Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Sep, 2021

By Karin Rives and Allison Good

| An operator at BP's 250-MW Cedar Creek 2 wind farm in Colorado. BP says it will reach net-zero emissions across its entire value chain by 2050. Source: BP PLC |

Twelve of the world's largest oil companies plan to cut their carbon and methane emissions by 50 million metric tons annually by 2025. But what the companies excluded from a recent pledge to reach net-zero emissions by 2050 may increasingly weigh on the sector.

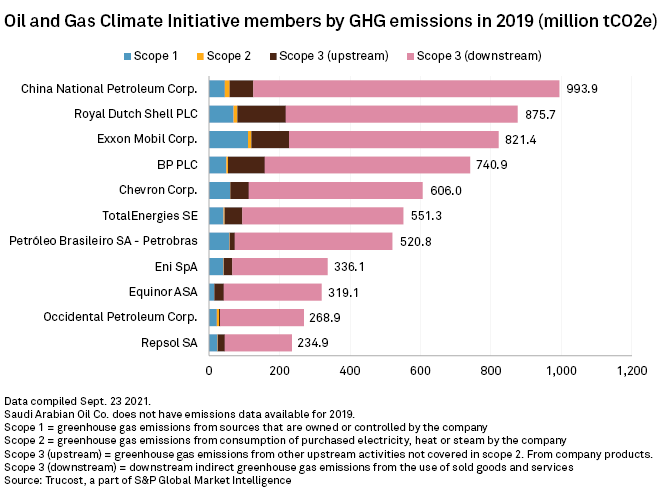

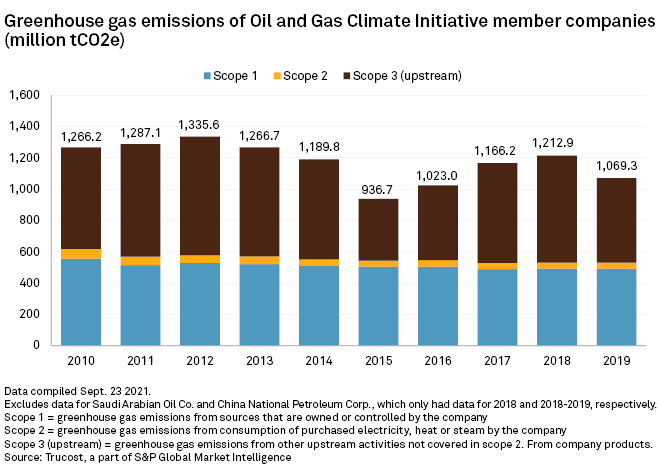

Specifically, the 12-member Oil and Gas Climate Initiative said its companies aim to reach net zero emissions from operations under their control, which spans Scopes 1 and 2 emissions. The commitment did not include Scope 3 emissions: those associated with products and services needed for exploration and production of oil. Importantly, Scope 3 also includes downstream greenhouse gases emitted from the oil, gasoline and diesel oil that companies sell to anyone who drives a car or flies a plane.

These kinds of emissions make up the vast majority of an oil company's total carbon footprint, with the downstream category far ahead of any other, S&P Global Trucost data shows. Such emissions are becoming a vexing issue for an industry that must now weigh dual pressures from investors: reducing their carbon footprint while maintaining profitability.

Tackling Scope 3 emissions is "becoming the biggest pain point for companies," World Resources Institute director and carbon accounting expert Cynthia Cummis said at a recent Moody's event.

Investors demand more

The global standard for carbon accounting, known as the Greenhouse Gas Protocol, expects companies to estimate and report their greenhouse gas emissions, including all Scope 3 emissions. The protocol defines Scope 3 as "all indirect emissions ... that occur in the value chain of the reporting company, including both upstream and downstream emissions." All but one of the OGCI's members — Saudi Arabian Oil Co. — reported their emissions in 2019.

When it comes to Scope 3, the step from reporting to reducing is an existential challenge for companies whose core business is selling oil.

