Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Nov, 2021

By Zoe Sagalow and Ronamil Portes

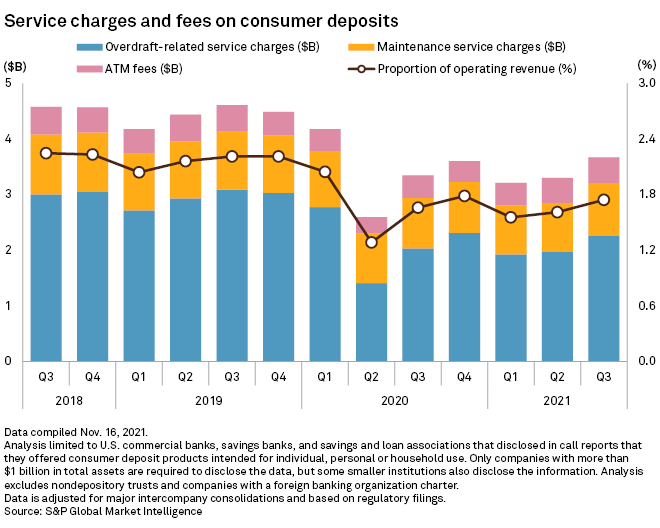

U.S. banks pared a coronavirus slump in overdraft fees, as shop re-openings and an economic rebound provided some respite from an industrywide shift away from charges.

Total third-quarter overdraft charges were up 14.9% quarter over quarter and 11.5% annually to nearly $2.27 billion, based on data analyzed by S&P Global Market Intelligence.

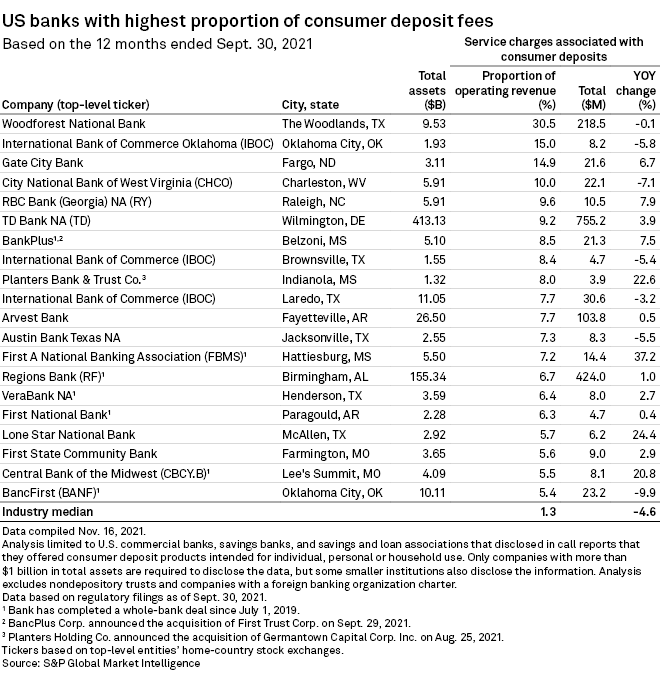

Hattiesburg, Miss.-based First A National Banking Association, Indianola, Miss.-based Planters Bank & Trust Co. and McAllen, Texas-based Lone Star National Bank posted the largest annual increases among the 20 banks with the highest proportion of consumer deposit fees, each over 22%.

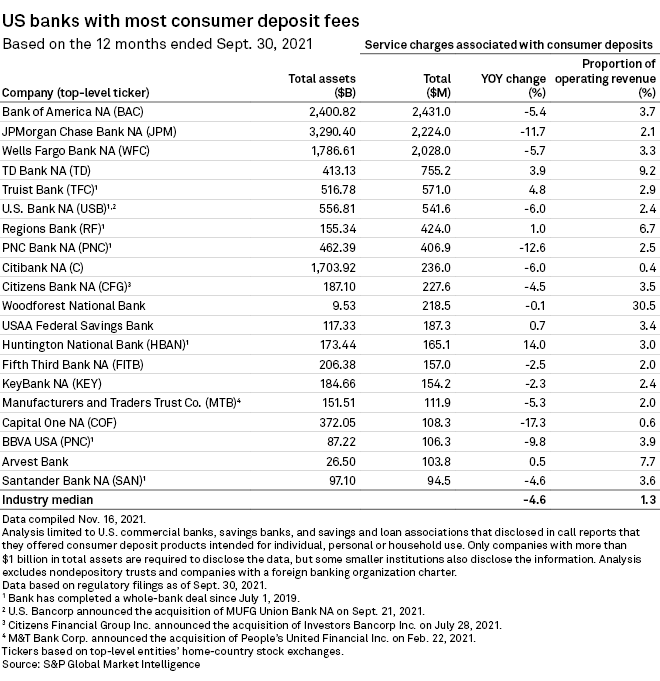

Even with the uptick versus the depths of the pandemic, fees were still down about 27% from 2019's levels as lenders switch to no-overdraft accounts amid political pressures and competitive threats from financial technology companies. Larger banks have led that shift, with Capital One Financial Corp., PNC Financial Services Group Inc., and JPMorgan Chase & Co. all posting year-over-year declines of more than 10%.

"A softening of overdraft policies at some of the largest banks will drive aggregate revenue down on a sustained basis," Corey Stone, senior adviser at both the Financial Health Network and Oliver Wyman, wrote in an email. "But so far the banks making the biggest changes are ones that depend on [overdraft] revenue the least."

The industry median year-over-year change was a 4.6% drop in service charges associated with consumer deposits. Service charges represented 1.3% of operating revenue.

Pressure on banks

Banks have started to lower or scrap overdraft fees amid competition from fintechs and a perception that charges have been overly punitive, according to Scott Siefers, an analyst for Piper Sandler & Co.

"While that's great for customer service and goodwill creation on the part of banks, it is tougher on their revenues,” he said. "My best guess is it either levels out or continues to decrease over time just given the competitive dynamic and the headline risk."

Banks may be able to offset some of the lost revenue by broadening their customer bases, including the addition of customers not currently in the banking system, Siefers said.

Alternatives to overdraft

Lenders, such as U.S. Bancorp and Huntington Bancshares Inc., have started offering small-dollar short-term loans, giving customers a way of accessing credit instead of using overdrafts. About a third of people who overdraft view it as a way to borrow small amounts of money rather than as a safety net for ensuring that checks clear, according to Alex Horowitz, principal officer of the consumer finance project at The Pew Charitable Trusts.

In addition, some banks, such as Huntington, offer grace periods for overdrafts, potentially as a way of competing with neobanks that do not charge overdraft fees. Legacy banks' overdraft penalties are usually $35, Horowitz said.

Banks could do more to help customers avoid overdraft fees, such as ensuring that transactions are processed in order rather than by size, he said. There's also scope to cut the number of fees paid by overdrawn customers so that they aren’t repeatedly charged for having a negative balance, he said.

Still the overall trend for overdraft fees is clear, he said.

"Everything is pushing in the same direction, which is away from overdraft penalties," Horowitz said in an interview. "Banks are changing practices, and there's increased competition from challenger neobanks."

Planters Bank & Trust and Lone Star National Bank did not respond to requests for comment. First A National Banking Association did not immediately respond to a request for comment.