S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 May, 2021

By Allison Good and Krizka Danielle Del Rosario

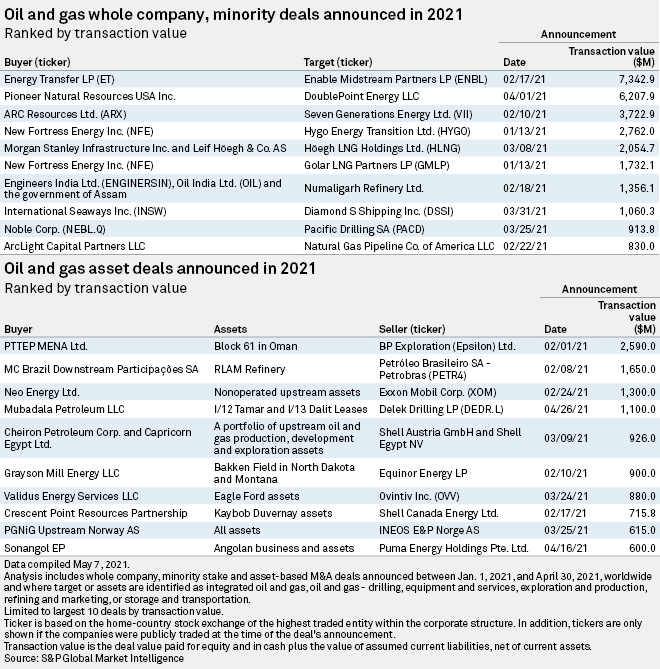

Large-scale oil and gas deal-making ebbed in April from the previous month but still increased over the prior-year period, according to S&P Global Market Intelligence data.

During the month, the sector announced 30 whole-company and minority-stake deals, compared to 16 in April 2020. The combined value of the April 2021 deals skyrocketed year over year from $356.6 million to almost $8 billion.

The aggregate value of announced asset transactions rebounded significantly from about $884 million to $2.6 billion as the number of deals rose from 17 to 37.

The biggest deal announced in April was independent U.S. driller Pioneer Natural Resources Co.'s $6.2 billion acquisition of DoublePoint Energy LLC, which is backed by Apollo Global Management Inc., Quantum Energy Partners, Magnetar Capital Fund LP and GSO Capital Partners LP. It received positive feedback from Moody's, and some equity analysts said the transaction could spark interest in consolidation among other players in the Permian Basin.

Pioneer CEO and director Scott Sheffield subsequently revealed during the producer's first-quarter earnings conference call that Chevron Corp. and Occidental Petroleum Corp. are marketing Permian asset packages for sale.

When it came to oil and gas asset M&A, Abu Dhabi's Mubadala Petroleum LLC entered into a nonbinding memorandum of understanding to buy a 22% interest in the Tamar and Dalit gas fields offshore Israel from Delek Drilling LP for up to $1.1 billion. Delek's divestment from Tamar is in accordance with a framework the Israeli government approved in 2015.

Angola's state-owned Sonangol EP in April agreed to acquire Puma Energy Holdings Pte. Ltd.'s Angolan business and assets for $600 million.