S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Oct, 2021

This article is the second in a two-part series on the sports betting market. Please see our prior coverage here.

The NFL season is in full swing, and America's most popular sport is expected to provide a significant boost to sportsbooks in the months ahead.

An estimated 45.2 million Americans are forecast to place a wager on the NFL in some fashion during this season, up 36.2% from the 2020-21 campaign, according to a study conducted for the American Gaming Association, or AGA.

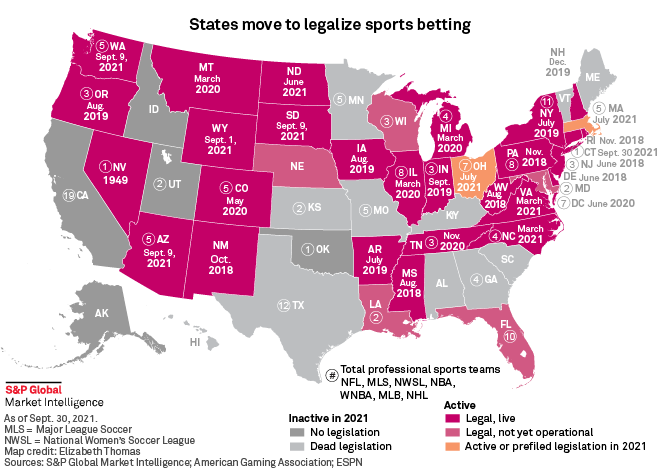

The increase in wagering comes as sports betting is now legal in 27 states and Washington, D.C. David Forman, senior director of research for the AGA, said in an interview that about 58% of the U.S. adult population today live in states where there is legalized sports betting.

The rise in popularity also means more opportunity for advertising spending. Meredith Corp.'s Local Media Group has noticed an uptick in markets where sports betting was legalized earlier. "Sports betting spend is heavier in the first year of launch, and then budgets settle into a lower but still healthy level," said Kevin James, senior vice president of revenue operations for Local Media Group. He noted that heavier spending levels begin in August with the NFL preseason and stretch through the Super Bowl.

Through July, Americans legally wagered nearly $27 billion on sports, generating more than $350 million in federal, state and local taxes. Goldman Sachs estimates that the combination of legislative initiatives and wider consumer adoption could push online sports betting from $900 million in 2021 to a $39 billion market in 2033, reflective of a 40% CAGR over the next decade.

Looking to participate in that interest and attendant increased tax and licensing revenues, Wyoming, Arizona, South Dakota and Washington state launched sports betting to various degrees in September, just in time for the NFL season's kickoff. In Connecticut, following a seven-day soft launch in which mobile betting was tested with a limited number of patrons and a limited number of hours, the practice is now fully available across the state as of Oct. 19.

Adding Texas, California, Ohio and Massachusetts over the next few years would boost sports betting's reach to more than 80%, according to the AGA. There have been various pieces of legislation debated in those four states, and the expectation is that there could be some form of sports betting passed into law in several of them by 2023.

"Those states are key to unlocking a lot of market potential," Forman said.

Online action, bettor demographics

Digital is spearheading the category's growth, with 86% of sports wagers this year placed online or via mobile devices, Forman said.

"There is a push toward more mobile and online betting," Forman said, noting that laws vary from state to state. For example, online betting is illegal in New York but it's not in neighboring New Jersey. As a consequence, bettors are crossing the Hudson River to wager in the Garden State.

"That's how people are betting comfortably and where the industry is going."

With legal sports betting becoming more widespread, young adults are making bets for the first time or shifting their action from illegal outlets. More than 60% of current sports gamblers are ages 40 or younger — 46% are millennials, while 15% are Gen Z adults, according to preliminary findings of an online consumer survey by Kagan, a media research group within S&P Global Market Intelligence. These younger generations are naturally looking to digital channels to venture a wager.

The betting market skews heavily male, with 90% of DraftKings Inc.'s sportsbook user base of almost 650,000 is male, with 53% between ages 18 and 34, according to Helixa, a user-insights platform. Over at FanDuel Inc. and its sportsbook's 1.1 million audience, 89% are male with 54% in the 18-34 age bracket.

