Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jun, 2023

More than half of US office real estate investment trusts began 2023 with mostly weaker quarterly operating metrics during the first quarter, according to an S&P Global Market Intelligence analysis.

Funds from operations, recurring EBITDA

Operating funds from operations (FFO) for 12 office REITs dropped quarter over quarter, while eight REITs booked sequential gains during the first quarter.

The proportion of gains and losses among office REITs was almost the same when looking at recurring EBITDA, with 11 REITs logging quarterly losses, as opposed to 10 REITs that reported gains.

Improvements in recurring EBITDA across all office REITs are more evident when compared to their year-ago and pre-pandemic levels. However, more REITs have lower operating FFO compared to their year-ago and pre-pandemic levels.

Market Intelligence defines operating FFO as FFO adjusted for extraordinary items or other nonrecurring items at the discretion of the company. Office REITs sometimes refer to this as normalized FFO or core FFO.

Falling occupancy rates, rising rents

The median office occupancy rate dropped to 87.4% during the first quarter, the lowest it has been since occupancy rates started declining in 2020. On an annual basis, the median occupancy rate was down 65 basis points and plunged 5.65 percentage points compared to the fourth quarter of 2019, just before the COVID-19 pandemic.

Franklin Street Properties Corp. reported the lowest occupancy rate for the quarter at 71.5%, down from 75.6% in the previous quarter and from 77.3% in the first quarter of 2022. The decline was mainly due to lease expirations in Denver and Minneapolis, as well as the sale of an asset in the Chicago area, Franklin Street Executive Vice President John Donahue said on the REIT's earnings call May 3.

City Office REIT Inc. had the fourth-lowest occupancy rate during the first quarter at 84.9%. Two large tenant exits drove the occupancy drop: a 49,000-square-foot space at the company's 5090 building in Phoenix and a 30,000-square-foot space at Denver Tech.

"What we're seeing with the smaller tenants is more consistency on renewals. What we're seeing with much of the larger tenants, corporate America is really assessing their options, downsizing where they can and in many cases, looking to move to higher-quality properties, the flight to quality," said City Office CEO James Thomas Farrar on an earnings call May 5.

On the flip side, Peakstone Realty Trust recorded the highest occupancy rate during the quarter at 98.2%, a slight drop from 98.3% in the previous quarter but an improvement from 90.0% a year earlier.

Corporate Office Properties Trust followed with an occupancy rate of 95%. During an April 28 earnings call, Corporate Office Properties President and CEO Stephen Budorick said there is a continuous demand for new leasing and renewals at the REIT's Defense/IT locations. Budorick added that the company expects to achieve a tenant retention rate in 2023 that is equal to or above the 10-year record high of 81% in 2017.

– For further company research, try the North America Real Estate 2-Page Profile template.

– Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

– Set email alerts for future Data Dispatch articles.

While the median occupancy rate fell, the median rent at US office REITs increased 2.3% to $51.04 per square foot per year in the first quarter. Compared with pre-pandemic levels, the median rent rose 13.9% from $44.80 per square foot per year during the fourth quarter of 2019.

Paramount Group Inc. reported the highest average office rent during the first quarter at $90.31 per square foot per year, up 1.4% from the prior quarter. It was followed by Vornado Realty Trust and Boston Properties Inc., which reported average office rents per square foot per year of $84.25 and $78.31, respectively.

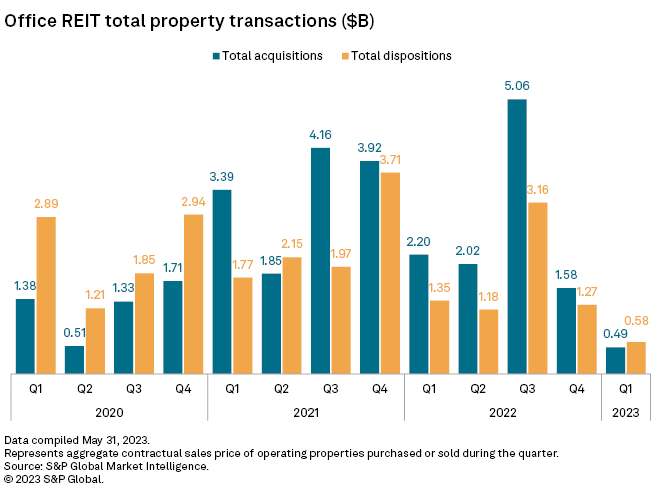

Limited property transactions activity in Q1 2023

Transaction activity by US office REITs slowed for the second consecutive quarter, following a robust sum of acquisitions and dispositions reported during the third quarter of 2022.

During the first quarter, the total amount of property acquisitions was at $489.1 million, following a $1.58 billion total value of transactions in the fourth quarter of 2022. Likewise, property dispositions among office REITs was at $584.7 million, down from $1.27 billion in the previous quarter.

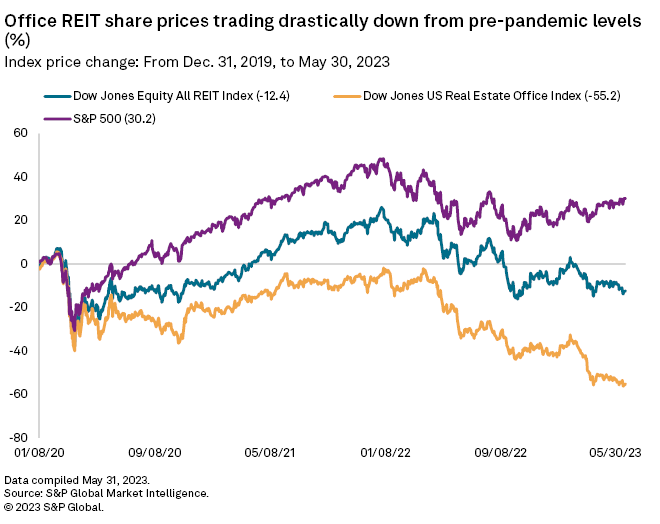

Office REIT stocks fare well below pre-pandemic levels

US equity REIT stocks still underperformed compared to the broader market during the first quarter. Office REIT stocks, in particular, were the worst-performing REIT stocks across all property types, with the Dow Jones US Real Estate Office Index losing 14.7% for the quarter.

As of May 30, the Dow Jones US Real Estate Office Index was down 55.2% compared to the end of 2019. It also underperformed the broader Dow Jones Equity All REIT index, which posted a 12.4% drop during the same period.