For oil and gas supermajors to meaningfully cut downstream Scope 3 emissions, they would have to sell off their fossil fuel assets, Morningstar analyst Allen Good said in a recent interview. "The only way really to reduce Scope 3 emissions is divestiture," Good said.

Royal Dutch Shell PLC, for one, recently announced the sale of its Permian Basin acreage to ConocoPhillips for $9.5 billion. Shell is attempting to cut its carbon emissions and invest more in renewable energy under a more aggressive timeline than many of its peers, after a Dutch district court in May ordered the oil and gas giant to reduce its net carbon emissions by 45% by 2030 from 2019 levels.

|

|

Still, divestiture only shifts the emissions from one operator to another, without bringing down emissions in aggregate. And the challenge for oil companies is that shareholders and lenders are increasingly asking for more.

"The investor focus is really on Scope 3," said Andrew Logan, senior director for oil and gas at nonprofit investor network Ceres. "If OGCI sees Scope 3 as something that has to be addressed through policy instead of individual company action, then it's really incumbent on them I think to get much more involved … than they've been willing to so far."

The OGCI's decision to not include Scope 3 emissions in its pledge signals that the commitments its members made "lack a real policy arm," Logan said.

'A major step forward'

The OGCI declined to address the Scope 3 emissions issue, pointing instead to the progress its members have made so far on greenhouse gases.

"The OGCI net-zero operation goal is a major step forward for several member companies who had not previously made this commitment," said Julien Perez, the group's vice president of strategy and policy. "And for those that had, we have also included action to leverage our influence to reach net-zero emissions from Scope 1 and 2 of non-operated assets."

To that end, OGCI members pledged to reduce upstream-only carbon emissions by zeroing out routine flaring of natural gas, electrifying oil production with renewables "where possible," co-generating electricity and heat, and achieving "near-zero" methane emissions.

Methane emissions have 82 times the warming effect of carbon dioxide for 20 years after first being released into the atmosphere. By expanding leak detection and repair campaigns in the industry, replacing "high-emitting devices," and reducing venting and flaring of unlit natural gas, the group said it expects to reach methane intensity of "well below 0.20%" by 2025.

Such emission reductions would typically fall into the Scope 1 category of greenhouse gas accounting and are considered to be the lower-hanging fruit for companies because the technology to address equipment leaks, for example, already exists.

Collectively, the OGCI's planned steps will help the oil majors reduce the average carbon intensity of their upstream oil and gas operations from 23 kilos of greenhouse gases per barrel of oil equivalent in 2017 to 17 kg in 2025, the group said. That means the emissions generated to produce one barrel of oil will decrease 26% over the next four years, which the companies say is consistent with goals set by the Paris Agreement on climate change.

Scope 3 emissions still looming

Several OGCI members have pushed back against pressure from activist investors to cast a wider net trying to reduce emissions amid concerns they could see more limited access to capital as a result. Most OGCI members have only been reporting downstream Scope 3 emissions since 2017, while historic upstream data has been available for at least a decade. In 2019, upstream Scope 3 emissions alone made up just over half of the companies' carbon footprint.

Running against the grain, however, BP PLC made a splash in early 2020 when newly picked CEO Bernard Looney pledged to transform the century-old company into a new kind of business focused more on renewables, biofuel and hydrogen, rather than on oil. As part of that announcement, the oil major said it would cut upstream Scope 3 emissions.

BP announced in March that it had reduced emissions 9% from its operations, the end-sales of its products not included. Even so, the company faces growing pressure from shareholders to make faster and deeper cuts.

A climate strategy that includes Scope 3 emissions has its "pluses and minuses," noted credit research and risk assessment provider CreditSights.

"A company like BP is being a lot more aggressive and so from an emissions outlook standpoint that compares favorably to something like what a Chevron may be doing," Jake Leiby, a senior analyst with CreditSights said in an interview.

"On the flip side, there are financial implications of that strategy shift BP is making that we'll also take into account," Leiby added. "So while the emissions piece looks great and screens well for ESG, it may not necessarily screen as well from an earnings and cash flow standpoint."

Trucost is part of S&P Global Market Intelligence.