S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Mar, 2022

By Bill Holland

|

Eight states are considering laws that would require managers of public employee pension funds to drop fossil fuel companies from their portfolios in an effort to support the fight against climate change. Source: Brandon Bell/Getty Images News via Getty Images |

Pension fund managers are walking a fine line as the energy transition evolves, balancing demands to limit investment in fossil fuels against those of oil-producing states that have threatened to take their business elsewhere if such a boycott happens.

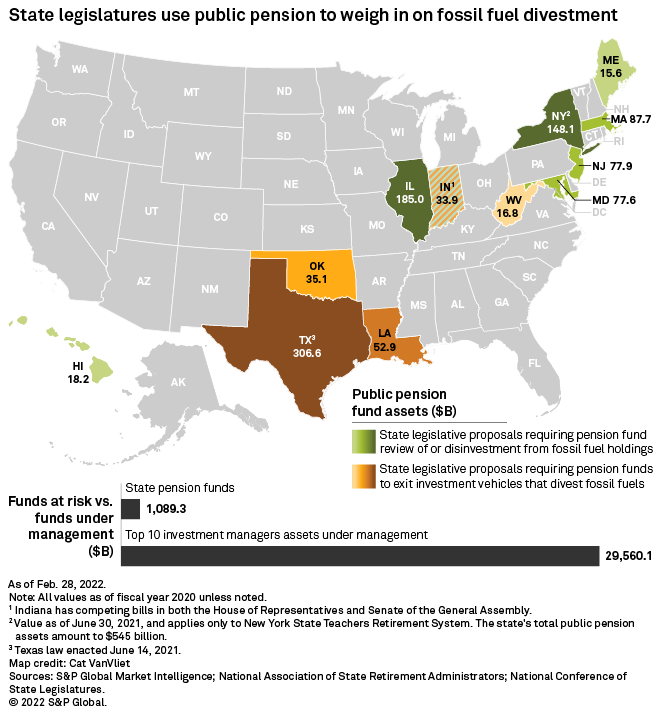

Eight states are considering laws that would require managers of public employee pension funds to drop fossil fuel companies from their portfolios in an effort to support the fight against climate change. Those states have a collective $644 billion under management.

At the same time, five states with $445 billion in pension fund assets either have or are considering laws that would take away fund management — and the fees that go with it — from investment managers such as BlackRock Inc. and JPMorgan Chase & Co. if the fund managers screen potential investments based on their environmental records.

Indiana is in both categories, with competing bills filed on either side of the issue, according to the legislative database of the National Conference of State Legislatures.

Texas led the fight against fossil fuel boycotts

Texas is the only state to have enacted a "boycotting the boycotters" bill. The state's comptroller issued notifications to 19 financial firms including BlackRock on March 16, demanding they clarify their stance on fossil fuels.

"Your company may appear on the State of Texas' list of financial companies that boycott energy companies," the notice from Texas Comptroller of Public Accounts Glenn Hegar said in bold type. "Such a listing will prohibit Texas governmental entities from investing in, and may potentially require divestment from, your company."

BlackRock wrote an open letter to Texas officials and lawmakers Jan. 3 noting that it has $91 billion invested in Texas fossil fuel companies, including supermajors such as Exxon Mobil Corp., independent producers such as EOG Resources Inc. and midstream operators such as Energy Transfer LP.

"We believe that the experience, expertise, and scale of fossil fuel companies will be integral to future energy solutions," BlackRock Senior Managing Director and Head of External Affairs Dalia Blass said in the letter. "As such, we have not and will not boycott energy companies."

Texas Lt. Gov. Dan Patrick holds that BlackRock's commitment to net-zero policies disqualifies it from collecting fees from the 100 Texas public employee pension funds, which have $306.6 billion in assets. BlackRock manages about $20 billion of that money, according to a person familiar with the matter who was not authorized to speak publicly.

"It is highly inconsistent to claim support for Texas' oil and gas energy industry while leading a 'net zero' policy effort that will destroy the oil and gas industry and destabilize the economy worldwide," Patrick told Hegar in a Jan. 19 letter.

BlackRock is the world's leading asset manager, with more than $10 trillion under management, according to S&P Global Market Intelligence data.

Differing investment strategies are not unusual

Conflicting client goals are a healthy part of the debate surrounding society's transition to a low-carbon energy world, said Aniket Shah, Jefferies Group LLC's global head of environmental, social and governance and sustainability research.

"I think you're seeing two different sets of motivators," Shah said in an interview. "You're seeing states that are linked fundamentally to the fossil fuel industry … and you're seeing other states which have very strong green energy, sustainability drivers, and you're seeing both pools of capital trying to express that through every way possible, including how state pension plans are invested."

The flaw in both sides' campaigns is they attack the fund managers rather than the asset funds themselves, Shah said. BlackRock and others should be allowed to screen green for one state without losing the business of another state, Shah said.

Bans could backfire

Lawmakers who avoid working with financial companies that have ESG goals might not be helping their constituent oil and gas companies, said Tisha Schuller, former head of the Colorado Oil and Gas Association and now principal at Adamantine Energy, an ESG consulting firm for oil and gas companies.

"While legislatures surely intend to support oil and gas producers with these laws, unfortunately, they simply reinforce the narrative that oil and gas companies are on one side of a climate battle playing out in the investor space," Schuller said in an email. "This undermines the very important work that oil and gas companies are doing to lead in providing climate solutions."

Investors know oil and gas companies that adapt while reducing emissions will be recognized and return value in a changing future, Schuller said. "We can all de-politicize energy and climate by recognizing and rewarding leadership among oil and gas companies on climate," she said.

Coal is the real target of funds that are selling fossil fuel stocks, according to Raymond James & Associates oil, gas and renewables analyst Pavel Molchanov, who called the debate "a sideshow for oil and gas investing."

"There is $19 trillion of investment funds globally that have some kind of fossil fuel divestment, but the vast majority of that — $15 trillion — pertains solely to coal," Molchanov said. "Thus, the impact of divestment on the oil and gas industry is immaterially small."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.