Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Mar, 2021

By Zach Fox and Ronamil Portes

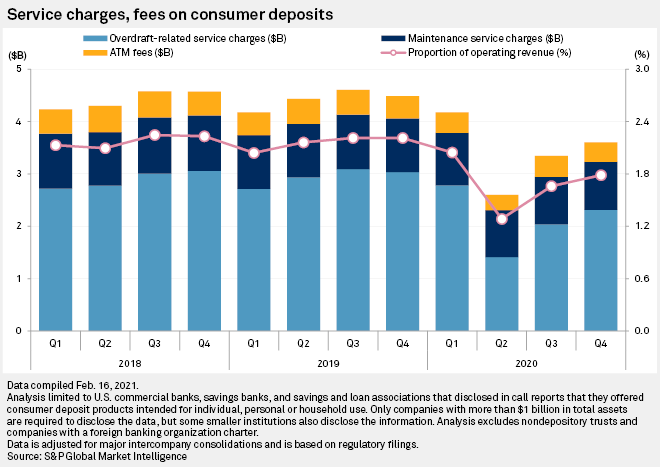

Overdraft fees collected by U.S. banks increased dramatically in the second half of 2020 after cratering at the onset of the COVID-19 pandemic.

While service fees have partially recovered from the 2020 second-quarter low, overdraft fees and service charges may not ever return to pre-pandemic levels. Some large banks are actively discouraging overdrafts, rolling out small-dollar loan products to provide a more affordable option. And the Consumer Financial Protection Bureau could resurrect their interest in the issue following the inauguration of President Joe Biden.

Service charges on deposit accounts totaled $3.60 billion in the 2020 fourth quarter, up 8% from the prior quarter but still down nearly 20% from the year-ago period. Overdraft fees constitute the largest component of service charges, clocking in at $2.32 billion in the 2020 fourth quarter, up 64% from the recent low in the 2020 second quarter but still 24% lower year over year.

Consumers tend to incur overdraft fees as a way to access short-term credit, said Nick Bourke, director of consumer finance research for Pew Charitable Trusts. He said government stimulus payments and various moratoria on evictions, forbearance and utility payments led to a decrease in consumers' need to access overdraft.

"People were getting stimulus payments, so they were a little more flush and had relief for bills, so that led to a decline in small-dollar credit," Bourke said in an interview.

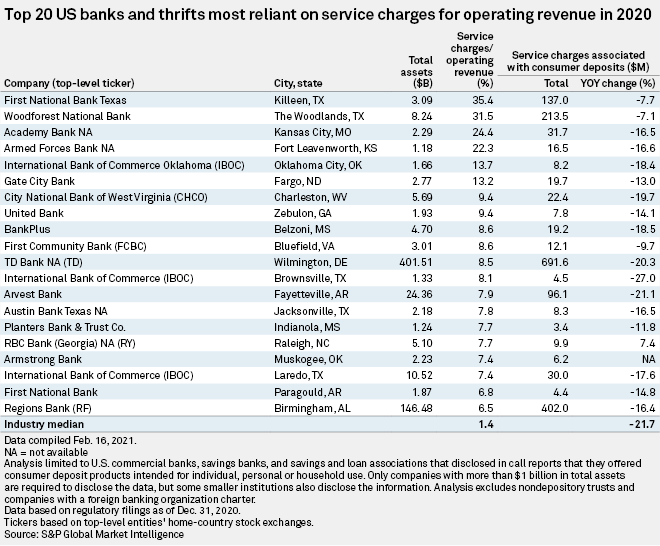

A couple smaller banks more reliant on overdraft revenue reported less of a decline in service charges. Both First National Bank Texas and Woodforest National Bank booked service charges that accounted for more than 30% of their operating revenue for the 2020 full year. The pair of banks reported declines of less than 8% year over year, compared with a median decline of 22% across the entire banking industry.

Aaron Klein, a senior fellow in economic studies for the Brookings Institution, calls both banks "overdraft giants" since both reported more in overdraft revenue than they did in net income. In 2020, First National reported $100.3 million in overdraft fees and $35.7 million in net income. Woodforest reported $142.4 million in overdraft fees and $128.4 million in net income for the full year.

"They are not banks. They are check cashers with a charter," Klein said in an interview. "For multiple years, the majority of their profit comes from a single fee that is only charged to people who run out of money. I seriously question why the [regulators] allow that business model and consider it safe and sound."

Woodforest and First National Bank Texas did not immediately respond to requests for comment.

Across the banking industry, in aggregate, companies collected $8.82 billion in overdraft fees and reported $147.80 billion in net income for the 2020 full year.

Some large banks have been discouraging overdraft fees. Most recently, Bank of America Corp. introduced a small-dollar loan product in the 2020 fourth quarter. Chairman and CEO Brian Moynihan said the loan product, which offers customers emergency cash for a $5 fee, was part of the bank's broader strategy to help consumers better manage their finances.

"We've had a strategy that is to lower clients' overcharges," Moynihan said on the bank's Jan. 19 earnings call. "We're trying to get customers to really use our services in a way that benefits them the most."

Huntington Bancshares Inc. has marketed its "Fair Play" approach to deposit accounts, which includes a 24-hour grace period to rectify an overdraft before incurring a fee. The bank estimated that employing that strategy across the accounts of its pending acquisition, TCF Financial Corp., would reduce revenue by roughly $15 million.

U.S. Bancorp rolled out its small-dollar loan product in 2018 and was one of the only large banks to report a pre-pandemic year-over-year decline in overdraft charges in 2019.

But some smaller banks are forecasting a recovery in overdraft fees for the year ahead. Great Southern Bancorp Inc. CFO Rex Copeland said service charges have started to normalize and should continue to do so later in the year. But he said the first quarter could show a dip as the government disburses another round of stimulus payments. A recovery in overdraft fees played a role in Equity Bancshares Inc.'s projection that its noninterest income would grow 10% to 20% this year. CFO Eric Newell highlighted that recovery as one of four items driving the forecast, alongside other factors such as stronger debit card interchange revenue and growth in the bank's trust and wealth management business.