "the construction of all of our facilities." Critics express more concern about competitive bidding for the supply of electricity.

"Competitive bidding is good" because it promotes "openness and transparency," Skop said. But because FPL has demonstrated its construction expertise, particularly in upgrading old gas plants, he said, it has convinced regulators that keeping the projects in-house is the best option, he said. "If you can predict the outcome with a high degree of certainty, then you have to ask yourself, why are we going through this process?"

But for monopoly utilities such as FPL, which make a regulated return on invested capital, bidding requirements help prevent overspending to juice profits, Jon Moyle, a lawyer for a coalition of large electricity users called the Florida Industrial Power Users Group, told state regulators in 2015.

In April, FPL said it expects to significantly increase the size of its solar portfolio by the end of 2028. The first wave of proposed projects, which FPL said will cost $1.79 billion, comprises 20 power plants, each of which is small enough to avoid triggering bidding requirements.

It looks to be the next big earnings opportunity for FPL and NextEra, even if those new solar investments come at the expense of existing natural gas plants, which appears likely, according to Hamilton Smith, an analyst at BTU Analytics.

"There is, of course, the potential for stranded assets" to land in the laps of NextEra shareholders rather than FPL ratepayers, said Rábago, the former regulator. But "we don't have much history with shareholders eating write-off expenses in the electric utility industry."