S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Feb, 2021

By Allison Good and Gaurang Dholakia

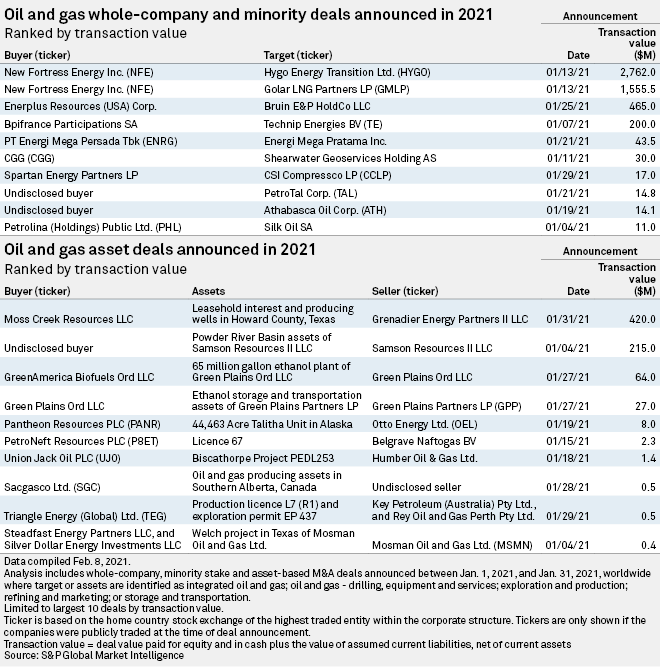

Large-scale oil and gas M&A deal-making got a boost in January from a pair of billion-dollar acquisitions by New Fortress Energy Inc., according to S&P Global Market Intelligence data.

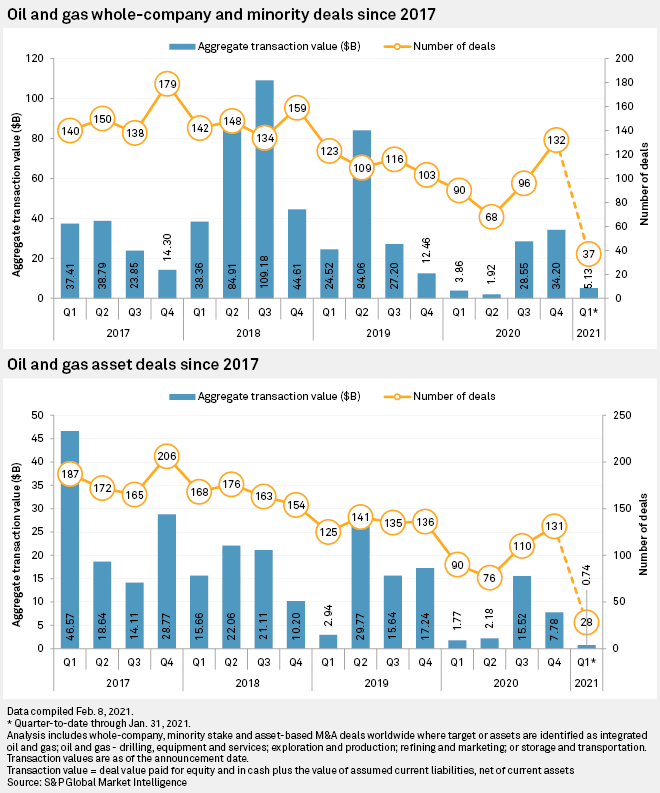

During the month, the sector announced 37 whole-company and minority-stake deals, compared to 27 in January 2020. The combined value of the January 2021 deals soared year over year from $616 million to $5.13 billion.

The aggregate value of announced asset transactions, however, decreased 22% from $950 million to $739 million as the number of deals fell from 32 to 28.

New Fortress Energy's acquisitions of Hygo Energy Transition Ltd. for $2.76 billion and Golar LNG Partners LP for $1.56 billion were the biggest deals announced during January.

The deals netted New Fortress four new LNG import terminals. One of those terminals is active, and the other three are in various stages of development. That will nearly double the LNG import terminals in New Fortress' portfolio. The company has five others: two in Jamaica, one in Puerto Rico, and two in development in Mexico and in Nicaragua. By buying Golar LNG Partners, New Fortress also acquired interests in other LNG projects around the world and in the partnership's four LNG carriers.

"New Fortress has evolved into what amounts to a frontier state energy transition specialist," Michael Webber, an independent LNG analyst and managing partner at Webber Research & Advisory, said in a recent interview. "That could be LNG, it could be hydrogen — and that's one of the reasons their stock is so strong. They are very much on the front foot of leaning in to finding greener solutions and more attractive solutions in frontier states. ... They've expanded their quiver of options to offer."

The third-largest transaction announced in January was independent oil and gas producer Enerplus Corp.'s acquisition of Bruin E&P Partners LLC's holding company for $465 million. Bruin E&P Partners, a pure-play Williston Basin private company, filed for Chapter 11 bankruptcy protection in July 2020 and secured a financial restructuring deal.

In other activity, Permian Basin-focused oil and gas company Surge Energy US Holdings Co.'s $420 million purchase of leasehold interest and producing wells in Howard County, Texas, from producer Grenadier Energy Partners II LLC was the largest asset-level deal announced in January. Surge Energy is owned by China's Shandong Xinchao Energy Corp. Ltd., and Grenadier Energy Partners is backed by private equity firms EnCap Investments LP and Kayne Anderson Capital Advisors LP.