Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Mar, 2023

By Eri Silva

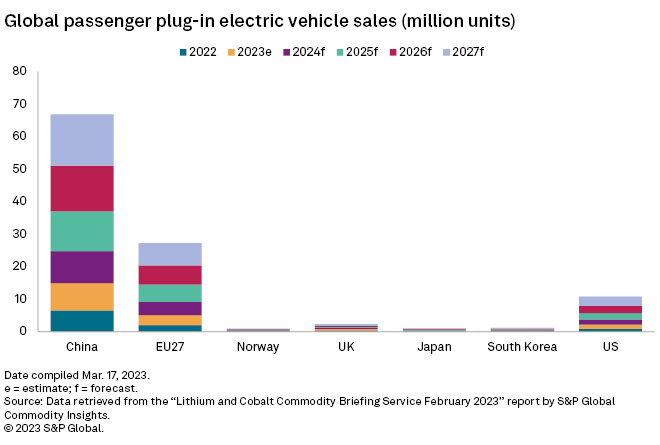

Yearly electric vehicle sales in the US are expected to more than double from 2022 to 2025, according to forecasts by S&P Global Commodity Insights.

Source: Prapass Pulsub/Moment via Getty Images

US President Joe Biden is considering adding EU member states to the list of those able to access certain benefits of the Inflation Reduction Act, a move backed by the metals industry and analysts.

After the passage of the Inflation Reduction Act (IRA), EU countries were immediately concerned that they were excluded from the incentives outlined in the law as the US moves to develop a domestic battery supply chain. The bloc called the law "market-distorting" and a risk to reaching global climate goals by changing a common objective to a "zero-sum game."

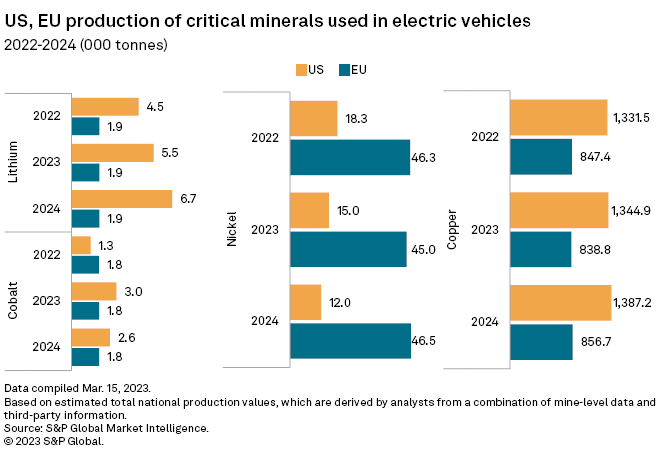

On March 10, Biden and European Commission President Ursula von der Leyen agreed to begin talks on an agreement that would allow electric vehicle producers in the US to source critical minerals, such as nickel, cobalt, copper and lithium, from the EU while keeping US buyers eligible for the IRA's $3,750 tax credit per vehicle.

US industry participants appeared open to the idea of expanding the number of trade partners, though they agreed that some trade-offs would be made, including the risk of lowering the incentives to build up a US-based supply chain.

Keeping investments in the country

Nathan Niese, a partner in electrification and climate change at Boston Consulting Group, told Commodity Insights that a potential expansion of countries getting benefits from the IRA supply chain incentives would not alter the law's requirement that EV batteries and cars be assembled in the US."The production tax credit is already proving to be a major driver of new investment in the US, and no agreement between US-Europe is likely to change that much," Niese said. Greenberger said one possible solution would be for the EU to provide the US with the "same form of subsidy" within its clean energy incentives package. "You give something, and you get something in exchange," the NAATBatt director said.Biden and von der Leyen have agreed to work on plans "to coordinate our respective incentive programs so that they are mutually reinforcing," according to a joint statement.

Congress questions Biden's authority

Whether Biden actually has the authority to add countries to the list without striking a formal free-trade agreement remains a subject of some controversy. The administration argues that other trade deals might be functionally equivalent to free-trade agreements and therefore could allow countries to act as sources of key materials under the law.

"In December, Treasury issued a white paper that lays out a possible approach to identifying additional agreements that could potentially qualify," Treasury Secretary Janet Yellen told a House panel March 10. But members of both parties were skeptical that the administration had the right view of the language in the law. "The IRA uses the language 'countries with which the USA has a Free Trade Agreement in effect'. I'm surprised to hear that the administration may take the view that 'Free Trade Agreement' is undefined and open to interpretation," Rep. Adrian Smith (R-Neb.) said during the hearing. A colleague across the aisle supported Smith: "When the administration and Congress do not have a good working relationship on trade, with Congress playing its role, it doesn't end well," Rep. Earl Blumenauer (D-Ore.) said."I think that is ultimately going to be up to the Treasury and how they interpret the IRA," Energy Innovation's Orvis said. "We're all kind of eagerly awaiting the Treasury guidance and how restrictive they are."

The Treasury Department said it would release its guidance in March after missing its deadline of Dec. 31, 2022.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.