Tech-shy baby boomers and seniors, many of whom "play slot machines with gusto," do not appear to be very interested in online sports betting, said Keith Nissen, a senior analyst on Kagan's Consumer Insights team. "They tend not to use lots of apps."

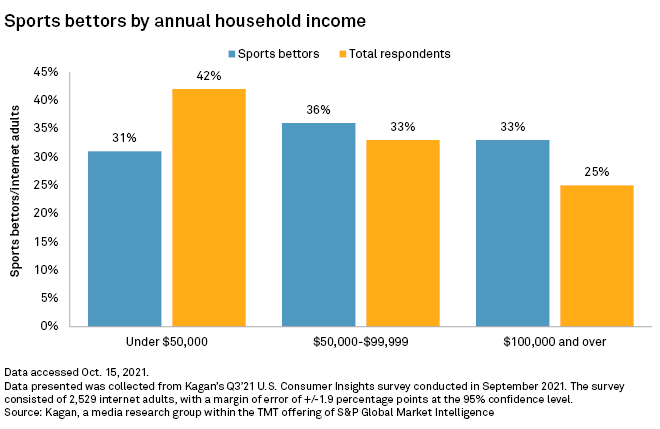

Sports wagering, though, does cross wallet sizes in near equal numbers. Kagan's survey data found that, among those who like to have some action on the games, one-third have household incomes of $100,000 or more, and another 36% fall into the $50,000-$99,999 category. But that still leaves 31% of sports betting respondents with incomes under $50,000.

"It might be that they are placing small bets, but I also suspect that the gambling instinct is independent of wealth," Nissen said, "like playing the lottery."

Enhancing engagement

Helixa's data shows that DraftKings' audience is also 1.9 times and 1.8 times more likely to regularly attend and regularly watch NFL games, respectively, while FanDuel's audience shares that pigskin fervor at 2.5 times more likely to regularly attend NFL contests and 1.7 times more likely to regularly view the action.

Forman said having fans with "some skin in the game" certainly brings more engagement and attachment to sports leagues, with the association's study finding that 37% of NFL fans plan to wager on the upcoming season, including just under half who identify as avid NFL fans. Moreover, 44% of all Americans and just under two-thirds of NFL fans view in-venue sportsbooks as an entertainment feature that adds appeal to attending games in-person.

Where the NFL previously eschewed direct ties to gambling, the league is now looking to sports betting as a means to enhance engagement across some of its fan base, "taking into account the experience of all our fans, including both active bettors and active rejectors."

The NFL said it has been closely monitoring public perception around legalized sports betting since the law limiting it to Nevada was struck down in 2018. The league's Sports Betting Committee, charged with evaluating changes year to year across the various states, allowed for the move toward limited in-game advertising from approved partners.

New entrants

|

Shawn Kemp joins Snoqualmie Casino CEO Stanford Le to place the first legal sports bet in Washington. |

The four most populous states in the U.S. are currently limited in their appeal to sportsbooks. California and Texas currently do not have legislation allowing for sports betting. It is legal but not yet operational in Florida, and New York is moving toward a wider playing field. As a result, there has been increased attention on recent launches outside of those areas.

Max Hartgraves, public information officer for the Arizona Gaming Department, said eight operators launched online sportsbooks Sept. 9. Hartgraves said it was important to the companies to be available at the start of the NFL season. Hargraves said others are set to roll out later this fall. In addition, FanDuel and Caesars opened physical retail locations in Phoenix on the same day.

Meanwhile, in Washington state, the Snoqualmie Casino became the first sports betting venue in the state, with live counters and six kiosks, as online sports betting is still prohibited. The venue has a prime location about 30 minutes away from Lumen Field and T-Mobile Park, the respective homes to the Seahawks and MLB's Seattle Mariners.

"We expect a number of fans will stop at our casino and make a wager before heading to the games," said Snoqualmie Casino's President and CEO Stanford Le.

Some of the data presented in this article was collected from Kagan's Q3'21 U.S. Consumer Insights survey conducted in September 2021. The survey consisted of 2,529 internet adults with a margin of error of +/- 1.9 percentage points at the 95% confidence level. Percentages are rounded up to the nearest whole number. Gen Z adults are those ages 18-23; millennials, 24-40; Gen X, 41-54; boomers/seniors 55+.