S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Dec, 2021

By Anser Haider and Morgan Frey

Oracle Corp.'s $28.30 billion bid for electronic medical records company Cerner Corp. exemplifies a key move toward software specialization, as tech companies are increasingly eyeing the massive healthcare sector as their next big opportunity.

The deal, expected to close in 2022, will bring Cerner — the second-largest U.S. provider of electronic health records software — together with tech company Oracle, a major cloud services provider that has lagged tech peers such as Amazon.com Inc. and Microsoft Corp. The deal is expected to jumpstart Oracle's healthcare cloud business.

Scott Kessler, global sector lead, TMT, at research firm Third Bridge, said verticalization — which refers to a company's strategy to specialize how it sells and markets by industry vertical or function — is a growing focus for cloud services providers. While the cloud was built to be used broadly to help all industries scale their businesses, cloud providers are increasingly offering new specialized services for various industry verticals.

"The Cerner deal shows that Oracle agrees that verticalization is an important step to grow its business," Kessler said. "This acquisition would give Oracle a proverbial shot in the arm to aggressively expand into healthcare, which is a very large vertical, but somewhat behind other industries when it comes adopting digital technologies."

Demand for virtual healthcare via telehealth and remote patient monitoring tools skyrocketed during the COVID-19 pandemic as clinicians tried to keep people out of crowded hospitals and patients avoided leaving their homes. Market research firm IDC expects the healthcare industry to spend about $16 billion on cloud infrastructure and software by 2023.

Cerner, the biggest seller of software used for electronic health records in the U.S. after Epic Systems Corp., already has its largest business and clinical system on the Oracle Database.

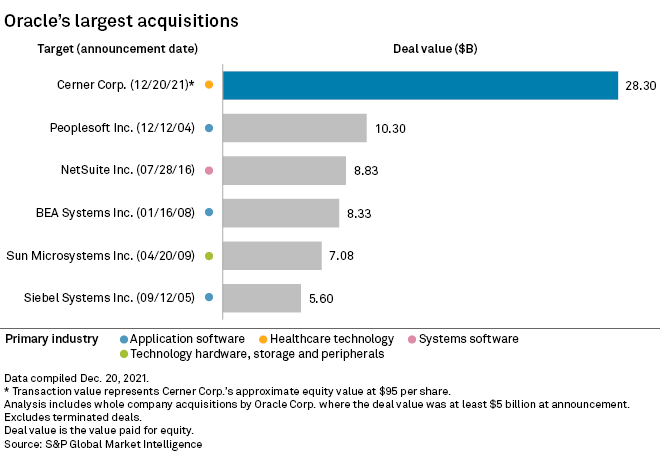

The all-cash transaction, which values Cerner at $95 a share, would mark Oracle's largest acquisition to date, following its purchase $10.30 billion of enterprise-software company PeopleSoft in 2005 and the 2016 purchase of cloud-software provider NetSuite for $8.83 billion.

The Cerner deal announcement joins Microsoft Corp.'s $19.80 billion acquisition of Nuance Communications Inc., a cloud and AI company that is heavily focused on the healthcare industry, as one of the biggest tech deals of 2021.

"Two of the largest software companies in the world by market cap announcing essentially the largest-ever software deals in and around the healthcare space in 2021 is very significant," Kessler said.

Stephanie Davis, managing director of healthcare technology and distribution at healthcare-focused investment bank SVB Leerink, noted that Oracle has long viewed Cerner as a potential takeover target. Court documents related to a 2004 antitrust trial revealed that Cerner was one of nine companies that Oracle was considering for a takeover at that time.

Ultimately, the deal makes sense for both Oracle and Cerner, according to Davis, as Cerner's desire to expand internationally will be boosted by Oracle's footprint. Davis likened Oracle to a "neutral third party" as opposed to other big tech companies like Amazon or Alphabet Inc.'s Google, where there may have been concerns about how those companies would utilize the health data that Cerner brings to the table.

Davis said she does not see consolidation in the health tech space slowing down any time soon. In addition to tech, consumer retailers like Walmart Inc. and Best Buy Co. Inc. have also been making healthcare acquisitions.

Holger Mueller, vice president and principal analyst at Constellation Research, said Oracle will benefit from the large number of additional workloads that will be moved to the company's cloud platform as part of the Cerner deal.

"More workloads mean better economies of scale for a cloud provider, which means lower costs that will attract even more workloads in the long run," Mueller said.

Patrick Moorhead, president and principal analyst at Moor Insights & Strategy, said the Cerner acquisition would allow Oracle to bolster its suite of strong cloud software offerings, which include digital business platforms Fusion and NetSuite.

"Cutting vertically into healthcare would be a powerful move for Oracle as once you choose a healthcare IT provider, rarely do you change," Moorhead said.

In an analyst note, Jefferies analyst Brent Thill wrote that Oracle will benefit from synergies between Cerner's health records data and Oracle's cloud applications. "Cerner also brings with it several mega government deals as well as a high-margin services, support and maintenance business," Thill said.

John Dinsdale, chief analyst at Synergy Research Group, is skeptical about the deal's overall impact on Oracle's cloud infrastructure services, which he noted have a worldwide market share that has been stuck around the 2% mark for three years now. Although Oracle has increased its capital expenditures substantially in the last two quarters and launched its cloud platform in new regions, the company's cloud investments are still dwarfed by rivals Amazon, Microsoft and Google, Dinsdale said.

"While Cerner will clearly add to Oracle's overall business scale in the medical sector, I don't see how Cerner really moves the needle much in terms of making a difference to Oracle's market position in cloud," Dinsdale said.

Oracle's stock was down more than 5% Dec. 20, closing at $91.64.